Investing in renewable energy has become increasingly popular as individuals seek out sustainable and environmentally friendly investment opportunities. One way to gain exposure to the renewable energy sector is through exchange-traded funds (ETFs), which offer a diversified portfolio of clean energy companies.

In this article, we will explore the best clean energy ETFs, provide a step-by-step guide on how to invest in them, analyze their performance, and compare different options within the sector.

The Best Clean Energy ETFs

When it comes to investing in clean energy, choosing the right exchange-traded fund (ETF) is crucial for achieving your financial goals. In this section, we will explore some of the best-performing clean energy ETFs available today.

We’ll start by examining the top-performing ETFs that consistently deliver strong returns. These funds provide exposure to leading companies in the renewable energy industry. We’ll analyze their underlying holdings, sectors, and strategies to help you make informed investment decisions.

Next, we’ll delve into an analysis of expense ratios and fees associated with clean energy ETFs. Understanding these costs will enable you to make effective comparisons between different funds and optimize your investment strategy.

Lastly, we’ll compare the performance and returns of various clean energy ETFs over different time periods. By examining historical data and trends, we can identify top-performing funds that align with your investment goals.

How to Invest in Clean Energy Using ETFs

Investing in clean energy ETFs is a great way to support renewable energy and potentially earn a return on your investment. To get started, open a brokerage account and research different firms to find one that suits your needs. Once your account is set up, research and choose the clean energy ETFs that align with your investment goals.

Purchase the ETFs through your brokerage account using their trading platform. Monitor your investments regularly, stay informed about industry news, and consider rebalancing your portfolio as needed. By following these steps, you can begin investing in clean energy and contribute to a more sustainable future.

Performance of S&P Global Clean Energy Index

The performance of the S&P Global Clean Energy Index is a crucial aspect for investors looking to understand the trends and potential profitability within the clean energy sector. This widely followed benchmark tracks the performance of companies engaged in renewable energy-related businesses.

By examining historical data and analyzing past trends, investors can gain valuable insights into how this index has fared over time.

