Investing in stocks has long been considered a complex and intimidating endeavor, reserved for those with deep pockets or extensive financial knowledge. However, with the advent of Robinhood stocks, investing has become more accessible than ever before.

In this article, we will explore the rise of Robinhood as an investment platform and delve into the world of hot stocks that are capturing the attention of investors.

Introduction to Robinhood Stocks

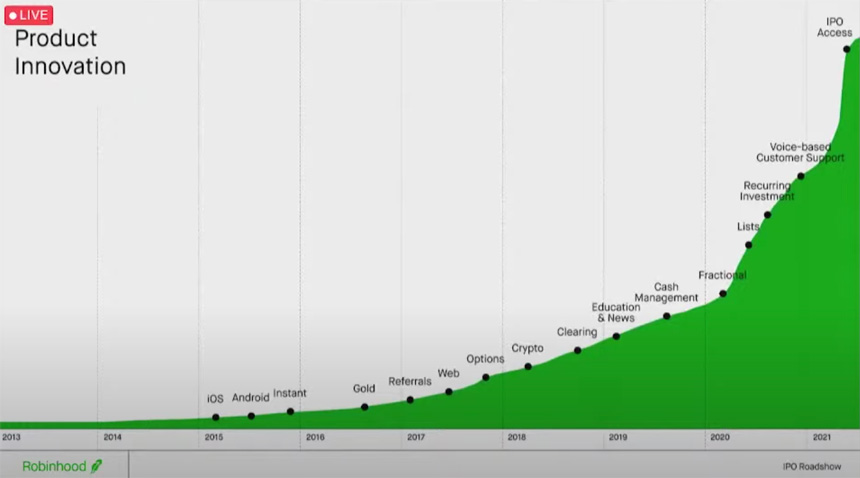

Robinhood stocks have revolutionized investing for beginners. The online brokerage platform, Robinhood, has gained immense popularity due to its user-friendly interface and commission-free trades. It allows users to buy and sell stocks without paying any commissions, making it an attractive choice for those entering the world of investing.

Robinhood stocks refer to stocks available for trading exclusively on the Robinhood platform. Unlike traditional brokerages, Robinhood eliminates fees for trades, making it more accessible to beginner investors. The platform’s simplicity and ease of use have democratized investing by removing barriers such as complicated interfaces and high costs.

In addition to its user-friendly approach, Robinhood provides educational resources tailored for novice investors. These resources include articles, videos, and tutorials that aim to educate users about various aspects of investing and help them make informed decisions.

With its mobile app-based platform, Robinhood offers convenience by enabling investors to access their accounts anytime and anywhere using their smartphones.

In summary, Robinhood stocks have transformed the investment landscape by offering a user-friendly platform with commission-free trades. Its accessibility, educational resources, and convenience make it an appealing option for beginners looking to enter the stock market without incurring high costs.

The Rise of Robinhood as an Investment Platform

Robinhood’s popularity has soared as an investment platform, particularly among younger investors. Its appeal lies in its accessibility, allowing users to start investing with as little as $1.

Unlike traditional brokerages that require significant initial deposits or charge high fees, Robinhood empowers individuals to take control of their financial futures.

Another key factor contributing to Robinhood’s rise is its integration with social media platforms and online communities. This interconnectedness enables traders to discuss stock tips, share strategies, and collectively drive market trends.

By leveraging the power of collective insights and knowledge-sharing, Robinhood users gain valuable insights that enhance their decision-making processes.

By combining accessibility and community engagement, Robinhood has disrupted the investment industry and attracted a new generation of investors who seek financial growth and autonomy.

Through its innovative approach, Robinhood has established itself as a leading investment platform for those looking to build wealth and take charge of their financial futures.

Understanding Hot Stocks and Their Popularity

Hot stocks are those that experience significant price movements or show strong growth potential in a short period. These stocks generate excitement among investors due to their volatility and potential for high returns.

Investors are attracted to hot stocks based on factors such as strong company performance, innovative products/services, and a competitive edge. Stocks tied to rapidly growing sectors or emerging trends also gain attention. Positive news like earnings surprises or new product launches can greatly impact a stock’s popularity.

Hot stocks come with risks due to their volatility, so thorough research and portfolio diversification are essential. Understanding the factors contributing to a stock’s popularity helps investors make informed decisions about potential returns.

In summary, hot stocks offer exciting opportunities for high returns but require caution. Factors like company performance, industry trends, and news events contribute to their popularity among investors.

Top Hottest Robinhood Stocks in [Current Year]

Robinhood has gained popularity as a commission-free investment platform, attracting retail investors looking for potential growth opportunities. In this section, we will explore the top hottest stocks on Robinhood in [Current Year] and provide a brief overview of their products/services, historical performance, and expert opinions.

Understanding Stock #1’s industry position and its offerings is crucial when evaluating its growth potential. Analyzing its historical stock performance helps identify trends and market sentiment. Expert opinions from analysts provide additional insights.

