Inflation, the steady increase in prices over time, is a concern for investors as it erodes the purchasing power of their money. However, there are certain sectors that have historically performed well during periods of inflation. One such sector is food stocks. Food is a necessity and demand for it remains stable even during economic downturns.

In this article, we will explore the power of food stocks in times of inflation and discuss factors to consider when choosing the best food stocks for inflation protection.

The Rising Tide of Inflation

Inflation, the gradual increase in prices over time, has significant implications for investors. It erodes the value of money and affects consumers’ purchasing power. As a result, consumer behavior changes, impacting businesses across sectors. Investors must adjust strategies to counteract inflation’s effects.

Central banks monitor and implement measures to control inflation and maintain economic stability. Staying informed about inflation trends is crucial for making sound financial decisions.

The Power of Food Stocks in Times of Inflation

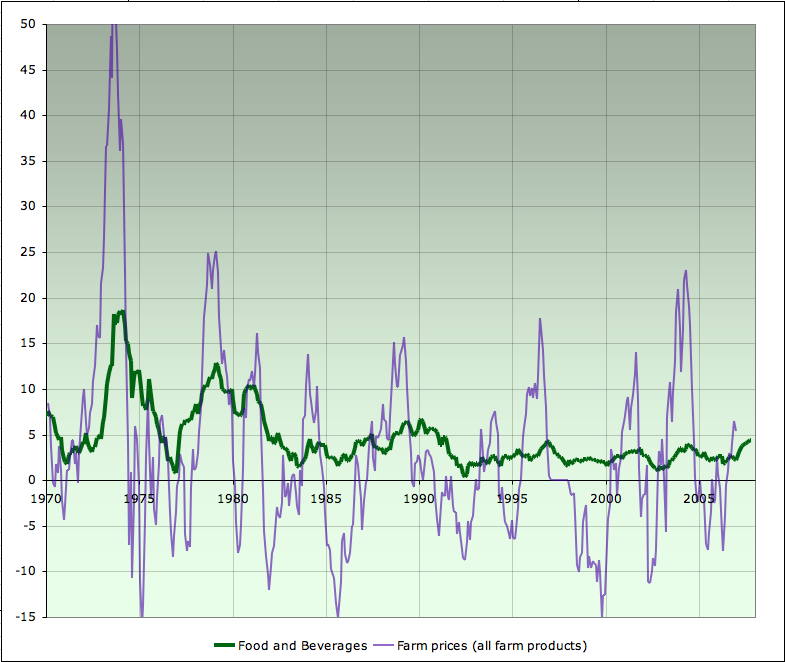

Food stocks have historically outperformed other sectors during inflation. This is because food is a necessity, and demand remains stable regardless of economic conditions. Investors see food stocks as a safe haven when prices rise, as consumers prioritize essential items like groceries.

Additionally, companies can pass on higher costs to consumers, maintaining profit margins. Including food stocks in a diverse portfolio helps balance potential losses in other sectors affected by inflation.

While not all subsectors perform equally well, the resilience and profitability of food stocks make them an attractive investment option during inflationary periods.

Factors to Consider When Choosing Food Stocks for Inflation Protection

When choosing food stocks for inflation protection, consider the following factors:

-

Pricing Power and Brand Loyalty: Look for companies with strong pricing power and loyal customer bases. These companies can raise prices without affecting demand significantly, safeguarding their profit margins during times of rising costs.

-

Supply Chain Resilience: Analyze a company’s supply chain to assess its ability to handle inflationary pressures. Robust supply chains can manage increased input costs and maintain uninterrupted production.

-

Cost Management Strategies: Choose companies with effective cost management strategies. These strategies help mitigate the impact of inflation on a company’s bottom line, ensuring profitability even in challenging economic conditions.

-

Innovation and Adaptability: Prioritize companies that invest in innovation and adapt to changing market trends. These firms can capitalize on new opportunities while mitigating risks associated with consumer preferences or economic fluctuations.

-

Regulatory Frameworks and Industry Trends: Stay informed about regulations impacting the food industry and monitor industry trends. Understanding these factors helps anticipate changes in costs and market dynamics.

By considering these factors, investors can make informed decisions when selecting food stocks that offer protection against inflationary pressures.

Top Food Stocks for Inflation Protection

Investing in food stocks can provide a reliable hedge against inflation. Here are some top options:

- General Mills: With popular brands like Cheerios and Häagen-Dazs, General Mills adjusts prices across its diverse product range to offset rising costs caused by inflation.

- Tyson Foods: Specializing in meat, Tyson Foods maintains pricing power through brand loyalty and cost optimization.

- Mondelez International: Known for snack brands like Oreo and Cadbury, Mondelez has successfully raised prices while maintaining customer loyalty during inflationary periods.

- PepsiCo: Diversified with beverages like Pepsi and snacks like Lay’s, PepsiCo focuses on cost controls and strategic acquisitions to deliver consistent returns.

- Grocery Store Stocks: Companies like Walmart, Kroger, and Costco offer stability as essential businesses with relatively stable demand even during economic downturns.

Investors seeking protection against inflation can consider these food stocks for their portfolios.

Investment Strategies for Food Stock Investors During Inflationary Periods

During periods of inflation, food stock investors should employ effective strategies to maximize returns and minimize risks. Diversifying investments across multiple food stocks helps spread the risk and can balance performance. Taking a long-term perspective has historically rewarded patient investors with attractive returns.

Staying informed about macroeconomic factors such as interest rates, consumer spending patterns, and government policies allows investors to adapt their strategies accordingly.

By diversifying, being patient, and staying informed, investors can navigate the challenges of inflation and position themselves for long-term success in food stock investments.

Conclusion: Investing in the Essentials

[lyte id=’q7yInbYLBX8′]