The Internet of Things (IoT) has revolutionized the way we interact with technology, connecting devices and enabling seamless communication. As this transformative technology continues to grow, it presents exciting opportunities for investors to capitalize on its potential.

But with so many investment options available, how do you navigate this complex landscape? Enter ETFs (Exchange-Traded Funds), your best friend in IoT investing.

In this article, we will explore the world of IoT investing and how ETFs can help you tap into this rapidly expanding market. We’ll examine the significance of IoT, discuss the growing opportunities it presents, analyze key players in the industry, and delve into specific IoT-focused ETFs worth considering.

So let’s dive in!

Understanding the Internet of Things (IoT)

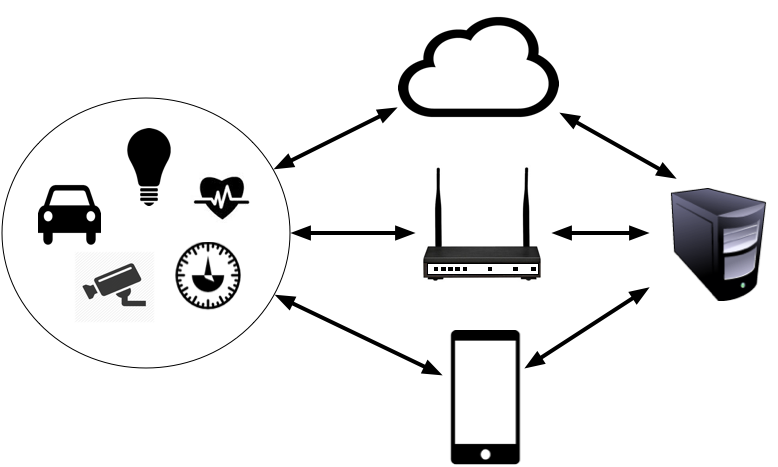

The Internet of Things (IoT) is a network of interconnected devices embedded with sensors, software, and connectivity capabilities. This technology has transformed industries by enhancing efficiency and convenience.

Examples include alarms adjusting based on sleep patterns, smart cars notifying about traffic conditions, and smart thermostats optimizing energy consumption. The possibilities are endless, making IoT a booming market with significant investment potential.

Its impact is evident in our everyday lives, reshaping how we interact with technology across various domains.

The Growing Opportunities in IoT Investing

The Internet of Things (IoT) market is booming, with over 41 billion connected devices projected by 2025. This growth opens up investment opportunities in sectors like healthcare, energy, transportation, and manufacturing. Investing in IoT allows access to advancements such as smart cities and precision agriculture.

To capture this growth efficiently, Exchange-Traded Funds (ETFs) offer diversification without the need for individual stock selection. ETFs reduce risk and provide exposure to multiple companies benefiting from IoT advancements across sensor technology, cloud computing, data analytics, and cybersecurity.

With immense potential for growth and disruption, investing in ETFs focused on IoT is a smart choice for investors.

Introducing ETFs: An Investor’s Best Friend

Exchange-Traded Funds (ETFs) have become a popular choice for investors due to their ability to track specific indexes or sectors. These funds hold a diversified portfolio of assets like stocks, bonds, or commodities, providing easy access to various markets through a single investment.

Unlike mutual funds, ETFs trade throughout the day on stock exchanges at market prices, offering flexibility for investors.

There are several advantages to investing in ETFs. Firstly, they provide instant diversification by investing in multiple companies within a sector, reducing the risk of relying on a single company’s performance. Secondly, ETFs offer transparency by regularly disclosing their holdings, allowing investors to analyze and make informed decisions.

Moreover, ETFs generally have lower expense ratios compared to mutual funds, making them cost-effective.

In the next section, we will explore specific IoT-focused ETF options available in the market today and discuss their features and benefits for investors.

Enter the World of IoT ETFs

With the increasing demand for IoT investments, a growing number of Exchange-Traded Funds (ETFs) have emerged in this sector. These specialized funds offer investors exposure to companies at various stages of development within the IoT ecosystem.

IoT-focused ETFs are designed to capture growth opportunities by investing in companies involved in areas such as connectivity infrastructure, hardware manufacturing, software development, and data analytics.

By diversifying their holdings across these sectors, these funds provide investors with a chance to tap into the potential of this rapidly expanding industry.

When considering an IoT-focused ETF for your portfolio, it’s crucial to evaluate several factors. Expense ratios, liquidity, performance history, and underlying holdings all play significant roles in determining the suitability of a particular fund.

Among the popular options worth considering are:

- Global X Internet of Things ETF (SNSR): SNSR seeks to track the Indxx Global Internet of Things Thematic Index and provides exposure to companies actively involved in creating and implementing IoT technology.

- First Trust Nasdaq Cybersecurity ETF (CIBR): While not explicitly focused on IoT, CIBR invests in companies engaged in cybersecurity solutions that play a crucial role in securing connected devices and networks.

