Marc Chaikin, a renowned figure in the investing world, transitioned from a successful career on Wall Street to becoming an entrepreneur. With over 50 years of experience in finance, Chaikin honed his skills at prestigious firms like Merrill Lynch and Morgan Stanley.

He developed a deep understanding of investment strategies and market dynamics during this time. In 2009, he founded Chaikin Analytics, aiming to democratize access to institutional-grade analytics for all investors.

Today, his platform offers comprehensive tools that combine technical analysis with fundamental research, revolutionizing the way individuals approach investing. Chaikin’s journey showcases his determination to challenge norms and empower investors through innovative solutions.

Marc Chaikin’s Passion for Investing and Analyzing the Markets

Throughout his illustrious career, Marc Chaikin has consistently demonstrated an unwavering passion for investing and analyzing the intricacies of the financial markets. His relentless pursuit of knowledge and understanding has propelled him to become a renowned figure in the investment industry.

Chaikin firmly believes that successful investing is not merely a matter of chance but rather requires a comprehensive understanding of both fundamental and technical analysis. With an insatiable curiosity, he constantly seeks to uncover new insights that can provide investors with a competitive edge.

Driven by his dedication to innovation, Chaikin has developed groundbreaking approaches to analyzing investment opportunities. Recognizing the crucial role that data-driven insights play in making informed investment decisions, he pioneered the creation of his own company, Chaikin Analytics.

Through Chaikin Analytics, investors are provided with cutting-edge tools and resources that empower them to make well-informed choices. By harnessing the power of data and sophisticated analytics, Chaikin enables investors to navigate complex market conditions with confidence.

Chaikin’s passion for investing extends beyond personal gain; he is driven by a genuine desire to help others achieve financial success. Through his extensive knowledge and expertise, he actively shares his insights through speaking engagements and educational materials, aiming to empower individuals to take control of their financial future.

The Creation of Chaikin Analytics: Empowering Investors with Data-Driven Insights

In 2009, Marc Chaikin founded Chaikin Analytics to empower investors with data-driven insights. The company offers a comprehensive platform that combines fundamental and technical analysis with powerful algorithms. This approach allows investors to make informed decisions based on objective data, rather than emotions or speculation.

With real-time market intelligence and customizable features, Chaikin Analytics levels the playing field for all investors, providing them with the tools they need to navigate the markets confidently.

