Investing in the stock market can seem like a daunting task, especially for beginners. However, with the right knowledge and strategies, even a small amount of money can grow into something substantial over time. In this article, we will explore how to invest $50 dollars in the stock market and maximize your investment growth.

So let’s dive in and discover the potential of investing!

Understanding the Potential of Investing

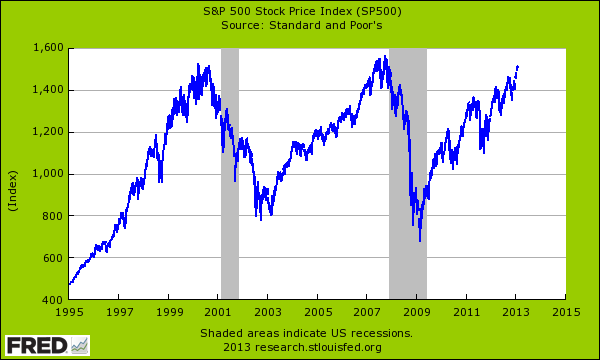

Investing is a smart way to make your money work for you. Instead of leaving it in a bank account earning minimal interest, investing allows for the potential of higher returns over time. When you invest in stocks, you become a partial owner of companies and can benefit from their growth.

By diversifying your portfolio and conducting thorough research, you can mitigate risk and increase your chances of achieving favorable returns. While there are risks involved, investing offers an opportunity to participate in the success of established companies or promising startups.

Overall, understanding the potential of investing is crucial for growing your wealth and achieving financial success.

Embracing the Idea of Starting Small with $50

Contrary to popular belief, you don’t need a large sum of money to start investing in stocks. In fact, you can begin your investment journey with as little as $50. Starting small has several advantages.

It allows you to learn about investing without taking on too much risk and gives you the opportunity to practice and develop your investment skills before committing larger amounts of money. It also helps foster discipline and consistency in your financial habits.

Over time, as you gain experience and confidence, you can gradually increase your investment contributions. So don’t let misconceptions hold you back – embrace the idea of starting small and set yourself on a path towards financial growth and success.

Researching Industry Trends and Growth Potential

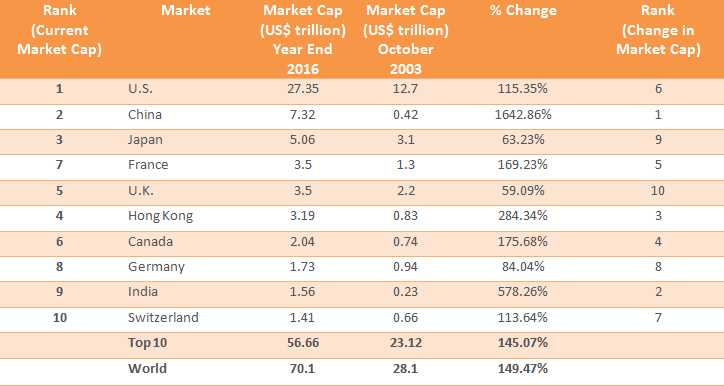

When investing in the healthcare sector, it’s crucial to research industry trends and growth potential. Look for areas with significant advancements or innovations that could lead to future growth. For example, advancements in biotechnology or telemedicine offer lucrative investment opportunities.

Stay informed about emerging market demands to target sectors experiencing high demand for specific healthcare products or services. By researching industry trends, investors can make well-informed decisions and position themselves favorably in a rapidly evolving market.

Analyzing Company Financials

When it comes to making investment decisions within the healthcare industry, a vital step is to analyze the financials of individual companies. By delving deeper into their financial statements, such as income statements and cash flow statements, investors can gain valuable insights into a company’s financial health.

One key aspect to consider is the balance sheet. A strong balance sheet indicates that a company has sufficient assets to cover its liabilities and is well-positioned for future growth. Look for companies with healthy liquidity ratios and manageable levels of debt.