- ARK Autonomous Technology & Robotics ETF (ARKQ): ARKQ aims to capture growth across multiple disruptive technologies including IoT, robotics, and automation.

These examples represent just a fraction of the available ETFs catering to different investment objectives within the IoT space. As you explore further, you’ll discover more options that align with your investment goals.

Now let’s delve deeper into the leading companies driving IoT innovation and uncover the exciting investment opportunities they present.

Examining Key Players in the IoT Market

Leading companies like Amazon, Google, Microsoft, and Intel are driving innovation in the IoT market. Amazon’s Echo devices with virtual assistant Alexa dominate the smart home sector, while Google’s Nest products offer intelligent home automation solutions.

Microsoft’s Azure cloud platform supports scalable IoT deployments, and Intel provides hardware components for connected devices. Investing in these industry leaders can provide exposure to the broader IoT market, but it’s important to evaluate their business models and competitive advantages.

Additionally, smaller players focused solely on IoT present exciting investment opportunities in niche areas such as industrial IoT or healthcare applications. In the next section, we’ll discuss potential risks associated with investing in emerging technologies like IoT and strategies to mitigate them.

Risks and Challenges in Investing in IoT ETFs

Investing in IoT exchange-traded funds (ETFs) comes with risks and challenges. The fast-paced nature of IoT technology brings technological uncertainty, as advancements can be unpredictable. Regulatory hurdles add uncertainties due to the rapidly changing landscape. Moreover, the interconnected nature of IoT devices increases cybersecurity threats.

To mitigate these risks, diversify investments across multiple companies within the sector. Conduct thorough research on individual companies held by an ETF to understand their financial health and growth potential.

Stay informed about industry trends, regulatory developments, and technological advancements to make well-informed investment decisions. By addressing these challenges, investors can navigate the dynamic world of IoT investing more effectively.

Choosing the Right IoT ETF for Your Portfolio

When it comes to investing in the Internet of Things (IoT), Exchange-Traded Funds (ETFs) can be an attractive option for diversifying your portfolio. These investment vehicles provide exposure to a basket of companies that are at the forefront of IoT innovation.

However, not all IoT ETFs are created equal, and it’s essential to choose the right one for your investment goals.

There are several factors to consider when selecting an ETF focused on IoT. Firstly, you should examine the expense ratio. Comparing expense ratios among different funds is crucial since lower expenses can have a significant impact on long-term returns. By minimizing fees, you have the potential to maximize your overall gains.

Liquidity is another important consideration. It’s essential to look for ETFs with higher trading volumes and narrower bid-ask spreads. This ensures ease of buying or selling shares without incurring significant price discrepancies. Higher liquidity provides flexibility and allows you to enter or exit positions more efficiently.

Analyzing a fund’s performance history relative to its benchmark index is also vital. Although past performance doesn’t guarantee future results, it offers insights into how a fund has performed during various market conditions.

By evaluating historical performance over different time periods, you can assess whether the ETF has consistently outperformed or lagged behind its benchmark.

By considering these factors – expense ratio, liquidity, and performance history – you can make a more informed decision when choosing an IoT ETF for your portfolio. It’s important to remember that investing involves risk and thorough research is necessary before making any investment decisions.

In the next section, we will delve into specific IoT ETFs worth considering for inclusion in your investment portfolio.

Diving Into Specific IoT ETFs Worth Considering

When it comes to investing in the Internet of Things (IoT) sector, specific Exchange-Traded Funds (ETFs) offer a convenient way to gain exposure to a diverse range of companies involved in this emerging industry. Here are a few top-performing and popular IoT ETFs worth considering:

- Global X Internet of Things ETF (SNSR): Provides exposure to companies generating significant revenue from the IoT industry, focusing on areas like semiconductor manufacturing, connectivity infrastructure, and data analytics.

- First Trust Nasdaq Cybersecurity ETF (CIBR): Invests in cybersecurity companies addressing challenges arising from increased interconnectedness through IoT devices.

- ARK Autonomous Technology & Robotics ETF (ARKQ): Offers exposure to multiple disruptive technologies intersecting with IoT, including autonomous vehicles, robotics, energy storage, and 3D printing.

Each of these ETFs follows a unique investment strategy catering to different aspects of the broad IoT theme. SNSR targets growth opportunities within semiconductor manufacturing, connectivity infrastructure, and data analytics.

CIBR focuses on cybersecurity solutions for IoT devices, while ARKQ captures growth across sectors like autonomous vehicles and robotics that integrate IoT technology.

By understanding the composition and investment strategies of these ETFs, investors can make informed decisions aligned with their goals and risk tolerance. It’s important to conduct thorough research and consult with a financial advisor before making any investment decisions.

[lyte id=’zbMFjCOSnXU’]