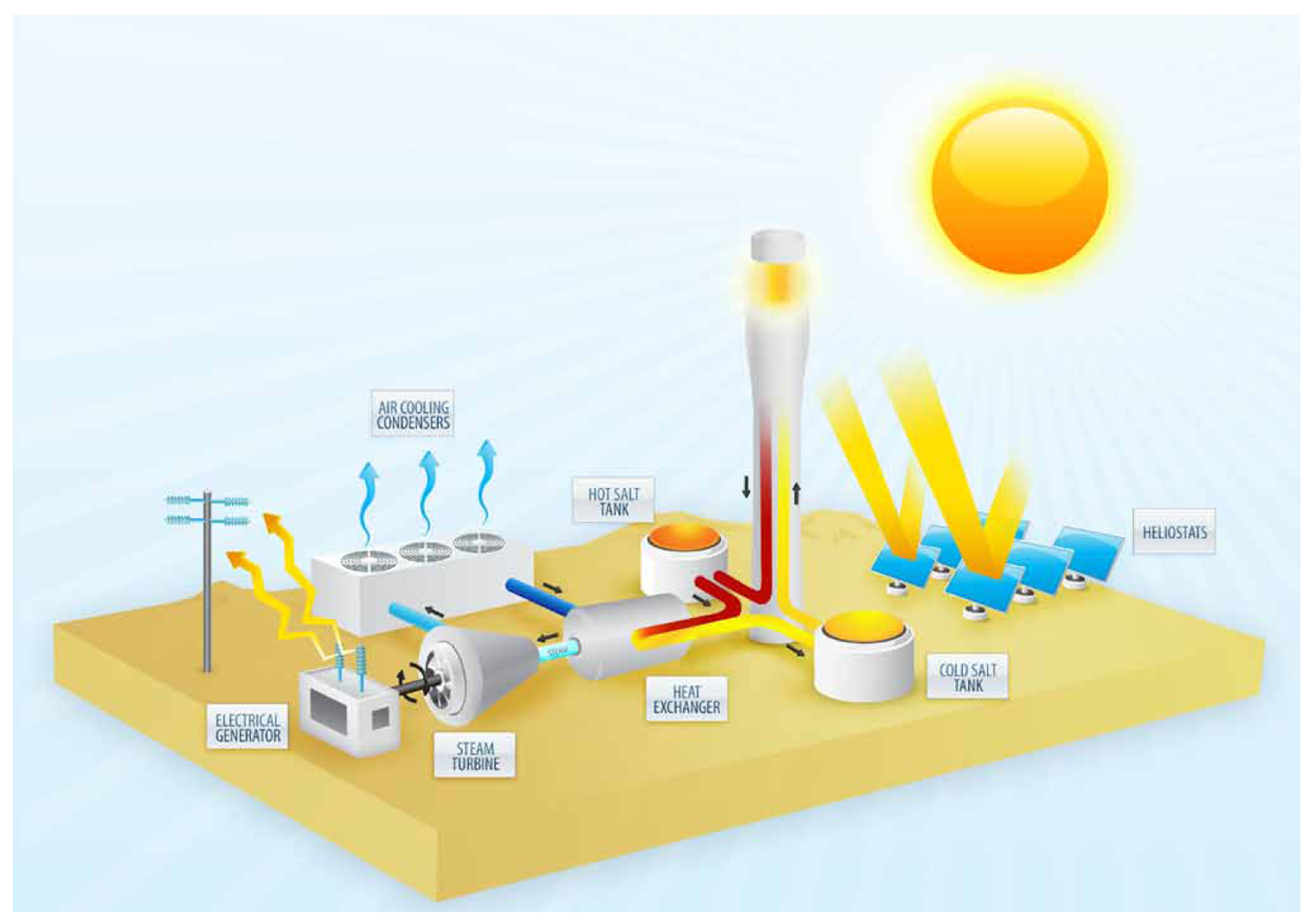

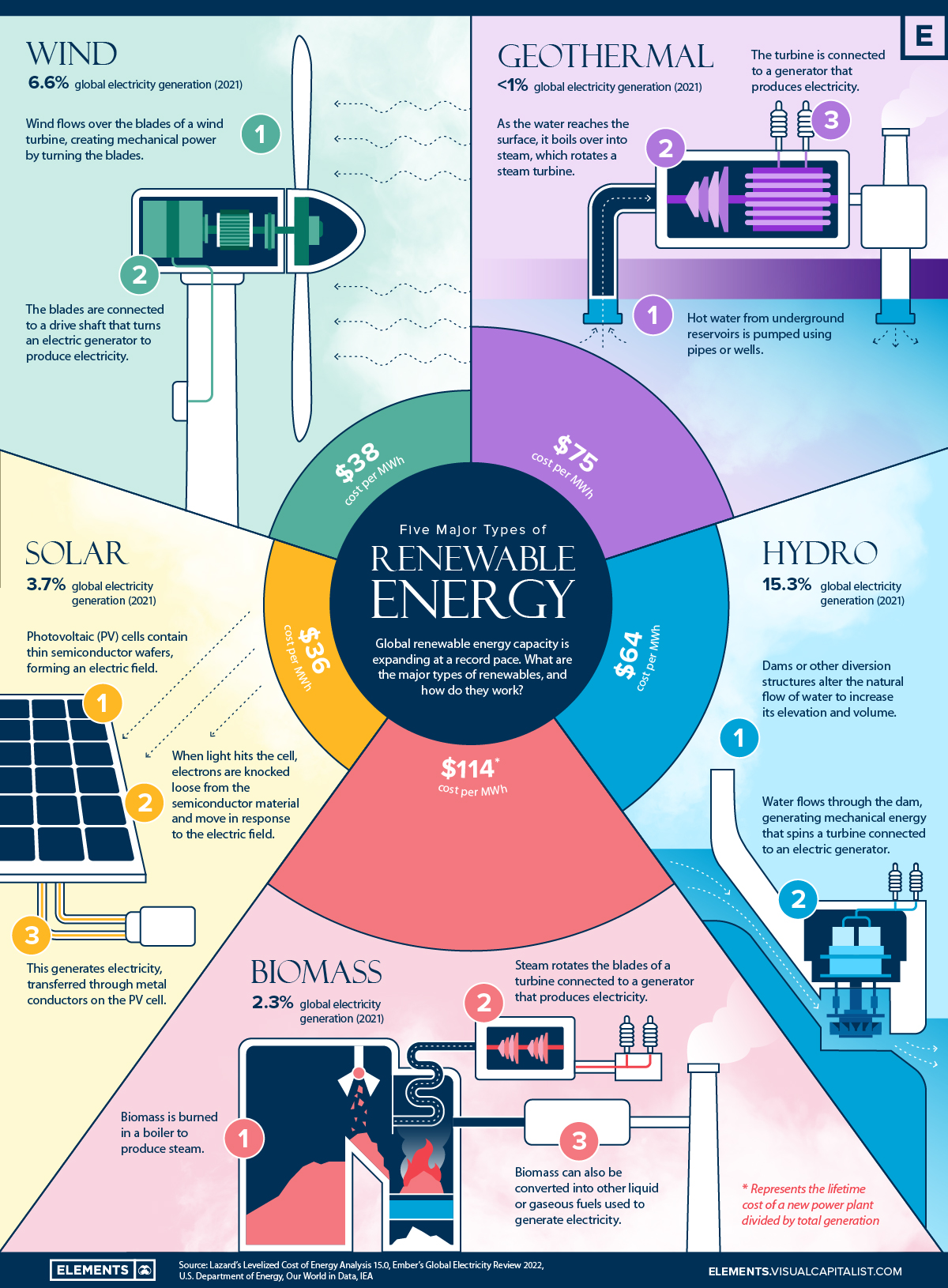

To comprehend the overall performance of the clean energy sector, it is essential to explore and understand the methodology and criteria for inclusion in the S&P Global Clean Energy Index. This index provides an overview of companies involved in renewable energy, such as solar, wind, hydroelectric power, and other sustainable technologies.

By tracking the performance of these companies, investors can gauge the growth trajectory and market sentiment towards clean energy.

Analyzing historical performance allows investors to identify patterns and trends that could influence future investment decisions. Examining ups and downs over different time periods helps paint a comprehensive picture of market volatility within the clean energy sector.

By understanding these fluctuations, investors can make more informed decisions about their investments in clean energy ETFs (Exchange-Traded Funds).

A closer look at historical data reveals how various factors have influenced the performance of the S&P Global Clean Energy Index. Market dynamics, government policies, technological advancements, and shifting consumer preferences all play a role in shaping this index’s ups and downs.

By studying these influences, investors can anticipate potential opportunities or challenges that may arise in the future.

In summary, monitoring the performance of the S&P Global Clean Energy Index provides valuable insights into the overall health and direction of the clean energy sector.

Understanding its methodology, analyzing historical data, and identifying trends are all crucial steps for investors aiming to make informed decisions regarding their investments in clean energy ETFs.

Comparison of Clean Energy ETFs

Investing in clean energy ETFs has gained popularity as investors seek environmentally responsible investments. With numerous options available, choosing the right ETF can be overwhelming. In this section, we will evaluate clean energy ETFs based on factors such as expense ratios, holdings diversity, geographic exposure, and investment strategies.

