When it comes to investing, there are a multitude of options available, each with its own unique characteristics and strategies. One such option that has gained popularity in recent years is Vers ETF Holdings. In this article, we will delve into the world of Vers ETF Holdings and explore what sets it apart from other investment options.

Overview of Vers ETF Holdings

Vers ETF Holdings is an investment company that offers exchange-traded funds (ETFs) designed to provide investors with exposure to specific markets or sectors. These funds are traded on major stock exchanges, allowing investors to buy or sell shares at market prices throughout the trading day.

Vers ETF Holdings aims to provide a diversified portfolio that aligns with investor goals and risk tolerance. Transparency is a key feature, as the company regularly publishes fund holdings, enabling informed decision-making. The liquidity of these funds provides flexibility for investors to easily convert their investments into cash when desired.

Overall, Vers ETF Holdings offers a convenient and transparent way for investors to gain broad market exposure without individually purchasing each security.

Understanding Vers ETF Holdings

Vers ETF Holdings is a crucial aspect to comprehend when delving into the world of exchange-traded funds (ETFs). This section aims to provide a comprehensive understanding of the performance and growth of Vers ETF Holdings, enabling investors to make informed decisions.

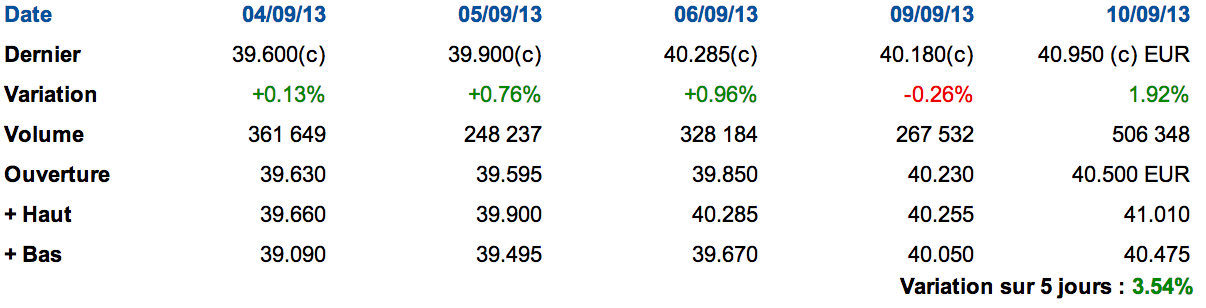

To evaluate its performance effectively, factors such as historical returns, volatility, and risk-adjusted metrics are analyzed. Historical returns gauge profit or loss over time, while volatility indicates stability and potential risks. Risk-adjusted metrics evaluate how well Vers ETF Holdings manages risk while generating returns.

Another valuable metric is tracking the growth of $10,000 invested in the fund since its inception. This analysis allows investors to assess whether Vers ETF Holdings aligns with their financial goals and has delivered consistent positive returns.

Understanding Vers ETF Holdings is paramount for investors seeking an informed approach towards investing in exchange-traded funds. By considering performance analysis, historical returns, volatility, and growth over time, investors can make well-informed decisions aligned with their financial objectives and risk appetite.

Exploring Vers ETF’s Portfolio Holdings and Exposures

Understanding the holdings and exposures of Vers ETF is vital for investors to evaluate diversification and risk. By analyzing the portfolio holdings, investors can determine if the fund aligns with their investment strategy.

Vers ETF Holdings employs various diversification and allocation strategies to manage risk and enhance returns, such as spreading investments across different sectors, asset classes, or geographic regions. Investors should assess these strategies to ensure they align with their own risk tolerance and investment preferences.

Overall, exploring Vers ETF’s portfolio holdings and exposures provides valuable insights for informed investment decisions.

The Benchmark for Vers ETF: Introduction to the Index

To accurately evaluate Vers ETF’s performance, it’s important to understand the benchmark index against which it is compared. The benchmark serves as a reference point for measuring how well the fund has done relative to a specific market or sector.

The index used by Vers ETF plays a significant role in shaping its investment strategy and overall performance. By understanding how the index is constructed, investors can gain insights into why certain securities are included in the portfolio or why certain sectors are overweighted or underweighted.

Analyzing the benchmark index helps investors assess Vers ETF’s performance and investment strategy. It allows for a comparison of returns and minimizes tracking error, ensuring consistent results. Understanding this index empowers investors to make informed decisions about including Vers ETF in their portfolios.

Performance Analysis: Evaluating Returns and Risk Management

To accurately evaluate the performance of Vers ETF Holdings, investors need to analyze returns and risk management. Historical performance metrics such as annualized returns, standard deviation, Sharpe ratio, and maximum drawdown provide insights into how well the fund has managed risk while delivering competitive returns over time.

Examining the fees and expenses associated with Vers ETF Holdings is crucial as it directly impacts investment returns. By comparing these costs to similar funds in the market, investors can ensure they are getting good value for their investment.

Assessing the correlation of Vers ETF Holdings with the overall market provides insights into how closely its performance aligns with broader market trends. This analysis helps investors understand how the fund may perform during different market conditions.

By evaluating historical performance, fees and expenses, and market correlation, investors can make informed decisions about investing in Vers ETF Holdings. This comprehensive analysis enables them to understand how well the fund has managed risks while delivering competitive returns over time.

The Future Outlook for Vers ETF Holdings

To anticipate how Vers ETF Holdings’ portfolio may be impacted in the future, investors need to consider potential market trends and opportunities. By staying informed about industry developments, they can make more informed decisions about their investment strategies.

Analyzing emerging sectors, technological advancements, regulatory changes, and global economic shifts is crucial in evaluating potential impacts on Vers ETF Holdings’ portfolio. Identifying growing industries and understanding geopolitical events can provide insights into which stocks or sectors may experience rapid growth or volatility.

Investors should also employ risk management strategies to maximize returns. Diversification across different asset classes reduces exposure to any single risk factor. Regularly rebalancing portfolios ensures alignment with long-term goals and changing market conditions.

Implementing risk management techniques such as stop-loss orders or options strategies adds protection against market downturns or adverse events.

Conclusion: Why Consider Investing in Vers ETF Holdings?

Throughout this article, we have explored the reasons to consider investing in Vers ETF Holdings. By analyzing its purpose, performance analysis, and portfolio holdings, we can understand the potential benefits it offers.

One advantage is diversification, spreading risk across various assets. Transparency is another benefit as Vers ETF Holdings discloses its portfolio holdings regularly. Additionally, liquidity allows investors to buy or sell shares at market prices throughout the trading day.

To evaluate suitability, analyzing performance metrics and understanding the holdings is crucial. By researching each component and considering industry trends, investors can anticipate how these holdings may perform.

In conclusion, Vers ETF Holdings provides diversification while aligning with investment goals and risk tolerance. The advantages of diversification, transparency, and liquidity make it a compelling investment option.

[lyte id=’ypDmnCCQ6wI’]