Investing in stocks can be a thrilling and rewarding venture. However, it’s often perceived as an activity reserved for those with deep pockets. The good news is that you don’t need to break the bank to make significant gains in the stock market.

In fact, some of the most lucrative opportunities lie in low-priced stocks, with Zacks providing valuable insights into this realm.

In this article, we will delve into the world of Zacks’ best stocks under $5, examining their track record, understanding market conditions, managing investor psychology, leveraging technology, learning from mistakes, and exploring other sources for identifying promising low-priced stocks.

Analyzing the Track Record: Evaluating the Success Rate of Zacks Best Stocks Under $5

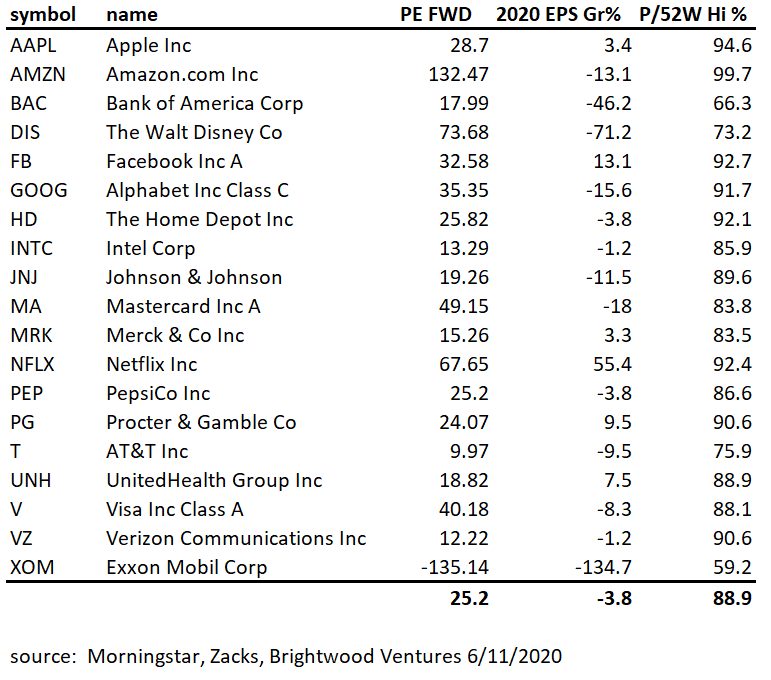

Zacks has earned a reputation for identifying undervalued stocks with high growth potential. In this section, we will assess the success rate of their stock recommendations for low-priced stocks ($5 or less).

By analyzing historical performance and understanding the factors contributing to Zacks’ accuracy, investors can gain valuable insights for future investment decisions.

Examining the historical performance of Zacks’ recommendations provides valuable information on how these picks have fared over time. This analysis helps investors assess the reliability and accuracy of Zacks’ stock selections in the low-priced market segment.

Zacks’ success rate is attributed to rigorous research methodologies and the expertise of seasoned analysts. Their comprehensive evaluations of market indicators, financial statements, industry trends, and company fundamentals help identify undervalued stocks with growth potential.

By considering both historical performance and the underlying factors contributing to Zacks’ success rate, investors can make more informed decisions about low-priced stock investments. These insights serve as a foundation for identifying potential opportunities and optimizing portfolio returns.

Please note that past performance does not guarantee future results. It is essential for individual investors to conduct their own research before making any investment decisions.

Timing is Everything: Understanding Market Conditions for Investing in Low-Priced Stocks

Investing in low-priced stocks requires careful consideration of market conditions and timing. By analyzing economic indicators, industry trends, and company financials, investors can gain insights into the performance of these stocks.

Strategies such as technical analysis and fundamental analysis help identify optimal entry and exit points to maximize returns while minimizing risks. A well-defined strategy that takes into account market trends can greatly increase the chances of investment success in low-priced stocks.

The Role of Investor Psychology: Managing Emotions and Making Rational Decisions When Investing in Low-Priced Stocks

Investing in low-priced stocks is a volatile endeavor that often stirs strong emotions. Understanding how investor psychology influences decision-making is crucial for successful investing in this market. Cognitive biases and emotional pitfalls can cloud judgment, leading to poor decisions.

Tips for maintaining a rational mindset include overcoming emotional biases, staying disciplined, and making decisions based on sound analysis rather than impulsive reactions. By mastering emotions, investors can position themselves for success by capitalizing on overlooked opportunities.

Leveraging Technology: Enhancing Analysis of Zacks Best Stocks Under $5

In the digital age, technology has revolutionized investing. Online platforms, financial tools, and resources offer valuable insights for analyzing Zacks’ best stocks under $5. From stock screeners to research platforms, leveraging technology provides data-driven insights and streamlines the investment process.

Discover how data analytics, artificial intelligence, and machine learning algorithms can give you a competitive edge in identifying patterns and making informed investment decisions. Stay updated with real-time news and market trends to navigate the stock market landscape effectively.

Embrace technology to gain an advantage in analyzing low-priced stocks and uncover hidden opportunities within Zacks’ recommendations.

Learning from Mistakes: Case Studies on Failed Investments in Low-Priced Stocks

Investing in low-priced stocks can be enticing, but it’s important to learn from the mistakes of others. In this section, we’ll examine real-life case studies where investors faced losses or negative outcomes from these investments.

By analyzing the reasons behind these failures, we can identify warning signs and develop strategies to avoid similar pitfalls. Through actionable lessons and insights, you’ll gain the knowledge needed to navigate the market with confidence and minimize risks associated with low-priced stocks.

Join us as we explore these case studies and empower ourselves as informed investors.

Beyond Zacks: Exploring Other Sources for Identifying Promising Low-Priced Stocks

While Zacks is a valuable resource for identifying promising low-priced stocks, it’s important not to rely solely on one source. By exploring other reputable investment research firms, independent analysts, and online communities focused on low-priced stocks, we can gain additional insights and uncover hidden opportunities.

These alternative sources offer different perspectives and methodologies that can complement or challenge the recommendations provided by Zacks. Conducting comprehensive research beyond Zacks’ list allows us to expand our knowledge, make informed decisions, and potentially capitalize on overlooked gems in the low-priced stock market.

Let’s embark on this journey together as we unlock the potential of these often-underestimated investments.

[lyte id=’Sbp3p_F5ggs’]