Investing in the right sectors can yield significant returns, and for those looking to capitalize on the future of energy, lithium mining stocks are worth considering.

As the demand for clean energy solutions continues to rise, so does the need for lithium, a crucial component in batteries used in electric vehicles and renewable energy storage systems. In this article, we will explore the world of lithium mining stocks and provide you with valuable insights on how to navigate this exciting investment opportunity.

The Rise of Lithium: A Game-Changer in the Energy Industry

Lithium has revolutionized the energy industry, becoming essential in powering our modern lives. From smartphones to electric cars, its efficiency and lightweight nature make it an undeniable choice for battery technology.

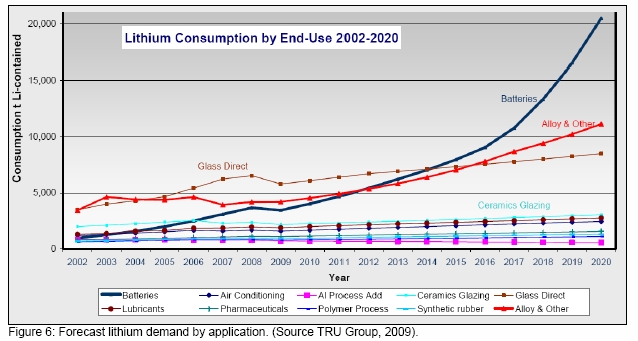

As governments push for greener solutions, the demand for lithium-ion batteries is skyrocketing, presenting lucrative opportunities for mining companies. With countries transitioning to renewable energy sources, reliable and sustainable battery technology is in high demand, positioning lithium mining companies to profit immensely from this trend.

The rise of lithium represents a paradigm shift in energy utilization and a game-changing force within the industry.

Understanding Lithium Stocks: What You Need to Know

Investing in lithium stocks requires a solid understanding of how stocks function as an investment. Stocks represent ownership in a company and are bought and sold on stock exchanges like NASDAQ or NYSE. The growing importance of lithium-ion batteries has led to increased interest in lithium mining stocks.

Before investing, consider factors such as a company’s financial health, market share, adaptability to industry changes, and technological advancements affecting the energy sector.

Top Players in the Lithium Mining Sector: Who’s Leading the Pack?

In the lithium mining sector, Albemarle Corporation, SQM S.A., and Ganfeng Lithium Co., Ltd. have established themselves as leaders. These companies dominate the industry globally, with Albemarle Corporation having a strong global presence and SQM S.A. focusing on sustainable practices.

Ganfeng Lithium stands out for its vertical integration approach. Analyzing their financial performance helps investors make informed decisions, while diversifying investments within the sector mitigates risk and maximizes potential growth opportunities.

In summary, Albemarle Corporation, SQM S.A., and Ganfeng Lithium Co., Ltd. are leading players in the lithium mining sector, offering investors diverse opportunities for growth and stability in this expanding industry.

Evaluating Lithium Mining Stocks: Key Metrics and Indicators

When evaluating lithium mining stocks, it is crucial to consider key metrics and indicators that provide insights into a company’s potential performance.

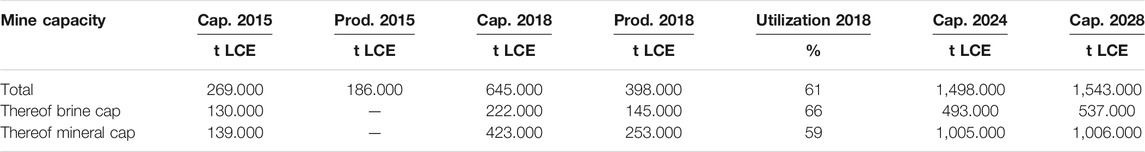

This includes analyzing financial statements, competitive advantages such as lithium reserves and production capacity, management team quality, and industry trends like battery technology advancements and government policies.

Understanding these factors through fundamental analysis allows investors to make informed decisions in the dynamic lithium mining sector.

