Private equity real estate funds are gaining popularity as a way for investors to diversify their portfolios and potentially achieve higher returns. These funds pool money from multiple investors to acquire and manage a portfolio of properties, providing access to institutional-grade real estate assets that would typically be out of reach.

By investing in private equity real estate funds, individuals can benefit from greater diversification, access investment opportunities with high costs or complexity, potentially earn attractive returns, and enjoy liquidity and flexibility.

Examples of Successful Private Equity Real Estate Funds

Private equity real estate funds have proven to be lucrative investments, delivering impressive returns for investors. Blackstone’s Real Estate Partners VIII raised over $15 billion and achieved an average annual net return of 14%. TPG Real Estate Partners III raised $3 billion with an internal rate of return exceeding 20%.

These successful funds highlight the potential for substantial returns when managed by experienced and knowledgeable professionals. Investors should carefully evaluate fund managers’ track records and expertise to capitalize on the benefits offered by private equity real estate funds.

Overview of the structure and operation of these funds

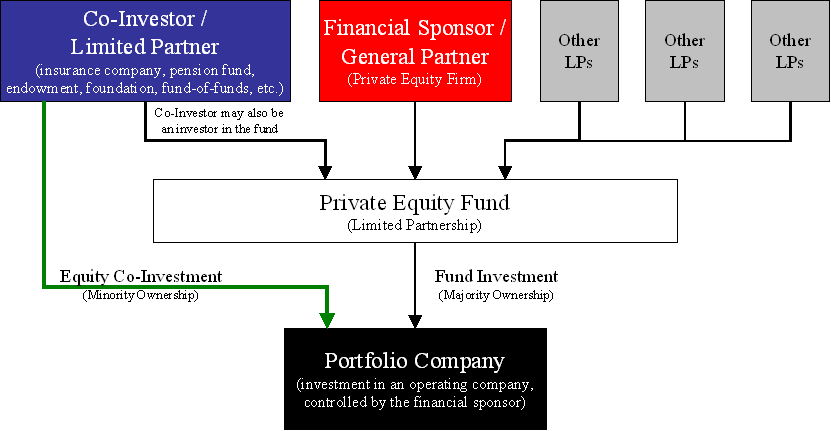

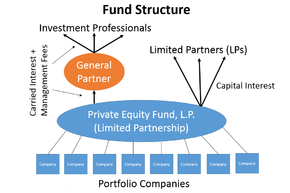

Private equity real estate funds operate as limited partnerships, with general partners managing the fund’s assets and making investment decisions. Limited partners, including individual investors, pension funds, endowments, and institutions, contribute capital in exchange for an ownership interest.

The general partners source and evaluate investment opportunities, negotiate acquisitions, manage properties, and sell them to realize profits. They charge management fees based on a percentage of the fund’s assets under management (AUM) and may receive a share of the profits from successful investments.

Limited partners benefit from diversification and access to real estate assets that would be otherwise inaccessible. These structured funds allow for professional management while mitigating risks through pooling resources. However, thorough due diligence is necessary for both general and limited partners before committing capital.

In summary, private equity real estate funds offer a structured approach to investing in real estate assets through limited partnerships led by experienced professionals. This allows individuals and institutions access to diversified portfolios with potential returns while benefiting from expert management skills.

Types of Properties Targeted by these Funds

Private equity real estate funds invest in a variety of property types based on their investment strategy. Residential properties, including single-family homes, apartments, and student housing, are commonly targeted for their potential rental income and value appreciation.

Commercial properties such as office buildings, retail centers, warehouses, and hotels offer higher returns through rental income from businesses and long-term lease agreements. Specialized funds focus on niche sectors like healthcare facilities, data centers, or self-storage facilities to capitalize on specific market trends.

By diversifying across different property types, these funds aim to generate attractive returns while managing risk effectively.

Explanation of the Investor’s Role and Benefits

Investing in private equity real estate funds offers several advantages for investors. By becoming a limited partner, you gain ownership in a portfolio of properties, potentially benefiting from their appreciation over time.

One key advantage is diversification, as pooling resources with other investors allows exposure to a diversified portfolio across different locations and property types, mitigating risk and enhancing returns.

Access to professional management is another benefit. The fund’s general partners have expertise in identifying attractive investment opportunities, negotiating favorable terms, and optimizing property performance through active management strategies.

This expertise ensures that investments align with the fund’s strategy and have long-term growth potential.

Private equity real estate funds also provide economies of scale. Pooling capital allows for larger acquisitions and cost efficiencies not achievable individually. Additionally, these funds offer increased liquidity compared to direct investments in real estate, providing periodic distributions or buyout options at predetermined intervals.

It’s important to consider the risks associated with these investments, including market volatility and illiquidity. However, overall, investing in private equity real estate funds can provide diversification, professional management expertise, economies of scale, and potential liquidity for investors seeking exposure to the real estate market.

Advantages for Investors: Diversification and Access to Professional Management

Investing in private equity real estate funds provides key advantages for investors. Diversification reduces risk by spreading investments across a portfolio of properties, resulting in more stable returns. Professional management expertise enables the identification of lucrative opportunities and successful navigation of complex transactions.

