Investing has always been a complex and dynamic field, with countless variables to consider when making informed decisions. However, with the advent of artificial intelligence (AI), the investing landscape has seen significant advancements.

AI has emerged as a powerful tool that can help investors navigate through vast amounts of data, identify patterns, and make data-driven decisions. In this article, we will explore the role of AI in investing and how Crunchbase, a valuable platform for investors, leverages AI to provide insights and opportunities.

AI and its Role in the Investing World

Artificial intelligence (AI) is transforming the investing world by revolutionizing data analysis and decision-making. AI algorithms simulate human intelligence, enabling them to process vast amounts of financial data quickly and accurately.

This technology helps investors sift through data efficiently, identify investment opportunities, and make informed decisions. Tools like Crunchbase leverage AI to provide comprehensive company information, track funding rounds, and offer predictive analytics for better investment outcomes.

With AI’s ability to analyze trends and continuously improve accuracy over time, it has become an invaluable asset in the investing world.

The Growing Importance of Data-Driven Decision Making in Investments

In today’s digital age, data-driven decision making has become crucial for investment professionals. Access to accurate and reliable information is essential for informed choices. With the abundance of financial data available online, investors can now analyze vast databases using advanced algorithms to uncover valuable insights.

The sheer volume of available data, coupled with advancements in technology, allows investors to extract patterns and trends that were previously inaccessible. This wealth of information helps them make more informed decisions when it comes to allocating their capital.

Real-time insights into market trends and emerging opportunities are vital due to market volatility. AI-powered tools like Crunchbase provide up-to-date information, enabling investors to make timely and well-informed choices.

Data-driven decision making also promotes objectivity by reducing bias and relying on concrete data rather than subjective opinions. By analyzing historical performance data and industry-specific metrics, investors gain a comprehensive understanding of the market landscape.

Moreover, data analysis facilitates better risk management strategies by assessing potential downside risks associated with investments or asset classes. This enables investors to implement appropriate risk mitigation measures and adjust portfolio allocations accordingly.

Introduction to Crunchbase as a Valuable Tool for Investors

Crunchbase is a leading platform that provides comprehensive company data and insights, making it an invaluable resource for investors. With its vast database of companies and financial data, Crunchbase has become an essential tool for investors looking to gain an edge in the market.

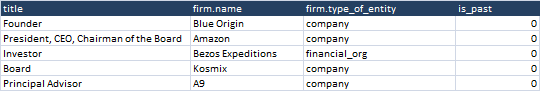

Crunchbase’s user-friendly interface allows investors to access detailed information on companies’ funding rounds, key metrics, performance indicators, and executive teams. By leveraging this data, investors can conduct thorough market research, perform due diligence on potential investments, and identify emerging trends within specific industries.

In the following sections, we will delve deeper into Crunchbase’s features and benefits for investors while exploring how AI-powered tools on the platform can enhance investment analysis.

Overview of Crunchbase’s platform and its functionalities

Crunchbase is a powerful platform that provides investors with actionable insights. It offers a vast database of company profiles, financial data, funding rounds, key personnel information, news articles, and more.

With advanced search filters, investors can target specific investment opportunities based on industry verticals, location, funding stage, revenue range, and other criteria. Personalized alerts keep users updated on new funding rounds and developments in their preferred sectors.

The user-friendly interface allows for easy navigation and engagement with the community through comments and discussions. Overall, Crunchbase empowers investors by providing the tools needed to identify promising investment opportunities and navigate the business landscape confidently.

Accessing comprehensive company information and financial data

Crunchbase, a powerful tool for investors, offers an extensive range of resources to access comprehensive company information and financial data.

With its user-friendly interface and in-depth profiles, Crunchbase empowers investors to make informed decisions by providing a wealth of information on companies’ financial health, funding history, executive teams, and more.

By utilizing Crunchbase for market research and due diligence, investors gain valuable insights into potential investment opportunities. They can analyze a company’s revenue growth over time, funding history, and competitive landscape.

This comprehensive understanding of a company’s financial trajectory allows investors to assess its potential for long-term success or possible risks.

In addition to detailed company profiles, Crunchbase also provides key metrics and performance indicators that investors can utilize to evaluate companies effectively. These metrics include revenue growth rate, employee count, valuation trends, investor activity, and more.

By analyzing these quantitative measures alongside market trends and industry dynamics, investors can gain a holistic view of a company’s potential for growth or decline.

The availability of such comprehensive data on Crunchbase enables investors to move beyond intuition-based decision-making. Instead, they can rely on quantitative analysis backed by factual information. This not only mitigates risks but also enhances their ability to identify promising investment opportunities in today’s competitive market.

Overall, accessing comprehensive company information and financial data through platforms like Crunchbase is crucial for modern-day investors seeking well-informed investment decisions.

By leveraging the power of technology and data-driven insights offered by Crunchbase, investors can navigate the complexities of the market with confidence and maximize their chances of success.

Tracking funding rounds, investment trends, and startup opportunities

Crunchbase serves as a valuable resource for tracking funding rounds, analyzing investment trends, and identifying potential startup opportunities. By monitoring the funding activities across various industries and geographies, investors gain crucial insights into the ever-evolving startup ecosystem.

By delving into the data on Crunchbase, investors can pinpoint sectors that are experiencing significant investment activity. This information allows them to align their investment strategies with emerging trends, focusing on sectors poised for growth or disruption.

Identifying these high-potential areas enables investors to make informed decisions and position themselves for successful investments.

Moreover, tracking funding rounds provides an opportunity to identify promising startups at an early stage. Startups that have recently secured substantial funding often present attractive prospects for angel investors or venture capitalists seeking high-growth opportunities.

By staying up-to-date with these developments on Crunchbase, investors can seize the advantage of being among the first to invest in these promising ventures.

Crunchbase’s extensive database of startups is a treasure trove for uncovering hidden gems that may not be widely known yet. With powerful filters and search functions at their disposal, investors can tailor their search criteria to match their investment preferences.

This feature is particularly valuable for those interested in early-stage investments or looking to diversify their portfolios. Through this comprehensive startup database, investors can discover and evaluate potential high-growth companies that align with their investment goals.

In summary, Crunchbase offers a wealth of resources for tracking funding rounds, analyzing investment trends, and identifying startup opportunities.

By leveraging this platform effectively, investors can stay ahead of market movements and make well-informed investment decisions based on real-time data and insights from the dynamic world of startups.

[lyte id=’2QzJRqgiovA’]