Investing in emerging technologies can be both exciting and daunting. One such technology that has been gaining significant attention is quantum computing. With its potential to revolutionize industries and solve complex problems, it’s no wonder investors are curious about the opportunities it presents.

In this article, we will explore the basics of quantum computing, its applications in various industries, key players in the field, potential risks and rewards of investing, practical tips for investors, case studies of successful investments, challenges facing quantum computing investment, and ultimately help you decide whether or not you should invest in this groundbreaking technology.

Understanding the Basics of Quantum Computing

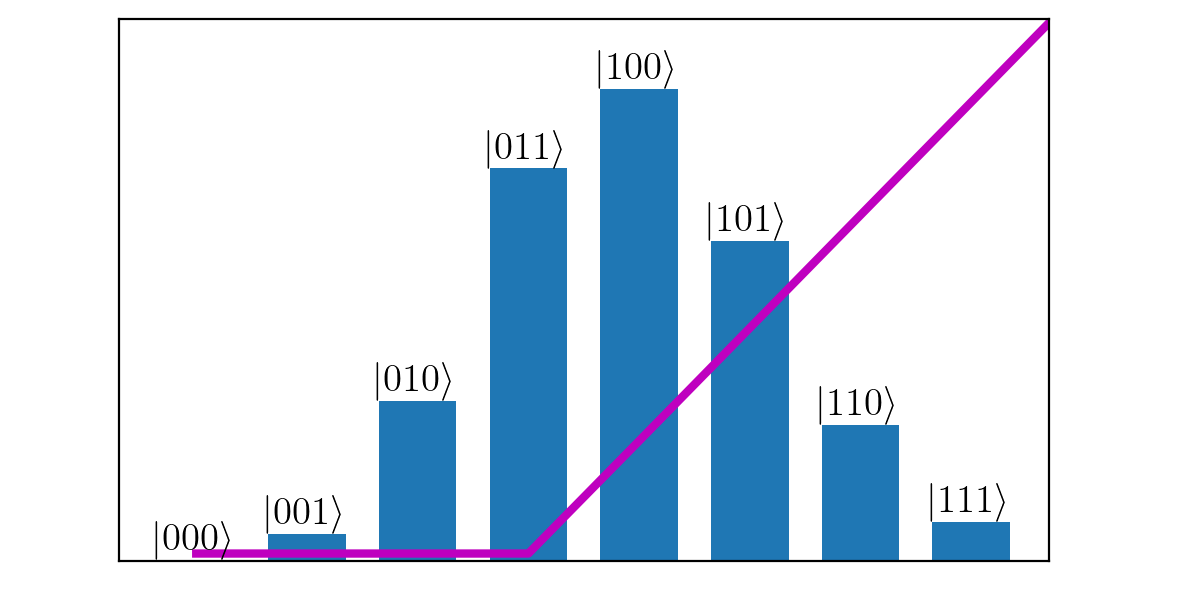

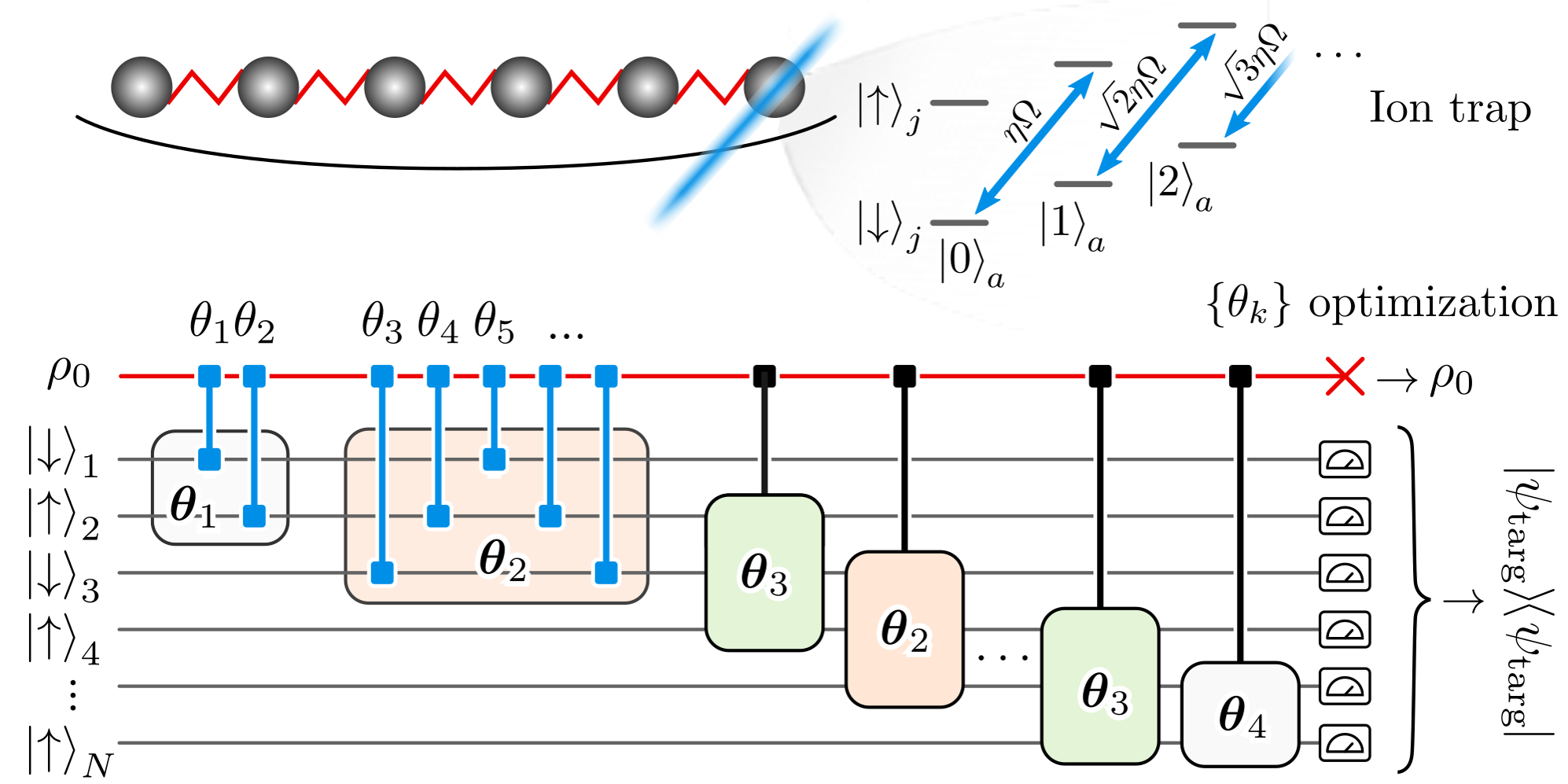

Quantum computing utilizes quantum mechanics to perform computations beyond classical computers’ capabilities. Unlike binary-based bits, quantum computers use qubits that can exist in multiple states simultaneously (superposition).

This enables them to process vast amounts of information simultaneously and potentially achieve exponential computational power.

The key difference between quantum and classical computing lies in their approach. Classical computers operate sequentially with limited binary bits, while quantum computers leverage entanglement and superposition for parallel computations, enabling faster problem-solving.

