Investing in the stock market is an ever-evolving game, with new sectors constantly emerging as potential opportunities for investors. One such sector that has gained significant traction in recent years is the electric vehicle (EV) industry.

As the world looks to transition towards more sustainable transportation options, the demand for EVs has skyrocketed. And powering these vehicles are lithium batteries, making lithium EV stocks a hot commodity in the investment world.

Introduction to the Growing Popularity of Electric Vehicles (EVs)

Electric vehicles (EVs) are rapidly gaining popularity worldwide due to their lower carbon emissions and potential cost savings on fuel. Governments have been incentivizing their adoption through initiatives and subsidies, while major automakers are investing heavily in developing EV models to meet the growing demand.

This shift towards cleaner and more sustainable transportation options is revolutionizing the automotive industry and driving advancements in charging infrastructure. With continued advancements in technology and increasing accessibility, electric vehicles are poised to play a significant role in shaping the future of transportation.

Importance of Lithium Batteries in Powering EVs

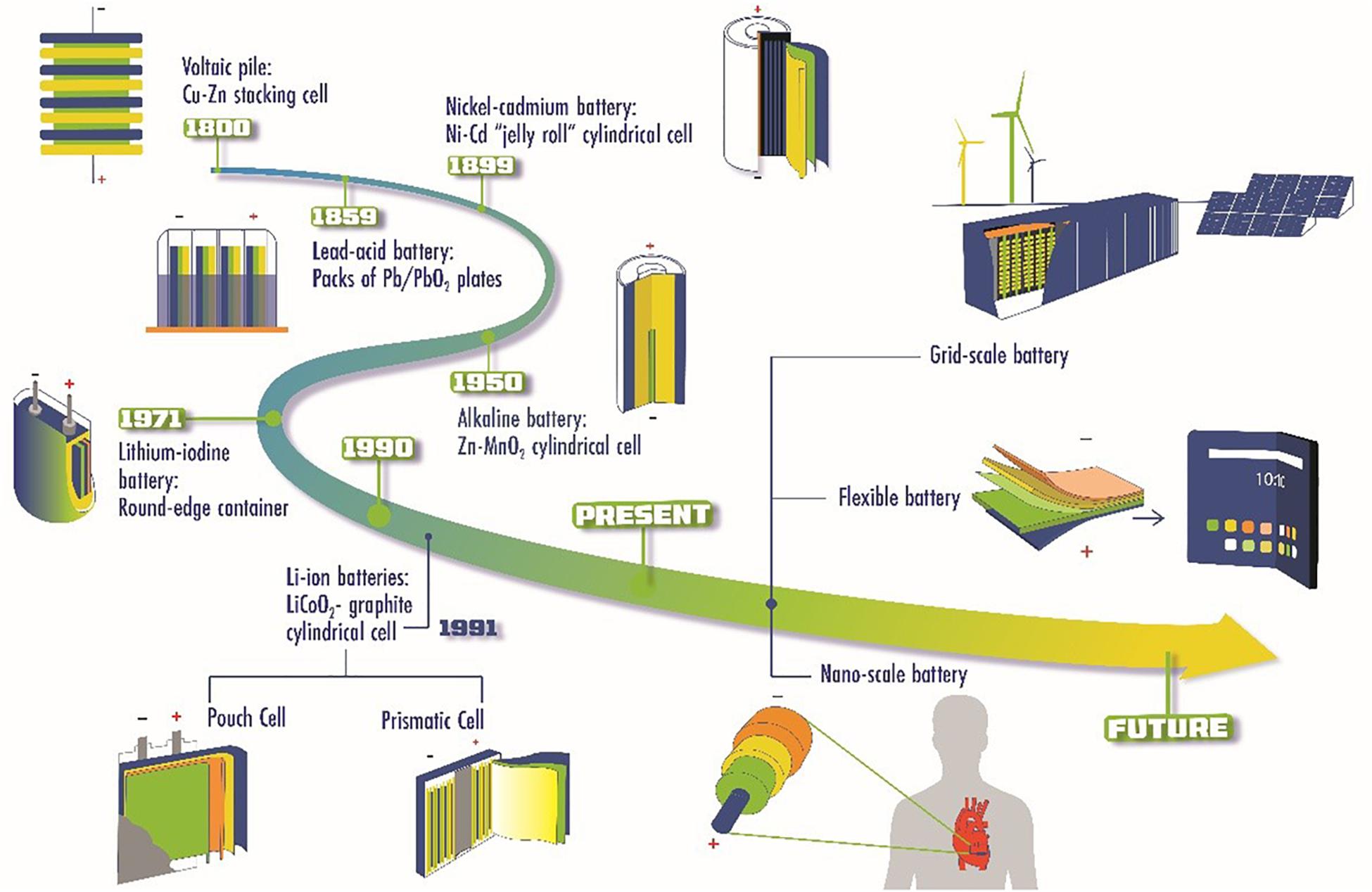