Expense ratios are important to consider as they impact returns. Lower expense ratios mean higher potential gains for investors. Holdings diversity varies among clean energy ETFs, with some focusing on specific industries or regions while others offer broader exposure.

Geographic exposure determines which regions’ clean energy markets the fund invests in.

Investment strategies vary as well, with some funds passively tracking specific clean energy indexes and others actively managed by professionals. By comparing these factors, investors can make informed decisions aligned with their preferences and beliefs.

| Factor | Consideration |

|---|---|

| Expense ratios | Evaluate annual fees to maximize returns |

| Holdings diversity | Examine diversification within sectors and industries |

| Geographic exposure | Assess investments across regions to capitalize on growth opportunities |

| Investment strategies | Understand indexing or active management approach |

Return Comparison of All Clean Energy ETFs

In this section, we will conduct an in-depth analysis of the returns across all clean energy ETFs. By comparing their performance over different time frames, we can identify trends and top-performing funds within the renewable energy sector.

This comprehensive evaluation will provide readers with valuable insights to make informed investment decisions. We will also present a table outlining key performance metrics for each ETF, including annualized returns, volatility measures, and risk-adjusted returns.

By considering both short-term and long-term performance trends, investors can gain a clear understanding of which funds have consistently delivered strong results in the clean energy market. This information will empower readers to make informed investment choices that align with their financial goals and commitment to sustainability.

[lyte id=’0B4aaB05LRY’]