Investing can be a daunting endeavor, especially for those who are new to the world of finance. With countless investment strategies and recommendations out there, it’s crucial to find a trusted source that aligns with your goals. One name that often comes up in discussions about personal finance and investing is Dave Ramsey.

In this article, we’ll delve into who Dave Ramsey is, explore his investing philosophy, analyze criticisms surrounding his approach, assess the performance of his investment principles, and provide additional resources for investors seeking advice beyond Dave Ramsey.

Who is Dave Ramsey?

Dave Ramsey, a renowned personal finance expert, has helped millions of people achieve financial stability through his books, radio shows, and seminars. His straightforward approach emphasizes getting out of debt, building an emergency fund, saving for retirement, and making wise financial decisions.

With a no-nonsense attitude towards money management, Dave Ramsey’s practical advice resonates with individuals striving for financial freedom. He emphasizes living within one’s means and avoiding debt while providing guidance on budgeting effectively and making disciplined choices.

Overall, Dave Ramsey’s popularity in the financial world stems from his ability to empower individuals with tools and knowledge to transform their financial lives.

Dave Ramsey’s Investing Philosophy

Dave Ramsey advocates for a conservative approach to investing that prioritizes long-term stability over short-term gains. He believes in minimizing risk through diversification and focuses on mutual funds instead of individual stocks.

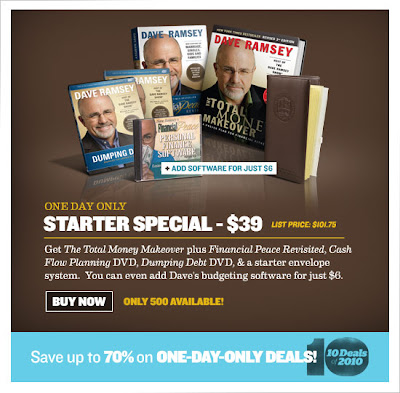

Ramsey’s philosophy includes key principles such as getting out of debt, saving up an emergency fund, investing 15% of income in retirement accounts, choosing growth stock mutual funds, and maintaining a long-term perspective with consistent investing.

Following these principles can provide individuals with a clear roadmap for financial success and security.

Criticisms and Controversies Surrounding Dave Ramsey’s Approach to Investing

Dave Ramsey’s approach to investing has garnered both praise and criticism within the financial community. While many people find his conservative investment philosophy beneficial, there are those who argue that it may limit potential returns.

Critics contend that focusing solely on mutual funds, as Ramsey advises, may hinder opportunities for higher gains through individual stock investments.

One area of contention revolves around allegations against Ramsey’s endorsed local providers (ELPs) program. Some critics raise questions about potential conflicts of interest in his recommendations. They argue that these endorsements may be influenced by financial arrangements rather than solely based on the provider’s competence.

Such concerns cast doubt on the objectivity of the advice given and raise questions about the true motivation behind these recommendations.

To address these concerns, it is essential for investors to conduct their own research and consider multiple sources before making investment decisions. While Dave Ramsey’s advice can serve as a starting point, it should not be the sole basis for financial choices.

Engaging in thorough due diligence ensures that investors have a comprehensive understanding of various investment options and can make informed decisions based on their own risk tolerance and financial goals.

Furthermore, it is crucial to recognize that no single investment approach is universally suitable for everyone. Each individual has unique circumstances and preferences when it comes to investing. Therefore, blindly following any one philosophy without considering personal factors could lead to suboptimal outcomes.

Analyzing the Performance of Dave Ramsey’s Investment Principles

Dave Ramsey’s investment principles have shown significant potential in transforming individuals’ financial situations. Success stories highlight the effectiveness of his approach, particularly in debt reduction and long-term wealth accumulation.

For example, Jane diligently followed Ramsey’s advice, paying off all her debts and building substantial wealth through consistent investing.

However, it is important to acknowledge that strict adherence to Ramsey’s principles may not always guarantee desired outcomes. Factors such as market conditions or personal circumstances can affect results.

Evaluating criticisms and failures associated with his approach allows for informed decision-making and consideration of alternative strategies.

By analyzing both success stories and cases where Ramsey’s principles may fall short, we gain a comprehensive understanding of their overall performance. This exploration guides us in applying these strategies effectively in our own financial journeys.

| Key Points |

|---|

| – Success stories demonstrate the effectiveness of Dave Ramsey’s investment principles |

| – Criticisms and failures highlight the need for evaluation and consideration of individual circumstances |

Seeking Advice Beyond Dave Ramsey: Additional Resources for Investors

When it comes to investing, it’s important to explore advice beyond just Dave Ramsey. While he offers valuable insights, considering other reputable sources can provide a well-rounded perspective. Experts like Warren Buffett, Benjamin Graham, and John Bogle offer different viewpoints that can enrich your understanding of investing.

In addition to expert advice, utilizing tools such as investment calculators, budgeting apps, and online courses can enhance your knowledge about investing. These resources provide practical guidance on portfolio management, risk assessment, and asset allocation.

For personalized guidance in your investment journey, consulting a qualified financial advisor can be beneficial. They can provide tailored advice based on your individual circumstances and goals, helping you navigate the complexities of investing.

By seeking advice beyond Dave Ramsey’s recommendations and exploring additional resources, you can broaden your knowledge base and make more informed decisions as an investor.

Conclusion

[lyte id=’g6YTFJto-i4′]