Risks and Challenges of Investing in Lithium Mining Stocks

Investing in lithium mining stocks presents a range of risks and challenges that potential investors must be aware of. Fluctuations in lithium prices can have a direct impact on the profitability and stock performance of companies within this sector.

Understanding the factors that drive price volatility is crucial for investors looking to navigate this market successfully.

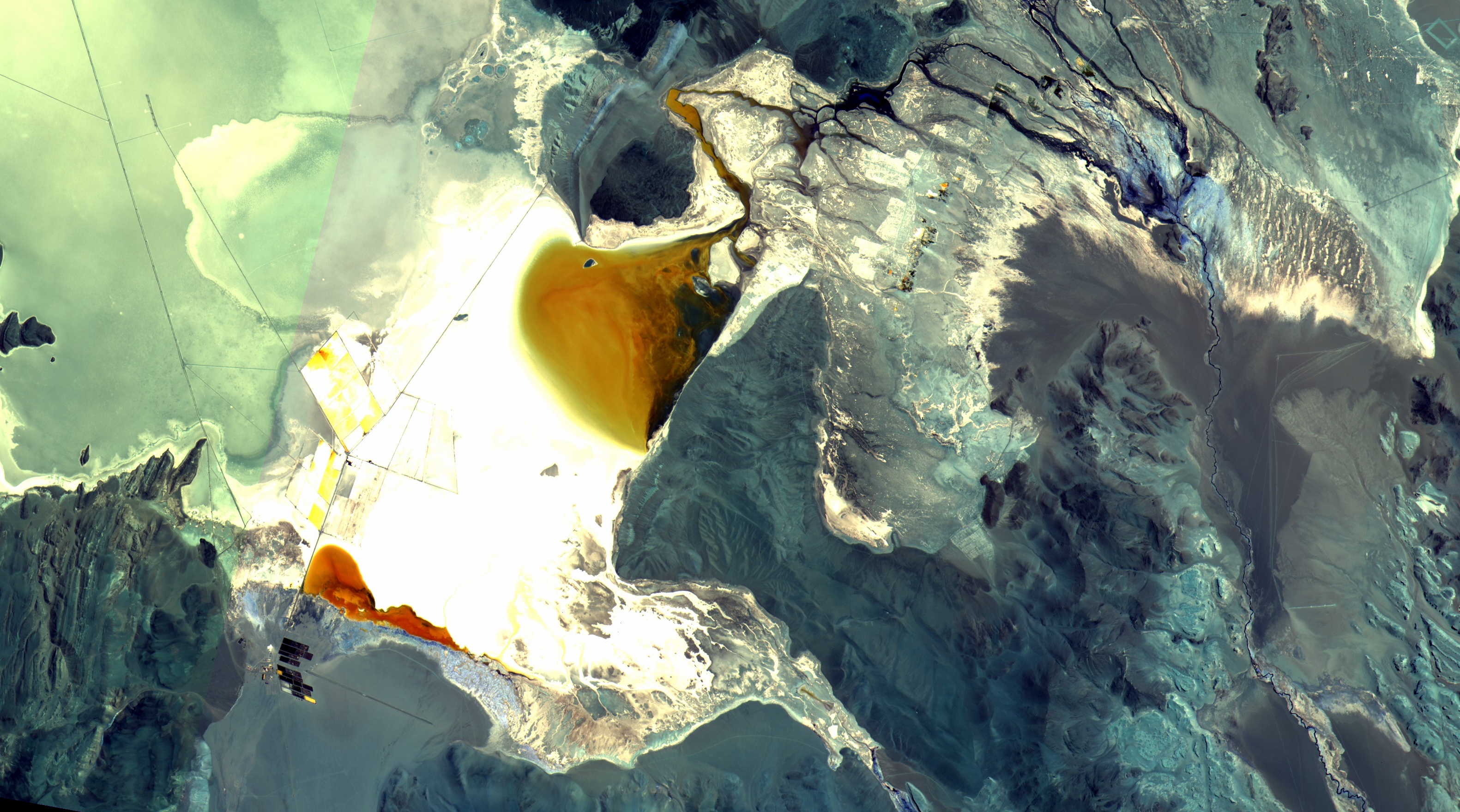

One significant risk associated with investing in lithium mining stocks is the potential environmental concerns related to lithium mining operations. This includes issues such as water scarcity and soil degradation.

