Investing in real estate has long been a popular choice for individuals looking to grow their wealth. However, traditional methods of real estate investment often require significant financial resources and expertise. This is where real estate equity firms have emerged as game-changers in the investment world.

These firms have gained increasing popularity and success, offering attractive opportunities for investors to participate in the lucrative real estate market.

What Exactly Are Real Estate Equity Firms?

Real estate equity firms, also known as private real estate investment firms or real estate private equity (REPE) firms, are entities that pool funds from multiple investors to invest in various real estate projects.

These firms offer a unique approach to real estate investment, providing opportunities for individuals to access a diversified portfolio of properties without the need for substantial capital or specific industry knowledge.

Unlike traditional methods of real estate investment, such as purchasing individual properties or investing in publicly traded real estate companies, real estate equity firms focus on acquiring properties with high growth potential and value-add opportunities.

Through their expertise and network, these firms aim to generate superior returns for their investors.

By pooling funds from multiple investors, real estate equity firms provide the opportunity to diversify investments across various property types, locations, and risk profiles. This diversification helps mitigate risks associated with individual property investments and provides a more stable return profile for investors.

Investing with a real estate equity firm also grants access to professional expertise and resources. These firms have dedicated teams of professionals who specialize in property acquisition, due diligence, asset management, and property disposition.

Their knowledge and experience significantly increase the chances of successful investments and maximize returns for investors.

In summary, real estate equity firms offer an attractive alternative to traditional forms of real estate investment. They provide the opportunity to participate in a diversified portfolio of properties with higher potential returns while mitigating risks through pooled funds.

Additionally, investors benefit from the expertise and resources provided by these firms’ experienced professionals. By leveraging their skills and networks, these entities strive to deliver profitable outcomes for their investors in the dynamic world of real estate investment.

How Real Estate Equity Firms Operate

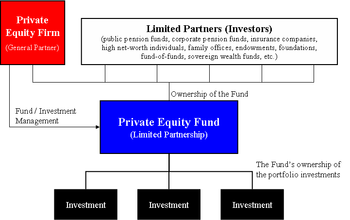

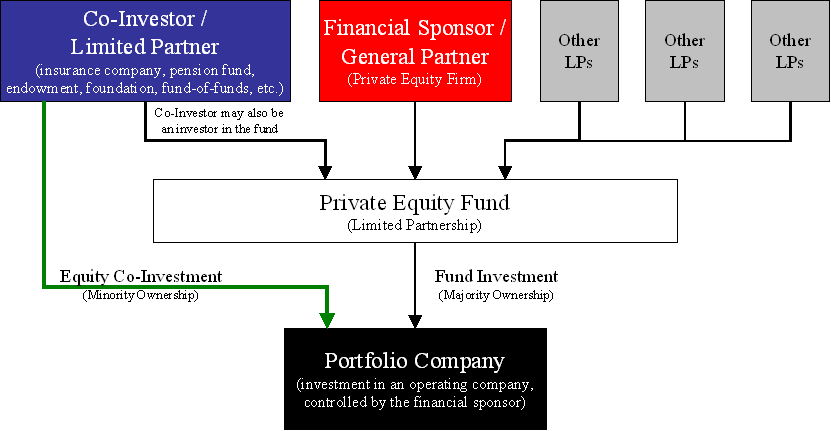

Real estate equity firms operate on a partnership model that fosters collaboration between investors and the firm itself. These firms typically consist of a general partner (GP) who manages the fund and makes crucial investment decisions, as well as limited partners (LPs) who provide the capital for these investments.

The GP plays a pivotal role in sourcing investment opportunities, conducting comprehensive evaluations, negotiating deals, managing assets, and ultimately achieving profitable exits.

The process through which real estate equity firms make investments is meticulous and strategic. They prioritize sourcing opportunities that align with their investment criteria, carefully evaluating various factors such as market conditions, property fundamentals, financial projections, and risk analysis.

Thorough due diligence processes enable them to assess potential acquisitions thoroughly and minimize risks associated with these investments.

Once investments are made, real estate equity firms actively manage properties to enhance their value. This involves implementing various strategies such as renovations, repositioning, or optimizing leasing arrangements. By proactively managing assets, these firms aim to maximize returns for both themselves and their investors.

To maintain strong performance and ensure optimal outcomes for all parties involved, real estate equity firms continually monitor market trends and adapt their strategies accordingly. They stay informed about changing regulations or economic fluctuations that may impact their investments.

By staying agile in an ever-evolving industry, these firms can navigate challenges effectively and capitalize on emerging opportunities.

In summary, real estate equity firms operate by establishing partnerships between investors and themselves. Through careful evaluation of potential acquisitions and active asset management strategies, they aim to generate attractive returns on investments while mitigating risks along the way.

Their ability to adapt to market dynamics ensures they remain successful in an industry characterized by constant change.

Examples of Successful Real Estate Equity Firms

Successful real estate equity firms have proven their ability to generate consistent returns for investors through strategic investments and effective asset management. Some notable examples include:

Americas

– Blackstone Group

– Brookfield Asset Management

– Tishman Speyer

Asia

– CapitaLand Limited

– Ascendas-Singbridge

– Keppel Capital

Europe Middle East Africa (EMEA)

– Carlyle Group

– AXA Investment Managers

– Europa Capital Partners

Notable Real Estate Investment Trusts (REITs):

– Simon Property Group

– Prologis Inc.

– Equinix Inc.

These firms have demonstrated their expertise in navigating regional markets, conducting thorough due diligence, managing risks, and capitalizing on value creation opportunities. Their success serves as inspiration for aspiring real estate equity firms seeking to establish themselves as trusted players in the industry.

Risks Associated with Investing in Real Estate Equity Firms

Investing in real estate equity firms comes with inherent risks that should not be overlooked. Market volatility can impact their performance, while illiquidity makes accessing capital challenging. Regulatory changes can also affect their operations and profitability.

Thorough research on a firm’s track record, investment strategy, and risk management practices is essential before committing funds. By understanding and addressing these risks, investors can make informed decisions aligned with their goals and risk tolerance.

How to Choose a Reliable Real Estate Equity Firm

To choose a reliable real estate equity firm, consider these key factors:

-

Track Record: Evaluate the firm’s historical performance in delivering returns to investors.

-

Expertise and Network: Assess the team’s experience, expertise, and industry connections.

-

Investment Strategy: Understand their approach to risk management and how it aligns with your goals.

-

Transparency: Look for open communication, high reporting standards, and strong governance practices.

-

Exit Strategy: Consider how they handle exiting investments and returning capital to investors.

By evaluating these factors, you can select a firm that aligns with your investment goals and risk tolerance.

Frequently Asked Questions about Real Estate Equity Firms

Real estate equity firms are not just for high-net-worth individuals; there are options for investors of various financial backgrounds. The holding period for investments in these firms varies based on the investment strategy.

Investing in multiple real estate equity firms can provide additional diversification benefits, but it’s important to evaluate each firm’s track record and investment strategy. Fees associated with investing in these firms can vary, so it’s essential to understand the fee structure before committing capital.

Stay updated on your investments by regularly receiving reports and utilizing online portals provided by the firm.

Conclusion: Is Investing with Real Estate Equity Firms Right for You?

[lyte id=’fpw4clhqdhs’]