Welcome to the world of day trading, where buying and selling stocks within a single trading day can lead to lucrative profits. If you’re already familiar with the basics of investing, day trading offers an exciting opportunity to capitalize on short-term market fluctuations.

In this article, we will explore the key factors to consider when choosing day trading stocks, as well as strategies and risk management techniques that can help you succeed in this fast-paced arena.

What Is Day Trading?

Day trading involves buying and selling financial instruments, such as stocks, within the same trading day. Unlike long-term investors, day traders aim to take advantage of short-term price movements to make quick profits.

By analyzing market trends and using technical indicators, day traders can enter and exit positions within hours or even minutes. This strategy offers potential for high returns but also carries risks, such as higher transaction costs and the need for strong analytical skills and risk management strategies.

Overall, day trading requires expertise and constant monitoring of market conditions to succeed in this fast-paced environment.

How to Choose Day Trading Stocks

When day trading, selecting the right stocks is crucial for success. Thorough research and analysis are key to making informed decisions. Consider the following factors:

-

Volatility: Look for stocks with significant price movements throughout the trading session. Higher volatility provides more opportunities for profitable trades.

-

Liquidity: Focus on stocks with high average daily volume for better liquidity. This ensures easy buying or selling without impacting the stock price significantly.

-

Sector Performance: Consider the overall performance of the sector or industry in which a stock operates. Strong sector performance can drive up individual stock prices.

By carefully considering these factors and conducting thorough research, you can improve your chances of choosing profitable day trading stocks.

Beta: Assessing Risk in Day Trading Stocks

Day traders need to assess the risk associated with stocks they trade. One way to do this is by analyzing a stock’s beta, which measures its price volatility compared to the broader market. A beta greater than 1 indicates higher volatility, while a beta less than 1 suggests lower volatility.

Higher-beta stocks offer greater profit potential but also carry increased risk, while lower-beta stocks may be more stable but offer limited profit opportunities. Understanding a stock’s beta helps day traders align their trading strategy with their risk tolerance level and make informed decisions.

Volume: Identifying Liquidity in Day Trading Stocks

Volume is a key factor in day trading, indicating the level of liquidity and potential trading opportunities. It refers to the number of shares traded within a specific time period, like one trading day. High-volume stocks are preferred by day traders due to their increased liquidity, allowing for quick execution of trades at desired prices.

When there is significant buying or selling pressure indicated by high volume, it reflects market interest and increases the likelihood of profitable trading opportunities. Monitoring volume patterns helps day traders gain insights into market dynamics and identify important news or events that could impact stock prices.

By analyzing both absolute and relative volume, as well as the relationship between volume and price movements, day traders can make informed decisions and increase their chances of success in day trading.

Price Range: Capitalizing on Volatility in Day Trading Stocks

The price range in day trading stocks reflects the difference between a stock’s highest and lowest prices during a given trading period. Day traders often seek stocks with wide price ranges as they provide potential profit opportunities.

By identifying stocks that regularly experience significant intraday price movements, traders can enter and exit positions at advantageous price levels, maximizing their potential profits. It’s important to consider factors like liquidity and trading volume when selecting stocks to ensure sufficient market activity.

Overall, understanding and capitalizing on the price range is crucial for successful day trading.

Top Strategies for Successful Day Trading

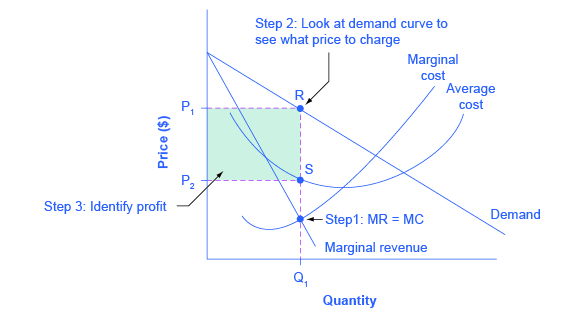

Day trading requires effective strategies to navigate the fast-paced market. Technical analysis tools like moving averages and the Relative Strength Index (RSI) help identify entry and exit points.

Moving averages smooth price fluctuations, while golden crosses (short-term crossing above long-term) and death crosses (short-term crossing below long-term) indicate buy or sell signals. RSI measures price movement speed and change to identify overbought or oversold conditions.

Price action strategies based on chart patterns are also crucial. Support and resistance levels indicate areas where a stock struggles to move past or finds support during declines. Breakouts occur when a stock’s price surpasses resistance, suggesting upward momentum.

Combining technical indicators with an understanding of chart patterns allows day traders to make informed decisions.

Successful day trading involves mastering these strategies, continuously learning, and adapting to changing market conditions. By employing these techniques, traders can increase their chances of success in the dynamic world of day trading.

Risk Management in Day Trading Stocks

Setting stop-loss orders is crucial for effective risk management in day trading stocks. These orders automatically sell a stock if it moves against your position beyond a predetermined level. By aligning stop-loss levels with your risk tolerance and considering stock volatility, you can protect your capital and prevent significant losses.

Analyze historical data, monitor market conditions, and adjust stop-loss orders accordingly to optimize risk management strategies. Incorporating these techniques enhances the chances of success in day trading stocks.

Resources for Learning Day Trading Strategies

To become a successful day trader, it’s essential to have access to resources that can help you improve your skills. Recommended books like “A Beginner’s Guide to Day Trading Online” by Toni Turner and “Technical Analysis of the Financial Markets” by John J. Murphy provide valuable insights into strategies and techniques.

Online courses and mentorship programs offer hands-on guidance and support. Continuous learning and staying updated with market trends are crucial in day trading as the financial markets constantly evolve. By utilizing these resources, you can gain the knowledge needed to make informed decisions and maintain a competitive edge.

[lyte id=’Wk-h2CwEH5k’]