Electric cars have gained significant popularity in recent years due to their environmental and economic benefits. With zero-emission capabilities and lower operating costs, electric vehicles are revolutionizing the transportation industry.

The increasing demand for cleaner and more sustainable forms of transportation is a key driver behind the rise of electric cars. As concerns over climate change grow, people are turning to electric vehicles as a greener alternative to traditional combustion engine cars.

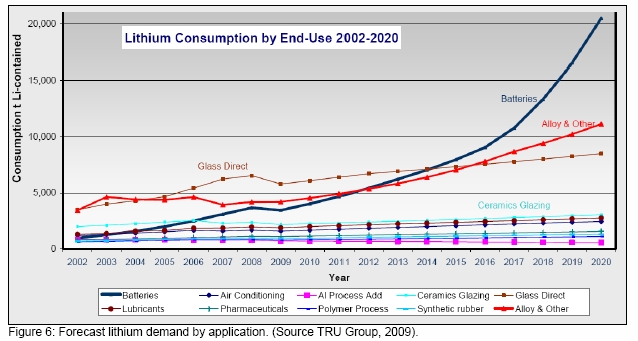

Advancements in battery technology have also played a crucial role in the widespread adoption of electric vehicles. Traditional lead-acid batteries are being replaced by more efficient lithium-ion batteries, offering improved range, charging times, and overall reliability.

The rise of electric cars has not only impacted automotive manufacturing but has also influenced energy production and infrastructure development. Governments worldwide are implementing policies to incentivize the adoption of electric vehicles through tax credits, subsidies, and infrastructure investments.

Investors are recognizing the potential for growth in electric vehicle production and related industries such as battery manufacturing. Investing in battery stocks presents a unique opportunity to capitalize on the growing demand for electric vehicle batteries.

Understanding Battery Technology

Electric vehicles (EVs) have revolutionized the automotive industry, offering a sustainable and environmentally-friendly alternative to traditional gasoline-powered cars. Central to the success of EVs is battery technology, which provides the necessary power to propel these vehicles.

There are several types of batteries used in electric cars today, each with its own advantages and limitations.

Lithium-ion batteries are the most commonly used type in electric cars due to their high energy density, long lifespan, and low self-discharge rate. Nickel-metal hydride (NiMH) batteries, although less common, find applications in certain hybrid electric vehicles for their high power output.

Solid-state batteries are an emerging technology with potential for higher energy density, improved safety, and faster charging times.

Despite advancements in battery technology, challenges remain. Lithium-ion batteries face limitations such as limited energy storage capacity and safety concerns. The high cost of production also hinders widespread adoption of electric vehicles. However, ongoing research and declining costs are driving progress in addressing these challenges.

Understanding battery technology is crucial for investors looking to capitalize on the growing EV sector. By recognizing the advantages and limitations of different battery types and acknowledging current challenges, investors can make informed decisions that contribute to the continued growth of this exciting industry.

Top Battery Stocks for Electric Cars

As the demand for electric vehicles (EVs) continues to rise, the need for reliable and advanced battery technology becomes increasingly important. In this section, we will explore three top battery stocks that are driving innovation in the electric car industry.

Tesla, Inc. is a leader in the EV market, known for its cutting-edge battery technology. With their Gigafactory producing lithium-ion batteries specifically designed for their electric vehicles, Tesla remains at the forefront of battery innovation.

Their impressive financial performance and stock growth potential make them an attractive choice for investors.

Panasonic Corporation is a key player in the battery sector, supplying lithium-ion batteries to Tesla for their EVs. This partnership has strengthened Panasonic’s position in the market.

With a history of stability and innovation, Panasonic offers investment prospects for those looking to capitalize on the growing demand for batteries in the EV industry.

CATL is one of the world’s largest manufacturers of lithium-ion batteries specifically designed for electric vehicles. Their strong market presence and focus on expanding production capacity and enhancing battery performance position them as an appealing choice for investors seeking exposure to battery stocks.

In summary, Tesla, Panasonic, and CATL are leading companies in the battery industry with significant contributions to the electric car market. These stocks offer opportunities for investors looking to benefit from the increasing popularity of EVs and sustainable transportation solutions.

Battery Innovations to Watch Out For

Advancements in battery technology, particularly lithium-ion batteries and emerging solid-state batteries, are shaping the future of electric vehicles (EVs). Researchers are focused on increasing energy density, reducing charging times, and enhancing safety features. These developments will play a crucial role in the widespread adoption of EVs.

Solid-state batteries offer even greater energy density, faster charging times, and improved safety compared to traditional lithium-ion batteries. As this technology continues to develop, it could revolutionize the electric vehicle industry.

Investing Tips and Strategies for Battery Stocks

Investing in battery stocks requires careful consideration of various factors. Here are some key tips and strategies to help you make informed decisions in this sector:

-

Market trends and industry forecasts: Stay updated on the latest market trends and industry forecasts related to electric vehicle adoption and battery technology advancements. This information can guide your investment choices based on the growth potential of the battery industry.

-

Diversification and risk management: Mitigate risks by diversifying your investment portfolio with multiple battery stocks from different companies. This strategy helps reduce exposure to individual company performance or market fluctuations.

-

Long-term growth potential: Evaluate each company’s long-term growth potential by considering their financial stability, technological innovation, and market positioning. Thorough research will help identify companies with strong fundamentals for sustainable growth.

When investing in battery stocks, conducting thorough research and analysis is crucial. Assessing a company’s financials, competitive advantages, and industry dynamics provides valuable insights for making informed decisions aligned with your investment goals.

By following these tips and strategies, you can navigate the battery stock market more effectively and increase your chances of success.

Conclusion

[lyte id=’fddC65Bo7uw’]