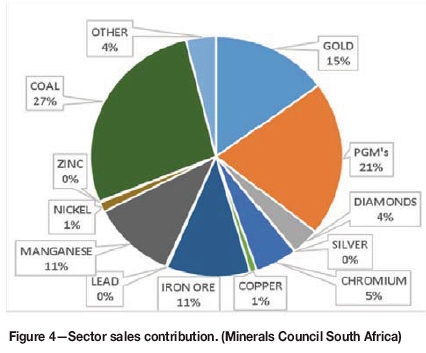

Investing offers a wide range of options, from stocks to real estate. However, one often overlooked avenue with immense potential is junior mining companies. These companies focus on early-stage exploration and development projects, playing a crucial role in discovering new mineral deposits.

Investing in junior mining companies allows for diversification and the possibility of significant returns. With increasing global demand for minerals, investing in these companies during a commodity upswing can be advantageous. However, careful analysis and due diligence are essential when considering investments in this sector.

By exploring the world of mining investments, investors can uncover unique opportunities for growth and wealth accumulation.

Understanding the Importance of Junior Mining Companies in the Mining Industry

Junior mining companies are vital players in the industry, bringing fresh ideas, innovative technologies, and exploration expertise. They explore overlooked regions and take on risky projects, contributing significantly to industry growth.

Furthermore, they serve as breeding grounds for future major players by capitalizing on early-stage opportunities. Understanding the challenges faced by junior miners is essential for investors and enthusiasts interested in this aspect of investing.

Volatility and Uncertainty

Junior mining companies encounter significant challenges in dealing with the inherent volatility and uncertainty of their operations. Early-stage exploration projects carry high risk due to limited information about potential mineral deposits, making it difficult for these companies to attract financing from risk-averse investors.

Fluctuations in commodity prices, geopolitical events, and global economic conditions can have a profound impact on the success or failure of a junior mining venture.

Managing these uncertainties requires careful planning, adaptability, and proactive measures such as building strong relationships with local communities and leveraging advanced technological tools for data analysis during exploration activities.

Regulatory Challenges and Environmental Concerns

Junior mining companies face regulatory challenges and environmental concerns that hinder their progress. Obtaining permits and licenses for exploration is time-consuming and expensive due to strict regulations on land access, environmental impact assessments, and community engagement.

Environmental sustainability is increasingly important in the industry, requiring responsible practices to minimize ecological footprints. Failure to address these concerns affects operations and reputation among investors and stakeholders. Navigating these challenges is crucial for success in the mining sector.

Capitalizing on Early-Stage Opportunities

Junior mining companies can position themselves for success by capitalizing on early-stage opportunities. By identifying underexplored regions with significant geological potential, these companies secure prospective mineral rights at lower costs.

Employing advanced exploration techniques like geophysical surveys, geochemical analysis, and remote sensing technologies helps them efficiently identify areas with high mineralization potential. This allows junior miners to acquire valuable assets that could yield substantial returns in the future.

Navigating the Financing Landscape

Securing adequate financing is a crucial challenge for junior mining companies, especially those with limited financial resources. These companies heavily rely on external funding sources to support their mining projects.

Equity financing, venture capital investments, strategic partnerships, and joint ventures are common avenues that junior miners explore to attract investors and acquire the necessary funds.

To successfully appeal to potential investors, junior mining companies must present compelling investment cases supported by robust geological evidence. The ability to demonstrate a clear path towards resource delineation and development is essential in gaining investor confidence.

Building strong relationships with investors who understand the unique risks associated with early-stage projects becomes paramount in securing consistent funding throughout various stages of exploration and development.

One effective strategy for attracting investors is through showcasing case studies of successful junior mining companies. These case studies serve as real-life examples of how certain companies have navigated the financing landscape successfully.

By highlighting these success stories, junior miners can inspire confidence among potential investors and demonstrate their capability to deliver on their promises.

In summary, navigating the financing landscape is crucial for the success of junior mining companies. By presenting compelling investment cases backed by solid geological evidence and fostering relationships with supportive investors, these companies can secure the necessary funding to advance their exploration and development efforts.

Through case studies of successful peers within the industry, they can further enhance their credibility and attract more investment opportunities.

How Company X Became a Major Player in Gold Production

Company X, a small exploration firm with limited resources, managed to transform itself into one of the leading global gold producers through strategic decision-making and meticulous geological analysis.

By identifying promising gold deposits in an overlooked region and attracting experienced investors who believed in their potential, Company X successfully developed the mine and scaled up operations. This success story exemplifies how junior mining companies can capitalize on early-stage opportunities to become major players in the industry.

Company Y’s journey from a struggling miner to discovering a massive copper deposit

Company Y faced numerous challenges during its initial years, including financial constraints and regulatory hurdles. Despite these difficulties, they persevered and continued their exploration efforts with unwavering determination. Through persistence and innovation, Company Y set out to uncover untapped potential in the mining industry.

Their tireless exploration paid off when they made a groundbreaking discovery – a massive copper deposit that had gone unnoticed by larger mining firms. This revelation completely transformed the trajectory of Company Y’s future, propelling them from obscurity to the forefront of the industry.

The significance of this discovery cannot be overstated. It not only reaffirmed the value of junior mining companies but also demonstrated the immense opportunities that lie within their reach through perseverance and commitment to exploration.

By daring to venture where others had overlooked, Company Y unlocked a treasure trove that attracted substantial investments from industry giants.

With this newfound resource potential, Company Y became an attractive proposition for investors eager to capitalize on their successful journey. The spotlight now shone brightly on the once-struggling miner as they basked in the attention and recognition earned through their relentless pursuit of success.

This incredible transformation serves as a testament to the importance of due diligence for investors. It highlights how thoroughly researching and understanding junior mining companies’ potential can lead to fruitful opportunities that may have otherwise been missed by more established players in the market.

[lyte id=’eDt7pj8gP5s’]