Exploring Stock #2’s notable aspects and industry position allows investors to assess its potential. Analyzing historical performance provides context, while expert opinions offer valuable market insight.

The Role of Social Media in Shaping Hot Stocks

Social media platforms like Twitter, Reddit, and TikTok have become influential tools for shaping investment decisions and driving the popularity of certain stocks. These platforms provide communities where investors discuss stocks, share strategies, and promote “hot stocks.”

Online communities within social media have the collective power to cause a surge in buying activity, rapidly driving up stock prices. Examples like GameStop and AMC Entertainment demonstrate how social media buzz can amplify investor interest and disrupt traditional market influence.

In today’s market landscape, staying attuned to social media chatter is essential for successful investing.

Risks and Benefits of Investing in Hot Stocks with Robinhood

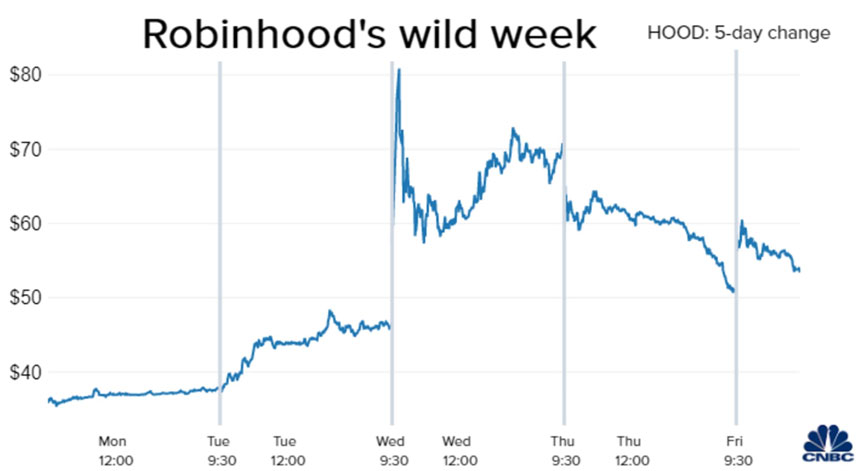

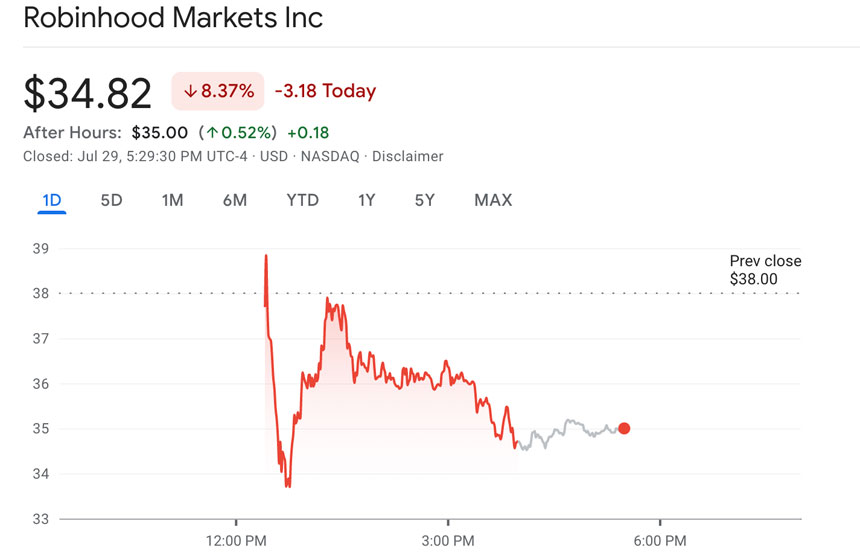

Investing in hot stocks through Robinhood offers both risks and benefits. Hot stocks are known for their volatility, with wild price swings that can result in significant gains or losses. Speculation plays a role, as their popularity may not always be grounded in solid fundamentals. It’s important to diversify to reduce risk.

On the positive side, investing in hot stocks through Robinhood can provide opportunities for high returns if timed correctly. The platform’s user-friendly interface makes it accessible for beginners to participate in market trends. With zero-commission trading, Robinhood levels the playing field and empowers novice investors.

By understanding the risks and benefits, investors can navigate this exciting but volatile market segment confidently.

Tips for Investing in Hot Stocks

To invest wisely in hot stocks, follow these essential tips:

-

Research before investing: Thoroughly analyze the company, its financials, and industry trends to gain a deeper understanding.

-

Diversify your portfolio: Spread your investments across different sectors and asset classes to manage risk effectively.

-

Set realistic expectations: Avoid expecting overnight riches and focus on long-term growth instead.

By following these tips, you can make informed decisions and increase your chances of success when investing in hot stocks.

Conclusion: Riding the Wave of Hot Stocks with Robinhood

[lyte id=’N7DC49JJm88′]

.png/1200px-Robin_Hood_(film_Disney).png)