Investing in the stock market can be a daunting task, especially for those new to the world of finance. With countless strategies and approaches available, it’s crucial to find one that aligns with your goals and risk tolerance. One strategy that has gained significant attention and proven success is the Chuck Hughes trader strategy.

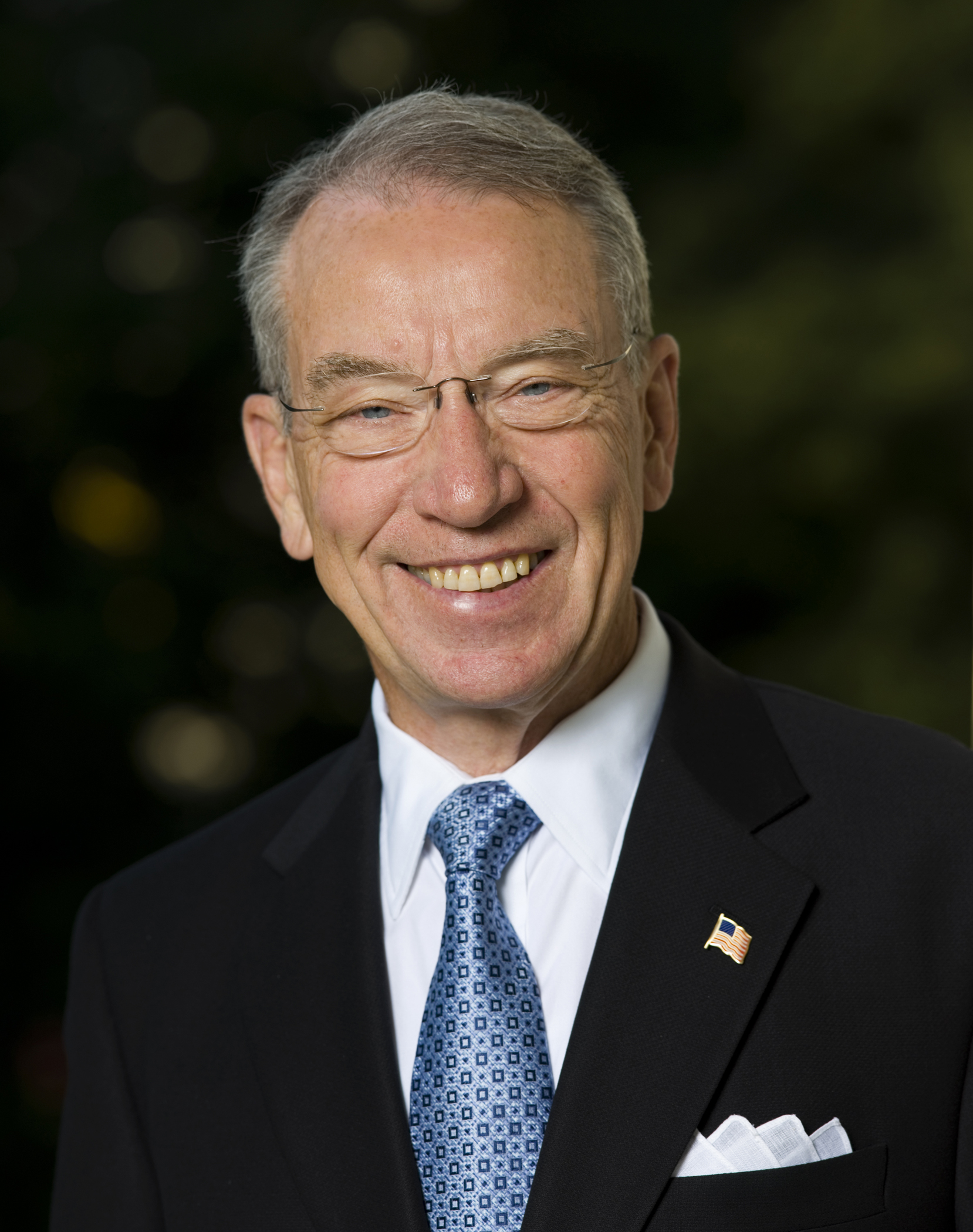

Who is Chuck Hughes?

Chuck Hughes is a renowned trader, author, and financial educator with over 30 years of experience. He has dedicated his career to helping individuals achieve financial success through investing.

Hughes’ impressive track record includes winning eight times in the prestigious World Trading Championship, showcasing his ability to generate consistent profits in both bull and bear markets.

As an author and financial educator, he shares his expertise through books and educational materials, empowering others to navigate the complexities of the market confidently. With a focus on careful analysis and risk management, Hughes’ approach to investing has proven to be successful.

Beyond his accomplishments in trading, he is also actively involved in philanthropy, supporting charitable organizations focused on education and healthcare. Overall, Chuck Hughes’ extensive experience and passion for educating others make him a trusted authority in the world of investing.

The Philosophy behind Chuck Hughes’ Trading Strategy

Chuck Hughes’ trading strategy is built upon a solid foundation of key principles that have proven to be successful in the world of investing. By understanding the importance of having a strategy, prioritizing risk management, and utilizing technical analysis, Hughes has been able to consistently achieve positive results in his trades.

