Private equity firms have emerged as major players in the investment world, offering unique opportunities for investors to grow their wealth. With their focus on acquiring and investing in private companies, these firms have gained significant prominence in recent years.

In this article, we will explore the concept of private equity, delve into what makes a private equity firm prestigious, and highlight some of the most renowned players in the industry.

Explaining the Concept of Private Equity

Private equity refers to investments in privately-held companies not traded on stock exchanges. It involves acquiring ownership stakes to generate long-term returns. Common forms include leveraged buyouts (LBOs), growth capital injections, and venture capital funding.

LBOs use borrowed funds to acquire control of mature companies, while growth capital injections support expansion efforts. Venture capital funds startups with high growth potential. Private equity offers direct ownership and longer holding periods, focusing on long-term growth rather than short-term fluctuations.

| Private Equity Investment Types |

|---|

| – Leveraged Buyouts (LBOs) |

| – Growth Capital Injections |

| – Venture Capital Funding |

How Private Equity Firms Have Become Major Players

Private equity firms have experienced remarkable growth and have emerged as influential players in the investment landscape. Several key factors have contributed to their rise in prominence.

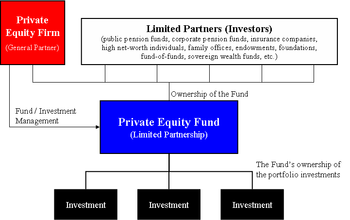

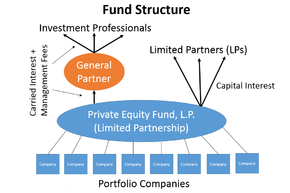

Access to Capital: Private equity firms possess a unique ability to raise substantial amounts of capital from various institutional investors, including pension funds, endowments, and high-net-worth individuals.

This influx of capital provides them with significant resources to engage in large-scale investments and generate substantial value for their stakeholders.

Operational Expertise: A distinguishing characteristic of private equity firms is their extensive operational knowledge and experience. They bring a wealth of expertise to the table and actively collaborate with management teams within their portfolio companies.

By implementing strategic initiatives, enhancing operational efficiency, and driving growth, these firms help unlock the full potential of the businesses they invest in.

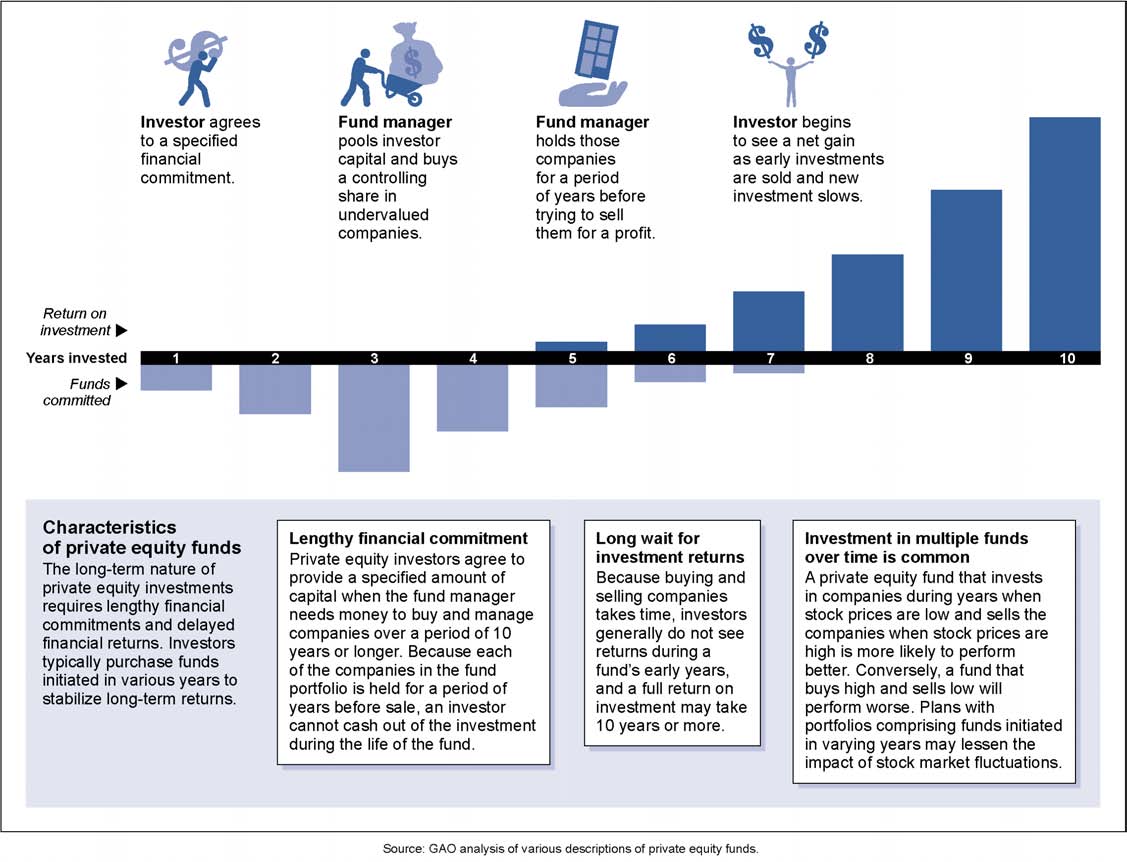

Long-Term Investment Horizon: Unlike public markets that emphasize short-term performance, private equity firms typically maintain a longer investment horizon. They are known for holding onto their investments for several years before exiting.