Lithium-ion batteries are vital for electric vehicles (EVs) due to their high energy density and long lifespan. These batteries outperform alternatives, maximizing the range and efficiency of EVs. With a compact size and powerful performance, lithium-ion batteries store more energy, enabling EVs to go further on a single charge.

Their quick recharge capability reduces downtime for users. Furthermore, these batteries offer enhanced safety features and ongoing advancements that promise more affordable EVs with increased driving ranges. Lithium batteries are key in unlocking the full potential of sustainable transportation.

Exploring the Surge in Demand for Lithium Batteries

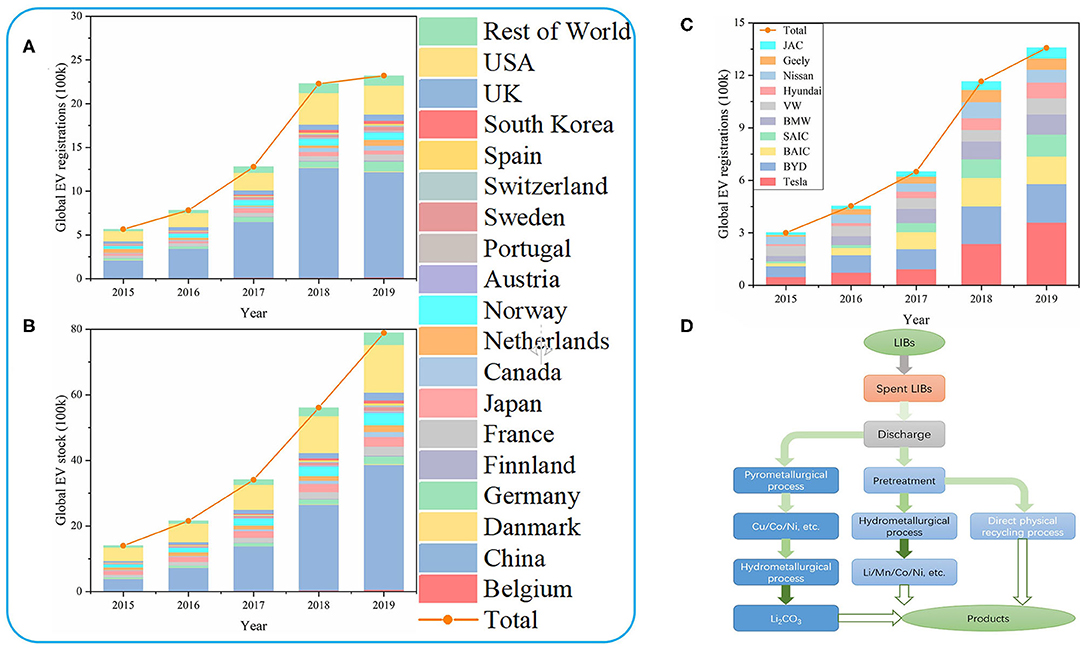

The global demand for electric vehicles (EVs) has driven a significant increase in the need for lithium batteries. Research predicts that by 2025, EV sales will reach 10 million units, necessitating a substantial boost in lithium battery production capacity.

Lithium-ion batteries are essential for powering EVs due to their high energy density and long-lasting performance. They enable efficient energy storage and release, making them ideal for electric transportation.

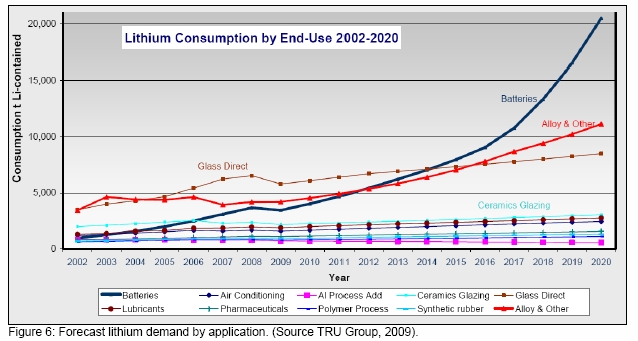

In addition to the automotive industry, lithium batteries are crucial for large-scale energy storage from renewable sources like solar and wind power. They store excess energy during peak periods and ensure a stable supply of clean electricity.