Quantum computing holds immense potential across various fields. It can revolutionize optimization problems, cryptography, drug discovery, weather forecasting, and artificial intelligence (AI).

From more efficient supply chain management to breaking traditional encryption methods and accelerating drug development, quantum algorithms offer novel solutions. Additionally, they can enhance AI by improving pattern recognition and solving complex problems.

Quantum Computing Applications in Various Industries

Quantum computing has the potential to revolutionize various industries. In finance and banking, it can optimize portfolio management, risk analysis, and fraud detection. In healthcare and pharmaceuticals, it can accelerate drug discovery, optimize treatment plans, and solve complex computational problems related to genomics.

In cybersecurity and encryption, it offers both a challenge and an opportunity by breaking traditional encryption methods while also enabling the development of quantum-resistant encryption algorithms. Overall, quantum computing holds immense promise for transforming industries and solving complex problems in innovative ways.

Key Players and Progress in the Race to Develop Quantum Computers

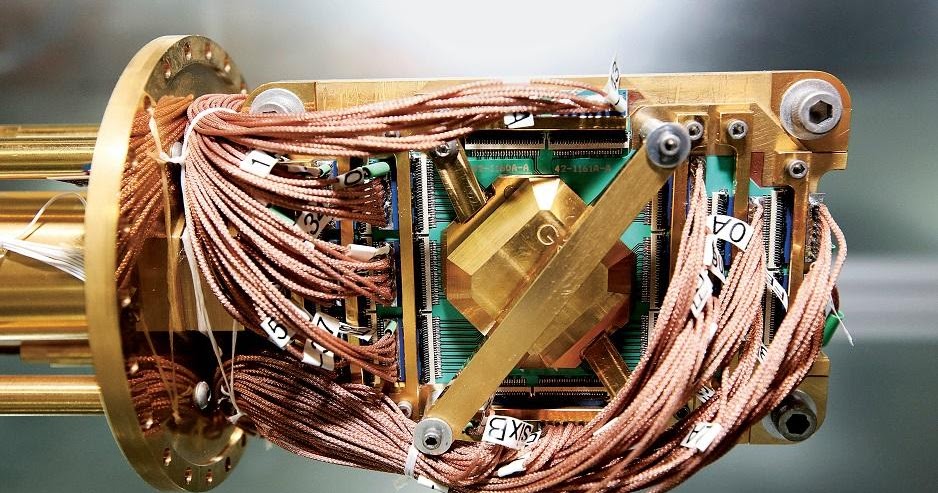

Major companies such as IBM, Google, Microsoft, D-Wave Systems, and Intel are heavily investing in quantum computing research. They aim to develop practical quantum computers with increased qubit counts and improved reliability.

