When it comes to investing, having access to reliable and accurate information is crucial for making informed decisions. One tool that has gained popularity among investors is the Power Gauge Chaikin. This powerful indicator combines both fundamental and technical analysis to provide a comprehensive view of a stock’s potential.

In this article, we will explore what the Power Gauge Chaikin is, how it works, and how you can effectively utilize it to enhance your investment strategy. Whether you are a seasoned investor or just starting out, understanding the Power Gauge Chaikin can help empower your investment journey.

What is the Power Gauge Chaikin and its purpose in investing

The Power Gauge Chaikin, developed by Marc Chaikin, is a powerful tool for investors. It combines fundamental analysis, which assesses a company’s financial health, with technical analysis, which analyzes historical price patterns. By considering over 20 factors, it assigns a rating to each stock based on its potential.

This helps investors quickly determine if a stock is worth further investigation or not. The Power Gauge Chaikin provides a comprehensive view of a stock’s potential and aids investors in making informed decisions.

Benefits of using the Power Gauge Chaikin for informed decision-making

The Power Gauge Chaikin simplifies complex data into an easily understandable rating system, saving investors time and effort. It considers factors like financials, earnings quality, price/volume activity, and expert opinions to provide a holistic view of a stock’s potential.

By analyzing these components, investors gain valuable insights into a company’s financial health, earnings reliability, market sentiment, and expert analysis. This comprehensive tool empowers investors to make informed decisions and increase their chances of success in the market.

The Role of Fundamental Analysis in Evaluating Stocks

Fundamental analysis is essential for evaluating stocks and guiding investment decisions. By analyzing a company’s financial statements, including revenue growth, profitability, debt levels, and cash flow, investors can assess its overall health and stability.

This analysis helps identify companies with solid foundations and higher long-term growth potential. The Power Gauge Chaikin methodology considers key fundamental factors to determine a company’s financial strength or weakness. It enables investors to make informed choices based on the company’s fundamentals.

Ultimately, fundamental analysis plays a crucial role in stock evaluation and identifying promising investment opportunities.

Exploring Technical Analysis and Its Importance in Stock Evaluation

Technical analysis complements fundamental analysis by examining historical price patterns and trends to evaluate stocks. It helps investors understand market sentiment, identify entry and exit points, and predict potential price movements.

The Power Gauge Chaikin algorithm incorporates technical indicators like moving averages, volume trends, relative strength, and price/volume activity. By considering both fundamental and technical insights, investors can make more informed decisions when evaluating stocks.

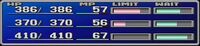

Assessing overall potential with the Power Gauge Rating

The Power Gauge Rating is a crucial part of the Power Gauge Chaikin system, providing an overview of a stock’s potential by considering all available information. A very bullish rating suggests strong positive signals across multiple factors, indicating potential outperformance in the near future.

Conversely, a very bearish rating highlights significant negative signals, urging caution or avoidance. Investors can use this rating as an initial filter to focus on stocks with higher potential for favorable returns. However, it’s essential to conduct thorough research before making investment decisions.

The Power Gauge Rating serves as a valuable tool in identifying stocks worth exploring further based on their overall potential.

Analyzing individual components: Financials and earnings quality

To truly evaluate the potential of a stock, it’s vital to dig deeper than just an overall rating. The Power Gauge Chaikin goes beyond that by analyzing individual components such as financials and earnings quality.

By assessing factors like revenue growth, earnings stability, debt levels, accruals, cash flow, and profit margins, investors gain valuable insights into a company’s financial health and its ability to generate consistent profits.

This comprehensive analysis helps investors make informed decisions based on a deeper understanding of the underlying factors driving a stock’s performance.

Identifying Undervalued Stocks with Growth Potential

Using the Power Gauge Chaikin, an investor successfully identified undervalued stocks with strong growth potential. By focusing on bullish ratings, positive signals in earnings quality and price/volume activity, they discovered hidden gems overlooked by the market.

These stocks eventually experienced significant price appreciation as their true value was recognized. This case study highlights how the Power Gauge Chaikin helps investors uncover missed opportunities and make informed investment decisions.

Avoiding Risky Investments through a Cautious Approach

A case study demonstrates how investors can effectively avoid risky investments by utilizing the Power Gauge Chaikin as a risk management tool.

By paying attention to very bearish ratings and negative signals in areas like financials and expert opinions, investors can steer clear of companies facing financial difficulties or operating in declining industries.

This cautious approach helps protect capital from potential losses and allows investors to focus on more promising investment opportunities. The Power Gauge Chaikin acts as a valuable tool for evaluating risks and making informed decisions based on data-driven insights.

By adopting this approach, investors can enhance their chances of achieving long-term profitability while minimizing potential risks in the market.

[lyte id=’p1F0p3ASDeE’]