It is important for investors to be aware of these environmental considerations and take them into account when evaluating potential investment opportunities. Companies that prioritize sustainable practices and responsible resource extraction should be given careful consideration.

In addition to environmental concerns, regulatory risks and geopolitical factors can also significantly affect the global supply chain of lithium. Changes in regulations or political developments can impact both production costs and market dynamics, influencing the overall profitability of companies involved in lithium mining.

Staying informed about these regulatory risks and geopolitical factors is essential for making well-informed investment decisions within this sector.

To summarize, investing in lithium mining stocks comes with its fair share of risks and challenges. Fluctuations in lithium prices, environmental concerns related to mining operations, as well as regulatory risks and geopolitical factors affecting the global supply chain all need to be carefully considered by investors.

By being aware of these potential pitfalls, investors can make more informed decisions when it comes to navigating the complex landscape of investing in lithium mining stocks.

VI Strategies for Successful Investing in Lithium Mining Stocks

Investing in lithium mining stocks requires careful consideration and the implementation of effective strategies. Here are a few key strategies to enhance your chances of success:

-

Diversification: Spread investments across multiple companies or sectors related to clean energy solutions. This minimizes risk and maximizes potential returns.

-

Long-term perspective: Focus on the potential growth of the lithium mining industry over time, rather than short-term market fluctuations.

-

Stay informed: Monitor industry news, technological advancements, and government policies to adapt your investment strategy accordingly.

-

Thorough research: Conduct due diligence on companies’ financial health, management expertise, and lithium reserves before making investment decisions.

-

Risk management: Set realistic expectations, diversify your portfolio, and be aware of the inherent volatility in the sector.

-

Engage with experts: Seek advice from financial advisors or industry professionals specializing in clean energy investments for valuable insights.

By implementing these strategies, you can increase your chances of success when investing in lithium mining stocks. With the growing demand for lithium in electric vehicles and renewable energy storage systems, this sector offers promising opportunities for investors with a well-informed and strategic approach.

Future Outlook for Lithium Mining Stocks: Opportunities and Challenges Ahead

The future of lithium mining stocks looks promising as the world embraces cleaner energy solutions. Electric vehicle adoption, renewable energy storage systems, and battery technology advancements offer growth opportunities within this sector.

Emerging markets provide significant potential for lithium mining companies. Developing countries’ focus on expanding renewable energy capacities drives demand for lithium-ion batteries. Investors can find lucrative opportunities by identifying these emerging markets.

Despite growth prospects, challenges like market competition, regulatory hurdles, and geopolitical uncertainties must be considered. Being aware of these risks allows investors to make informed decisions when investing in lithium mining stocks.

Conclusion: Is Investing in Lithium Mining Stocks Right for You?

Investing in lithium mining stocks offers a unique opportunity to capitalize on the future of clean energy solutions. However, it requires thorough research, staying informed about market trends, and assessing your risk appetite.

Factors such as financial stability, management expertise, growth potential, resource reserves, and global demand for lithium-ion batteries should be considered. Volatility in commodity prices and regulatory changes also pose risks.

Aligning your investment strategy with your goals and consulting with a financial advisor specializing in the sector can help make informed decisions. Approach investing in lithium mining stocks with caution and ensure it aligns with your overall investment strategy.

Table: Factors to Consider When Evaluating Lithium Mining Stocks

| Factors to Consider |

|---|

| Financial stability of the mining company |

| Management expertise and track record |

| Growth potential and expansion plans |

| Resource reserves and production capacity |

| Technological advancements in lithium extraction |

| Global demand for lithium-ion batteries |

| Commodity price volatility |

| Geopolitical risks and supply chain uncertainties |

[lyte id=’2KrzsbiSf_o’]