Investing in dividend stocks has long been a popular strategy for investors looking to generate income and achieve long-term growth. By focusing on companies that consistently pay dividends, investors can benefit from a steady income stream while also participating in the potential for capital appreciation.

In this article, we will explore the AAII Dividend Investing Portfolio and analyze its performance to understand the benefits and risks associated with dividend investing.

What is dividend investing?

Dividend investing involves choosing stocks from companies that regularly distribute profits to shareholders through dividends. These dividends provide a consistent income stream and are usually paid out quarterly or annually. Unlike strategies based on stock price appreciation, dividend investing offers a more immediate return on investment.

It can provide stability to a portfolio, especially for those seeking reliable income. Dividends can also be reinvested through dividend reinvestment plans (DRIPs), compounding long-term returns.

When selecting stocks for a dividend portfolio, factors such as financial stability, track record of consistent dividends, and dividend yield should be considered. Overall, dividend investing combines income generation with the potential for growth in the stock’s value over time.

Benefits of Dividend Investing

Dividend investing offers numerous advantages for investors seeking a reliable income stream and long-term growth potential. Additionally, it provides diversification benefits that can help mitigate risks during market fluctuations.

One of the primary attractions of dividend investing is the ability to generate a steady income stream without having to sell your investments. This consistent flow of cash can be particularly appealing for retirees or individuals looking for passive income to supplement their regular earnings.

Unlike relying solely on capital gains from selling stocks, dividends provide a reliable source of income that can help cover expenses or be reinvested for further growth.

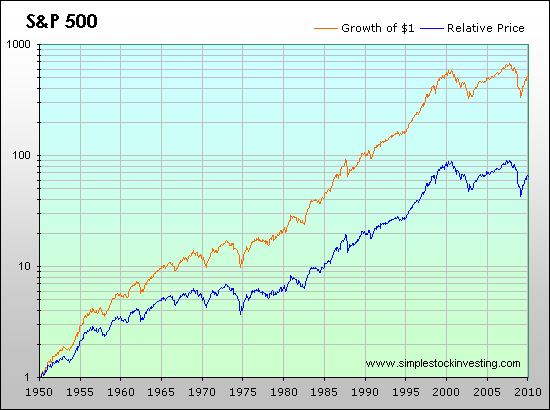

In addition to generating income, dividend investing also presents the potential for long-term growth through capital appreciation. By reinvesting dividends back into additional shares of stock, investors have the opportunity to compound their returns over time.

This compounding effect can lead to significant portfolio value increases, as each reinvestment boosts future dividend payments and subsequent share purchases.

Furthermore, dividend stocks offer diversification benefits by representing various sectors and industries. This effective portfolio diversification helps spread risk and reduces exposure to any single company or industry’s performance.

As a result, investors are better protected against losses during market downturns and enjoy greater stability in uncertain times. By holding a diversified range of dividend-paying stocks, investors can potentially enhance their overall returns while minimizing volatility.

To summarize, dividend investing provides a reliable income stream, potential long-term growth through compounding returns, and diversification benefits that reduce risk exposure. Whether you are looking for passive income or aiming to build wealth over time, incorporating dividend stocks into your investment strategy can be a wise choice.

Introduction to AAII Dividend Investing Portfolio

The AAII Dividend Investing Portfolio, offered by the American Association of Individual Investors (AAII), is a carefully curated selection of stocks designed to help investors achieve their goals through dividend-focused strategies.

By analyzing factors such as dividend history, payout ratio, financial stability, and growth prospects, the portfolio provides a diversified mix of high-quality dividend-paying stocks across various sectors and industries.

With its emphasis on regular income and long-term capital appreciation, the AAII Dividend Investing Portfolio offers investors a reliable and effective approach to achieving their investment objectives.

Analyzing the Performance of the AAII Dividend Investing Portfolio

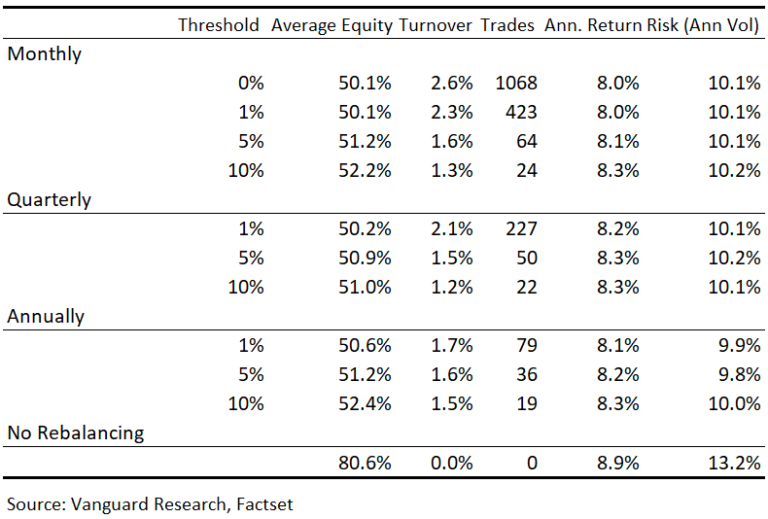

To evaluate the performance of the AAII Dividend Investing Portfolio, it’s crucial to review its historical returns compared to benchmark indices like the S&P 500 or Dow Jones. The portfolio’s stock selection methodology focuses on companies with consistent dividends and solid financials for long-term growth.

Diversification across sectors reduces risk, while reinvesting dividends maximizes compounding growth. These factors contribute to the portfolio’s performance relative to market trends and investor expectations.

| Key Factors Contributing to Performance Outcomes |

|---|

| 1. Stock selection methodology and criteria |

| 2. Sector allocation strategy |

| 3. Reinvestment of dividends |

Success Stories from the AAII Dividend Investing Portfolio

The AAII Dividend Investing Portfolio has produced remarkable success stories by focusing on stocks with consistent dividend growth and capital appreciation. One such example is Company XYZ, which has consistently increased its dividends while experiencing significant capital gains.

Additionally, the portfolio’s diversification across sectors has mitigated risk during market downturns, making it more resilient compared to concentrated portfolios. These success stories demonstrate the effectiveness of dividend investing in generating income and achieving long-term gains.

The Challenges and Risks of Dividend Investing

Dividend investing carries certain challenges and risks that require careful consideration. One key risk is the possibility of dividend cuts or suspensions during financial difficulties or economic downturns. Interest rate fluctuations can also impact stock prices, especially for high-yield dividend stocks.

Additionally, market volatility can result in temporary declines in portfolio value. To manage these risks effectively, investors should conduct thorough research, diversify their portfolios, and regularly monitor their investments.

By implementing these strategies, investors can navigate the challenges of dividend investing and potentially achieve their financial goals.

Tips for Building Your Own Dividend Investment Portfolio

To build a successful dividend investment portfolio, consider these key tips:

-

Select suitable stocks: Evaluate company fundamentals like earnings growth, payout ratios, and debt levels. Look for companies with a track record of consistent dividends.

-

Diversify your portfolio: Spread investments across sectors and industries to reduce concentration risk.

-

Monitor and adjust: Regularly review your portfolio’s performance, making adjustments as needed based on changes in market conditions or individual stock performance.

Stay informed about the companies in your portfolio to identify any potential risks or opportunities that may arise.

By following these tips, you can increase your chances of building a strong dividend investment portfolio that generates reliable income over time.

Conclusion: Is Dividend Investing Right for You?

[lyte id=’8-7XUg1mEYU’]