Having a well-defined trading strategy is crucial according to Hughes. Without a clear plan in place, investors are prone to making emotional decisions or impulsive trades that can lead to poor outcomes. By establishing a strategy, investors are able to minimize these pitfalls and provide themselves with structure and discipline.

Risk management is another fundamental aspect of Hughes’ strategy. Instead of solely focusing on profit potential, he places great emphasis on limiting losses. By implementing proper risk management techniques such as position sizing and stop-loss orders, investors can protect their capital and increase their chances of achieving long-term success.

Hughes heavily relies on technical analysis to identify profitable trade setups. He utilizes various indicators including moving averages, MACD (Moving Average Convergence Divergence), and RSI (Relative Strength Index) to time his entries and exits effectively.

Technical analysis provides valuable insights into market trends, patterns, and momentum, enabling informed decision-making.

By combining these elements together – a well-defined strategy, effective risk management techniques, and utilization of technical analysis – Chuck Hughes has developed a robust trading philosophy that has yielded consistent positive results over time.

This approach allows him to navigate the ever-changing landscape of financial markets with confidence while minimizing potential risks.

In summary, Chuck Hughes’ trading strategy is grounded in recognizing the significance of having a clear plan in place while prioritizing risk management and relying on technical analysis for decision-making. By adhering to these principles consistently, investors can increase their chances of achieving success in the challenging world of trading.

The Core Principles of Chuck Hughes’ Trading Strategy

Chuck Hughes has developed a trading strategy centered around a set of core principles that have proven to be highly effective in navigating the financial markets. These principles provide a framework for identifying high-probability trade setups and maximizing returns while effectively managing risks.

One key aspect of Hughes’ strategy is his ability to identify high-probability trade setups. In order to accomplish this, he meticulously explores various chart patterns and trends that can indicate profitable opportunities. Whether it’s a breakout pattern or a trend reversal, Hughes actively seeks out situations where the odds are in his favor.

By understanding these patterns, he gains the confidence needed to enter trades with conviction and capitalize on their profit potential.

Another critical element of Hughes’ strategy involves leveraging options trading to enhance returns while simultaneously mitigating risks. Options provide investors with the ability to control sizable positions with relatively small amounts of capital, amplifying their profit potential.

However, options also come with inherent risks, which is why Hughes places great emphasis on educating traders about the fundamentals of options trading.

By teaching concepts such as calls, puts, and spreads, Hughes equips traders with the knowledge they need to navigate this complex market effectively. Incorporating options into his approach allows him to generate consistent income streams while simultaneously reducing downside risk.

In summary, Chuck Hughes’ trading strategy revolves around two core principles: identifying high-probability trade setups and utilizing options trading to maximize returns while limiting risks.

Through his expertise in chart analysis and understanding of options strategies, Hughes has built a successful approach that enables traders to navigate the markets with confidence and potentially achieve significant profits.

Key Tools and Techniques Used by Chuck Hughes

Chuck Hughes utilizes option spread strategies and technical indicators to enhance his trading strategy.

Hughes employs various option spread strategies, such as vertical spreads, credit spreads, and iron condors. These strategies generate consistent income while effectively managing risk. Traders can tailor their actions based on individual goals, as each spread has its own risk-reward profile.

Technical indicators play a vital role in Hughes’ strategy for timing entries and exits accurately. Moving averages identify trends, while MACD and RSI provide insights into market momentum and overbought/oversold conditions. Interpreting signals from these indicators enhances trading decisions.

By utilizing option spread strategies and technical indicators, Chuck Hughes maximizes income generation while minimizing risk in his trading activities.

Examples of Successful Trades using Chuck Hughes’ Strategy

Chuck Hughes’ strategy combines technical analysis and options trading techniques to identify profitable opportunities. By carefully selecting stocks with strong upward momentum and increasing volume, Hughes maximizes the potential for sustained growth.

He enters trades at key support levels during pullbacks within the uptrend, minimizing risk while optimizing returns. Through options trading, he sets profit targets and manages risk effectively.

This systematic approach has consistently yielded positive results, making Hughes’ strategy a valuable resource for traders seeking success in dynamic markets.

Common Pitfalls to Avoid when Implementing the Chuck Hughes’ Strategy

Implementing Chuck Hughes’ trading strategy can lead to success, but it’s important to be aware of potential pitfalls. Recognize that no strategy is foolproof and losses can occur even with a robust approach. Diversify knowledge and explore other strategies to gain a comprehensive understanding of market dynamics.

Tailor the strategy to your goals and risk tolerance levels for optimal results. By staying informed, adaptable, and aligned with your objectives, you can enhance your chances of success in the market.

Tips for Incorporating Chuck Hughes’ Strategy into Your Own Trading

To effectively incorporate Chuck Hughes’ strategy into your trading, consider the following tips:

-

Start with paper trading or small positions to practice without risking significant capital and gain confidence.

-

Keep a trading journal to track progress, document trades, and learn from mistakes, helping you identify patterns and areas for improvement.

-

Join a community or mentoring program for support and guidance, allowing you to interact with like-minded individuals and continuously learn from shared experiences.

By following these tips, you can enhance your trading skills and successfully implement Chuck Hughes’ strategy into your own trading approach.

Conclusion

[lyte id=’Y1sBy_jkuV4′]

.jpg)