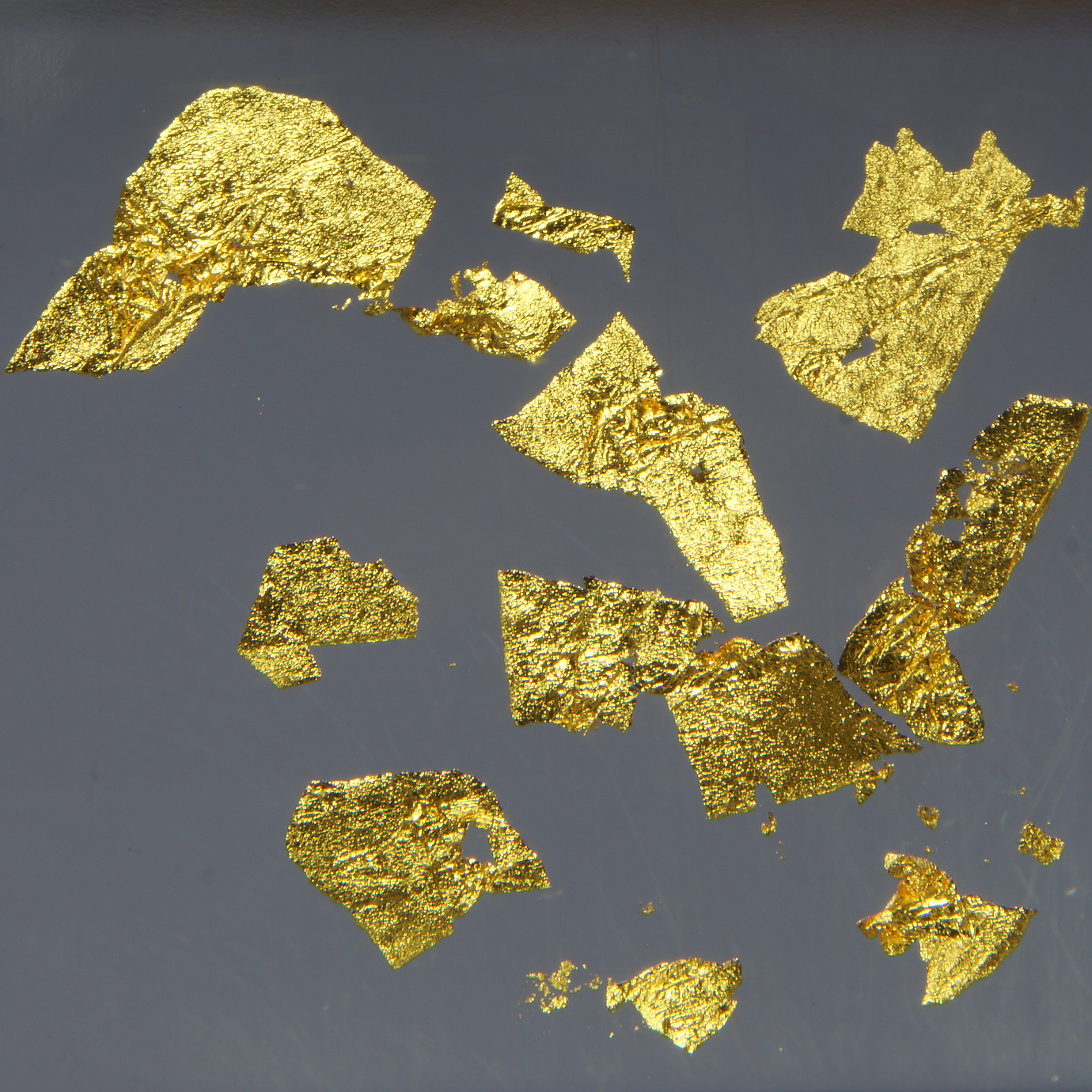

The Historical Significance and Value of Gold

Gold’s historical significance stems from its scarcity, durability, aesthetic appeal, and ability to retain value over time. Throughout civilizations, gold has been treasured for its limited supply and enduring nature. Its radiant shine and warm hue have made it a popular choice for expressing wealth and spirituality.

In times of economic uncertainty, gold has proven itself as a reliable store of wealth. Overall, gold’s historical importance lies in its exceptional qualities that have captivated humanity for centuries.

Reasons for Investing in Gold: Hedging against Inflation and Economic Uncertainty

Investing in gold offers multiple benefits. One key advantage is its ability to act as a hedge against inflation. While traditional currencies can lose value, gold tends to hold or appreciate its value during inflationary periods. This makes it an attractive option for protecting purchasing power.

Gold is also seen as a safe haven during economic uncertainty. When stock markets are volatile or geopolitical tensions rise, investors turn to gold for stability and diversification. Its historical significance as a symbol of wealth further adds to its appeal.

Additionally, investing in gold provides portfolio diversification benefits by reducing risk through asset class spreading. Gold’s performance is often independent of other assets like stocks or bonds, providing protection against market volatility.

However, investing in gold requires understanding market dynamics influenced by factors such as supply and demand, geopolitical events, and central bank policies. Being informed about these factors is crucial for making informed investment decisions.

In summary, investing in gold acts as a hedge against inflation and offers stability during economic uncertainty. Its historical significance, portfolio diversification benefits, and resistance to market volatility make it an appealing asset for long-term wealth preservation.

Diversifying Your Portfolio with Gold: Balancing Risk and Reward

Diversification is essential for a well-rounded investment portfolio, and including gold can help balance risk and reward. Gold has historically exhibited low correlation with other assets, reducing overall portfolio risk. Its stability during economic turmoil and ability to act as a hedge against inflation make it an attractive option.

Whether investing directly in physical gold or through gold-focused funds, incorporating this precious metal can provide stability and potential returns.

Applying Data Science to Understand Market Dynamics in the Precious Metal Market

Data science is revolutionizing the way we understand market dynamics, particularly in the precious metal market. Marc Chaikin, through his innovative approach and cutting-edge algorithms, uncovers hidden patterns and correlations that traditional analysis methods may overlook.

By applying data science techniques to historical market data, Chaikin Analytics provides investors with valuable insights into the factors driving gold prices. This data-driven approach empowers investors to make more informed decisions and navigate the complexities of the precious metal market with confidence.

How Marc Chaikin’s Proprietary Algorithm Works: Uncovering Hidden Patterns in Gold Prices

Marc Chaikin’s proprietary algorithm combines fundamental and technical analysis to uncover hidden patterns in gold prices. By considering factors such as supply and demand dynamics, economic indicators, and market sentiment, the algorithm provides real-time insights into the forces influencing gold prices.

This helps investors make informed decisions and seize profitable opportunities. The algorithm evaluates economic indicators, historical price data, and market sentiment to identify patterns and trends. With its advanced capabilities, it offers a comprehensive framework for understanding and navigating the volatile gold market.

[lyte id=’rOChU2rxf1s’]