Leading researchers and institutions worldwide have made significant advancements, including Google’s achievement of “quantum supremacy.” While practical quantum computers are still years away, ongoing research and investments suggest progress towards this goal.

Collaboration between academia and industry, along with government funding programs, contributes to the advancement of scalable and commercially viable quantum computers. The race to develop these powerful machines continues, driven by the potential for groundbreaking applications.

Investing in Quantum Computing: Risks, Rewards, and Opportunities

Investing in quantum computing presents risks, rewards, and opportunities. Investors can participate by investing directly in research companies, purchasing technology-focused ETFs, or backing venture capital funds supporting startups. However, careful evaluation of technological challenges, regulatory hurdles, and market uncertainties is crucial.

Despite the risks, early investments in groundbreaking technologies have historically yielded substantial returns. The long-term growth potential of quantum computing cannot be ignored. With a realistic perspective and a diversified portfolio, investors can potentially benefit from this futuristic industry’s advancements.

Practical Tips for Investing in Quantum Computing

Investing in quantum computing requires careful consideration and strategic decision-making. Here are some practical tips to guide your investment choices:

-

Seek expert opinions: Consult financial advisors specializing in tech investments for valuable insights into the industry landscape and potential opportunities.

-

Diversify your portfolio: Spread investments across companies, sectors, and asset classes to reduce individual risks and increase chances of benefiting from overall industry growth.

-

Stay updated on industry news: Regularly follow reputable sources to stay informed about developments, breakthroughs, and market trends within the quantum computing industry.

-

Assess regulatory implications: Understand how regulations may impact the commercialization of quantum technologies and watch for government support initiatives.

-

Evaluate partnerships: Keep an eye on strategic alliances between technology companies, research institutions, and government entities as they indicate shared resources and expertise.

By following these practical tips, you can make well-informed decisions and position yourself to capitalize on the transformative potential of quantum computing while managing risks effectively.

Successful Investments in Quantum Computing

Early investors in quantum computing, such as D-Wave Systems, have reaped substantial rewards. These pioneers saw significant returns as the company made advancements in its quantum computers. Successful investors utilize thorough research, diversification, and long-term strategies to make well-informed decisions.

Lessons learned from past investments emphasize the importance of assessing technological feasibility and market demand before investing in nascent technologies like quantum computing. Patience and a long-term perspective are crucial when navigating this rapidly evolving sector.

By adopting effective strategies and learning from successful case studies, investors can capitalize on the immense potential of quantum computing.

Challenges Facing Quantum Computing Investment

Quantum computing presents challenges in scalability, regulation, and public perception. Scaling up the number of qubits while maintaining coherence is a technical hurdle. Regulatory frameworks struggle to keep pace with advancements, raising concerns about data privacy, intellectual property, and national security.

Public skepticism due to complexity and potential consequences can hinder acceptance. Overcoming these challenges is crucial for successful investment and commercialization of quantum computing.

Conclusion – Should You Invest in Quantum Computing?

Quantum computing holds immense potential for transforming industries and solving complex problems.

The question remains: should you invest in this disruptive technology? Before making a decision, it is crucial to carefully weigh the potential benefits against the inherent risks.

Investing in quantum computing comes with significant potential rewards, but it also carries uncertainties and challenges. As an investor, it is essential to consider various factors before diving into this nascent technology. Assess your risk tolerance, investment horizon, and the expertise available to guide you.

Evaluate how quantum computing aligns with your overall investment strategy and financial goals.

Regardless of whether or not you choose to invest in quantum computing, staying informed about technological advancements and market trends is crucial. This ever-evolving landscape requires continuous learning and adaptation.

Seek professional advice from financial advisors who specialize in emerging technologies to make well-informed decisions that align with your financial goals.

Diversifying portfolios is another key aspect of navigating the quantum computing investment landscape successfully. By spreading investments across different sectors and asset classes, you can mitigate risks associated with specific technologies or companies.

Maintaining a long-term perspective is vital when considering quantum computing investments. This field is still in its early stages, and breakthroughs may take time to materialize fully. Patience and a commitment to long-term strategies can help investors weather the volatility that may accompany this emerging technology.

[lyte id=’sNn39TkbV9M’]