This patient approach allows them ample time to execute transformative changes within portfolio companies, leading to sustainable value creation over the long run.

Private equity firms’ success can be attributed to their ability to tap into diverse sources of capital, leverage operational expertise effectively, and adopt a patient investment strategy. By harnessing these strengths, they have solidified their position as major players in the investment world.

| Factors Contributing to Private Equity Growth |

|---|

| Access to Capital |

| Operational Expertise |

| Long-Term Investment Horizon |

What Makes a Private Equity Firm Prestigious?

Prestige in the private equity industry is built on several key factors. A prestigious firm has a strong track record of successful investments and impressive returns for investors. It also maintains a reputation for integrity, ethical practices, and responsible investing.

Additionally, prestigious firms tend to have significant assets under management (AUM) and a global presence, enabling them to undertake large-scale deals and access diverse investment opportunities. These factors combined establish a firm’s credibility and attract top-tier investors and talent.

| Factors | Description |

|---|---|

| Track Record | Demonstrating consistent success through profitable investments and strong returns for investors. |

| Reputation | Building a positive image based on integrity, ethics, and responsible investing practices. |

| Size and Scale | Managing substantial AUM with a global presence that allows for large-scale deals and access to diverse investment options. |

The Titans of Private Equity

Private equity is a thriving industry, and within it, several prestigious firms have emerged as true titans. Let’s explore some of these renowned organizations and their contributions to the world of finance.

Founded in 1985, Blackstone Group Inc. is one of the largest alternative asset managers globally. With investments spanning private equity, real estate, credit, hedge funds, and infrastructure, Blackstone has solidified its position as an industry leader through its impressive track record and operational expertise.

KKR & Co. Inc., established in 1976, is known for pioneering the leveraged buyout strategy in private equity investing. Through a strong focus on value creation via operational improvements, KKR has been instrumental in numerous high-profile acquisitions.

CVG Capital Partners specializes in growth capital investments across various industries such as technology, healthcare, and consumer goods. With a focus on long-term value creation and strategic partnerships with management teams, CVG Capital Partners has gained recognition for its successful investment strategies.

The Carlyle Group Inc., a global investment firm with diverse strategies including private equity and credit, has built its prestigious reputation through an extensive network and deep industry expertise.

Thomas Bravo focuses on software and technology sector investments. With a track record of successful acquisitions and value creation within its portfolio companies, Thomas Bravo has earned its place among the top players in the industry.

These titans of private equity have demonstrated exceptional success through their track records, operational expertise, and commitment to value creation. They serve as inspirations for aspiring firms while highlighting the importance of strategic decision-making and strong partnerships in this dynamic field.

Rising Stars in the Private Equity Universe

Amidst the dominant players in the private equity landscape, there are also rising stars worth mentioning. One such firm is Vista Equity Partners, specializing in investments in enterprise software companies with a focus on operational improvements and long-term growth strategies.

TPG Capital is another rising star, known for its disciplined investment approach across industries like healthcare, technology, and financial services. Warburg Pincus stands out as a leading global private equity firm focused on growth investing.

With their extensive network and industry knowledge, these rising stars have the potential to shape the future of private equity.

Nurturing Prestige: Strategies Employed by Top Private Equity Firms

Prestigious private equity firms maintain their status through several key strategies. First, they develop expertise in specific sectors or investment strategies, allowing them to identify unique opportunities and create targeted value.

Second, these firms actively engage with portfolio companies to drive operational improvements, strategic initiatives, and growth. They bring in top talent and leverage their networks to unlock value within the businesses they invest in.

Third, having a global presence enables them to access diverse investment opportunities and tap into emerging trends using regional expertise. Lastly, building strong relationships with industry players provides access to capital, deal flow, and valuable insights for continued success.

By employing these strategies, top private equity firms secure their reputation as leaders in the industry.

Beyond Prestige: Other Factors to Consider

Choosing a private equity firm requires looking beyond prestige and considering other essential factors. Cultural fit is crucial for effective collaboration and shared objectives. Evaluating investment strategy alignment helps identify potential synergies.

Responsible investing practices, including environmental, social, and governance (ESG) considerations, ensure alignment with values. Considering these factors alongside reputation enables informed decision-making for successful investments.

Preparing to Invest: Steps for Potential Private Equity Investors

To successfully invest in private equity, follow these key steps:

- Build knowledge: Understand private equity by reading books, attending seminars, or consulting experts.

- Define investment goals: Determine your objectives, time horizon, risk tolerance, and expected returns.

- Seek professional advice: Consult experienced financial professionals who specialize in private equity.

By taking these steps, potential investors can make informed decisions and navigate the complexities of private equity investing more effectively. Remember to conduct thorough research and consider the risks associated with any investment opportunity before committing your capital.

[lyte id=’U51ks4BqJBU’]