Exchange-Traded Funds (ETFs) have become increasingly popular in the world of investing, thanks to their unique characteristics and versatility. Essentially, an ETF is a type of investment fund that can be traded on stock exchanges, much like individual stocks.

However, what sets them apart is their ability to offer investors exposure to a diversified portfolio of assets, including stocks, bonds, or commodities.

The primary purpose of an ETF is to track the performance of a specific index or sector. By doing so, it provides investors with instant diversification without the need to purchase each underlying asset individually.

This feature allows investors to gain exposure to a particular market segment without having to conduct extensive research or meet high capital requirements.

One of the significant advantages that ETFs offer for investors is liquidity. Unlike some other investment options, ETFs can be bought and sold throughout the trading day at market prices. This means that investors have more flexibility and control over their investments.

Furthermore, compared to mutual funds, ETFs often have lower expense ratios. This makes them a more cost-effective choice for long-term investments since lower expenses mean higher returns for investors.

Another notable advantage of investing in ETFs is their tax efficiency. Generally, capital gains taxes are only realized when an investor sells their shares in an ETF.

This means that as long as shares are held within the fund, investors can potentially defer paying taxes on any capital gains realized by the underlying assets contained within the ETF.

In summary, Exchange-Traded Funds provide a convenient and accessible way for investors to gain exposure to diversified portfolios of assets such as stocks, bonds, or commodities.

Their liquidity, cost-effectiveness, and tax efficiency make them an attractive option for those looking to invest in specific market segments without needing extensive resources or expertise.

Understanding the Concept of Leverage

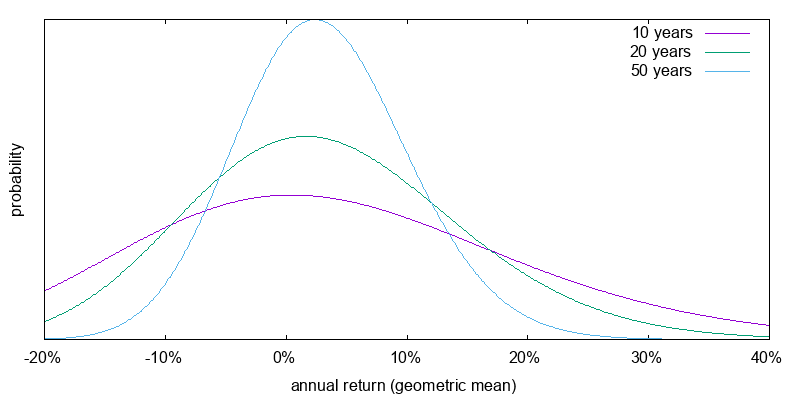

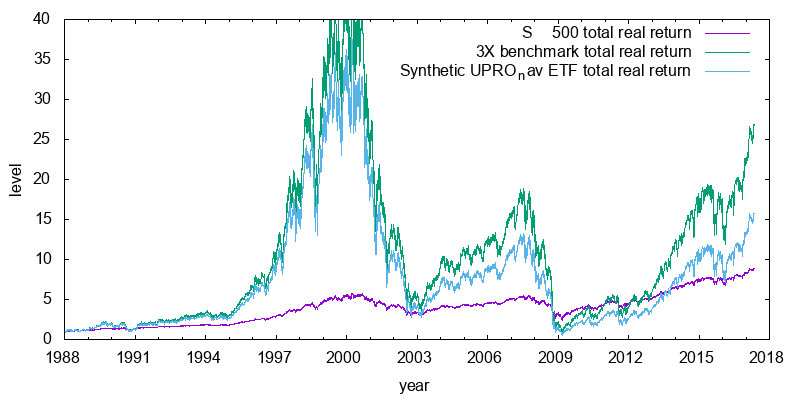

Leverage is a fundamental concept in investing that allows for the amplification of potential returns. In the realm of leveraged ETFs, these specialized funds aim to generate daily returns that are multiples (such as 2x or 3x) of their underlying index.

However, it’s important to note that while leverage can enhance profits in a rising market, it also amplifies losses during market declines. Due to daily rebalancing and compounding effects, leveraged ETFs may not perfectly track their intended multiple over longer periods.

As a result, these investments are typically recommended for short-term trades rather than long-term investments. Understanding leverage and its implications is crucial before venturing into leveraged investments.

Introducing the 3x Oil Bear ETF

A 3x Oil Bear ETF is a specialized exchange-traded fund designed for investors who believe that oil prices will decrease. Unlike traditional ETFs, which track the performance of their underlying assets, this fund provides triple inverse exposure to daily oil price movements.