To meet this rising demand, manufacturers are investing in expanding lithium battery production worldwide. This involves constructing new factories and employing advanced manufacturing techniques to streamline production and reduce costs.

Overview of Lithium and its Characteristics

Lithium is a soft, silver-white metal with remarkable conductivity and lightness. Its high reactivity allows for storing large amounts of energy within its atomic structure, making it ideal for use in rechargeable batteries found in electric vehicles (EVs) and portable electronic devices.

The increasing demand for EVs globally has driven the need for sustainable transportation solutions, leading to advancements in lithium extraction technologies. With its exceptional properties, lithium continues to play a vital role in advancing the future of clean energy systems.

| Key Points |

|---|

| – Lithium is a soft, silver-white metal known for its excellent conductivity and lightness. |

| – It can store large amounts of energy within its atomic structure, making it ideal for rechargeable batteries. |

| – The demand for lithium has surged with the growing popularity of electric vehicles worldwide. |

| – Advancements in lithium extraction technologies are crucial to meet the increasing global requirements. |

Role of Lithium in the Construction of EV Batteries

Lithium is a vital component in electric vehicle (EV) batteries, specifically in the cathode material. The cathode, typically made from lithium cobalt oxide or lithium iron phosphate, stores and releases energy during charging and discharging. Without lithium, these batteries would lose efficiency and performance.

Lithium’s characteristics make it ideal for EV batteries. Its high electrochemical potential enables significant energy storage while keeping the battery lightweight. It also allows for rapid charging and discharging cycles, crucial for practical use.

Additionally, lithium’s reactivity forms stable compounds with other materials used in battery construction, ensuring durability and longevity.

The increasing demand for EVs worldwide highlights the importance of lithium in battery technology. As governments and consumers embrace sustainable transportation options, efficient energy storage becomes essential. Lithium-ion batteries outperform alternatives like nickel-metal hydride due to their superior performance.

Why Lithium is Considered a Valuable Resource for Investors

Lithium has become a highly prized resource for investors due to its connection with electric vehicles (EVs) and lithium-ion batteries. As countries worldwide prioritize sustainability, the demand for lithium is expected to soar. This presents lucrative investment opportunities in companies involved in its production and supply chain.

The increasing popularity of EVs and the importance of lithium-ion batteries in various industries have contributed to the global demand for lithium. Investing in lithium stocks allows investors to capitalize on the growing market for clean energy storage.

Investors can explore different avenues within the lithium sector, including mining firms that extract lithium from rich sources and companies specializing in battery technology. Additionally, investing in companies involved in exploration, refining, transportation, and distribution of lithium-based products provides further opportunities.

It’s essential to conduct thorough research and exercise caution when investing in this sector due to commodity market volatility and geopolitical factors affecting mining operations.

In summary, as EVs gain traction and sustainability becomes a priority, the demand for lithium rises. By carefully navigating the market and identifying promising investment opportunities, investors can tap into the potential of this valuable resource.

Introduction to Investing in Lithium Stocks

Investing in lithium stocks allows individuals to capitalize on the growing demand for electric vehicles (EVs) and their reliance on lithium batteries. By investing in companies engaged in lithium mining, production, or battery manufacturing, investors can potentially benefit from the industry’s growth.

The global shift towards sustainable transportation solutions has accelerated the demand for lithium-ion batteries, making them a vital component in EVs. This trend is driven by environmental concerns and government regulations aimed at reducing carbon emissions. As a result, the sales of EVs are projected to experience exponential growth.

Investing in lithium stocks positions individuals advantageously within an industry poised for significant expansion. As countries adopt ambitious targets for electrification and battery storage capacity, there will be an unprecedented need for increased lithium supply.

Moreover, advancements in battery technology and decreasing costs further contribute to the surge in lithium demand. Lithium-ion batteries are renowned for their high energy density and long-lasting capabilities, making them essential not only for EVs but also for portable electronic devices.

Potential Benefits and Risks of Investing in this Sector

Investing in the lithium sector offers potential benefits and risks that require careful consideration. The growing demand for electric vehicles (EVs) powered by lithium-ion batteries presents an opportunity for significant returns.

However, market volatility, regulatory changes, and competition from alternative battery technologies pose risks that need to be carefully evaluated. Investors must stay informed and conduct thorough research to navigate these complexities effectively.

[lyte id=’w6k-HsM8xfw’]