Consistent revenue growth is another crucial factor. Companies that demonstrate steady revenue growth over time are more likely to be profitable and have the potential for long-term success. It’s important to assess not only the overall revenue figures but also identify any patterns or trends in revenue growth.

Equally important is evaluating the management team. A solid management team with a proven track record can greatly influence a company’s financial performance and strategic decision-making. Look for companies led by experienced executives who have successfully navigated challenges in the past.

In addition to these factors, analyzing financial statements can provide valuable insights into a company’s profitability, efficiency, and cash flow management. Pay close attention to metrics such as net profit margin, return on equity, and operating cash flow.

To summarize, thoroughly analyzing company financials involves assessing their balance sheets, revenue growth, and management teams while carefully scrutinizing their financial statements.

By considering these factors comprehensively, investors can make more informed decisions when selecting healthcare companies for potential investment opportunities.

Markdown Table: Key Factors in Analyzing Company Financials

| Factors | Importance |

|---|---|

| Balance Sheet | Indicates financial stability and ability to cover liabilities |

| Revenue Growth | Demonstrates long-term profitability potential |

| Management Team | Influences strategic decision-making |

| Financial Statements | Provide insights into profitability, efficiency, and cash flow management |

User-Friendly Interfaces and Educational Resources

When choosing an online brokerage platform, look for one with a user-friendly interface that is easy to navigate and execute trades. Additionally, prioritize platforms that provide educational resources like tutorials, articles, and webinars. These resources can help beginners understand the basics of investing and make informed decisions.

Consider platforms that integrate with financial news sources or offer research tools for further learning.

| Key Features |

|---|

| User-friendly interface |

| Easy navigation |

| Tutorial section |

| Educational articles |

| Webinars |

| Integration with financial news sources |

| Research tools |

Low or No Commission Fees

When choosing an online brokerage platform, it’s important to consider commission fees. As a beginner investor with limited funds, minimizing costs is crucial. Look for a platform that offers low or no commission fees on trades. This way, you can invest your $50 without worrying about excessive charges eating into your returns.

By reducing fees, you have more capital available to purchase stocks and can experiment and diversify your portfolio without being hindered by high costs. It’s essential to find a balance between affordability and quality service when selecting a brokerage platform for a positive investing experience.

Recognizing Achievements Along the Way

Investing is a journey filled with ups and downs, successes, and failures. It’s important to acknowledge and appreciate the achievements you make along this path. Recognizing milestones like hitting personal savings goals or making successful investment decisions boosts confidence and keeps motivation high.

Celebrate these accomplishments as they show discipline, commitment, and the ability to make informed choices. Don’t forget to acknowledge smaller victories too, like consistent contributions to your portfolio or sticking to an investment plan during market volatility.

By recognizing achievements, you build resilience and maintain a positive mindset that propels you towards greater success in your financial journey.

Sharing Your Experiences with Others to Inspire and Educate

Sharing your investment experiences can have a powerful impact on others. Whether through social media, blogs, or personal conversations, opening up about your journey can inspire and educate those around you.

By sharing your knowledge, you can motivate others to start their own investment journeys. Even starting small can lead to financial independence over time.

In addition to inspiration, sharing experiences helps demystify the stock market. You can provide guidance on specific industries, like healthcare, that show promise for growth.

Emphasizing the importance of maximizing compound returns is crucial. By reinvesting dividends and gains, wealth accumulation accelerates.

Choosing the right brokerage platform is another topic worth exploring. Discussing your research process and ultimate choice can help others make informed decisions.

Seeking advice from experts is valuable when entering the stock market. Sharing how professional guidance impacted your own journey inspires others to seek similar support.

Lastly, tracking progress and sharing strategies helps others stay on top of their investments. Showcasing tools like spreadsheets or portfolio management software provides valuable insights.

[lyte id=’h65R-XkAHjg’]