Investing in a 3x Oil Bear ETF offers benefits such as hedging against potential losses in existing oil-related holdings and the opportunity to profit from declining oil markets. However, it also carries higher risks due to leverage. Thorough research and careful consideration are essential before investing in these specialized funds.

Potential Advantages for Investors

Investors looking to navigate bearish oil markets can find potential advantages through the use of 3x Oil Bear ETFs. These specialized exchange-traded funds offer a unique opportunity to profit during declining oil markets due to their triple inverse exposure.

One advantage lies in the profit potential these ETFs present when oil prices are falling. As oil prices decline, the value of the 3x Oil Bear ETF increases at an amplified rate, providing investors with the chance to capitalize on downward trends.

This triple inverse exposure allows investors to generate substantial profits even during challenging market conditions.

Another advantage is the ability to leverage short positions for higher returns. Investors interested in short-selling or betting against rising oil prices can utilize 3x Oil Bear ETFs to amplify their returns.

By taking short positions on these specialized funds, investors not only benefit from declining oil prices but also enjoy increased leverage. This strategic approach allows investors to potentially achieve higher returns compared to traditional investment methods.

It is important, however, for investors to carefully consider the risks associated with using leveraged ETFs. While they can offer significant profit opportunities, they also carry a higher level of risk due to their use of derivatives and leverage.

Investors should thoroughly evaluate their risk tolerance and conduct thorough research before incorporating 3x Oil Bear ETFs into their investment strategies.

In summary, potential advantages for investors in bearish oil markets include the profit potential offered by 3x Oil Bear ETFs during declining markets and the ability to leverage short positions for higher returns. These advantages come with a heightened level of risk that should be carefully assessed by individual investors.

By understanding these factors and conducting proper due diligence, investors can make informed decisions and potentially capitalize on opportunities presented by bearish oil markets.

Considerations and Risks to Be Aware Of

Investing in 3x Oil Bear ETFs comes with considerations and risks that investors should be aware of. These leveraged investments tend to exhibit higher volatility due to amplified returns and compounding effects over time. It’s crucial to understand the increased risk exposure and be prepared for potential losses.

Timing the market correctly is essential for successful investment in these ETFs. Predicting oil prices can be challenging, requiring analysis of geopolitical events, supply and demand dynamics, and economic indicators.

Investors must also grasp the inverse nature of 3x Oil Bear ETFs, as they are designed for those anticipating a decline in oil prices. Additionally, liquidity may be reduced during certain market conditions or periods of heightened volatility, making it more challenging to buy or sell shares at desired prices.

Assessing individual risk tolerance and diversifying portfolios are important when considering these leveraged investments. It’s recommended to allocate only a portion of one’s portfolio that they are comfortable risking.

In summary, investing in 3x Oil Bear ETFs involves understanding their volatility, accurate market timing, their inverse nature, potential liquidity challenges, and assessing individual risk tolerance. Being informed about market conditions can help make more informed investment decisions.

Short-Term Trading Strategies

Short-term trading strategies allow investors to capitalize on brief market fluctuations in oil prices. By setting profit targets and stop losses, traders can protect their gains or limit potential losses. Technical analysis indicators, such as moving averages and trend lines, help identify entry and exit points based on historical price patterns.

Monitoring relevant news, such as OPEC decisions and geopolitical events, is crucial for well-timed trades. These strategies require discipline and market awareness but offer the potential for profitable outcomes within a condensed timeframe.

Long-Term Investment Approaches

Holding positions in 3x Oil Bear ETFs over a longer period can offer potential benefits. While these ETFs are typically used for short-term trading, investors may consider a longer-term approach to capitalize on sustained bearish trends in oil markets.

By holding these positions, investors can continuously benefit from the triple inverse performance of oil prices if they believe that prices will keep declining. Additionally, including a 3x Oil Bear ETF in an investment portfolio provides diversification benefits, helping to mitigate losses during periods of declining oil markets.

However, caution is necessary as these investments carry unique risks and require thorough research and analysis before making any investment decisions.

Understanding the Risks Involved

Investing in leveraged ETFs, like 3x Oil Bear ETFs, comes with inherent risks. Leverage amplifies gains and losses, making these investments highly volatile and unsuitable for risk-averse investors.

Over longer periods, the compounding effect can cause deviations from the intended multiple of the ETF, reducing their effectiveness as long-term holdings. It’s important to note that leveraged ETFs are better suited for short-term trading strategies rather than long-term investments.

Investors should carefully consider their risk tolerance before venturing into leveraged ETFs.

[lyte id=’4ZFulkQ9Kpc’]