Compared to traditional investments, these funds offer higher potential returns due to real estate’s historically attractive risk-adjusted performance. Additionally, investors gain access to exclusive investment opportunities and enjoy the convenience of having professionals handle day-to-day property management tasks.

Private equity real estate funds are a compelling option for individuals seeking diversification, expert guidance, and the potential for greater financial gains.

Potential Drawbacks: Illiquidity and High Fees

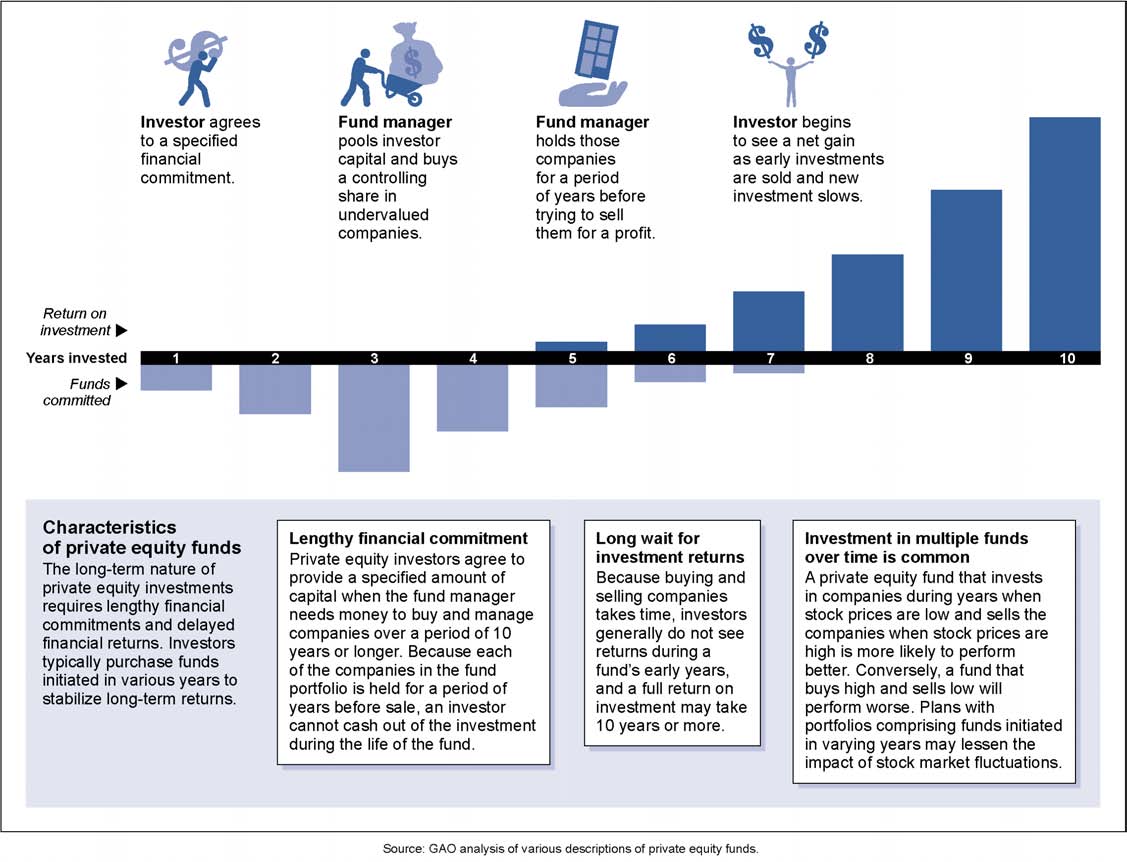

Private equity real estate funds have certain risks and drawbacks that investors should consider. One drawback is the illiquid nature of these investments, which can make it challenging to access invested capital for a specified period, often ranging from 7 to 10 years or longer.

Additionally, high fees associated with these funds, including management fees (around 1% – 2% of AUM) and performance fees (commonly 20% of profits), can significantly impact overall returns, especially if the fund underperforms.

It is crucial for investors to carefully evaluate their financial goals, liquidity needs, and the potential impacts of these factors before investing in private equity real estate funds.

Thorough due diligence, reviewing terms and conditions, and seeking professional advice can help mitigate these potential drawbacks and make informed investment decisions.

Understanding the Fund’s Strategy and Investment Thesis

Before investing in a private equity real estate fund, it’s crucial to understand the fund’s investment strategy and thesis. Different funds may have varying approaches, such as value-add investing, opportunistic investing, or core investing.

Value-add strategies focus on acquiring properties that require renovations or repositioning to increase their value. Opportunistic strategies involve taking advantage of distressed properties or market inefficiencies to generate outsized returns. Core strategies prioritize stable, income-producing properties with lower risk profiles.

By understanding the fund’s strategy and investment thesis, you can align your investment goals and risk tolerance with the appropriate fund.

[lyte id=’1bDshpbdgeQ’]