When it comes to investing, many individuals are drawn to the idea of finding low-risk options with stable returns. This is where low volatility index ETFs come into play. These investment vehicles offer a unique opportunity for investors looking to minimize risk while still achieving solid returns.

In this article, we will explore the world of low-volatility ETFs, discussing what makes them the best, how to invest in them, analyzing their performance and comparing them with other indices, evaluating their returns and associated risks, examining historical data for trends and patterns, exploring potential drawbacks and limitations, and finally considering how to incorporate these ETFs into your investment strategy.

By the end of this article, you will have a comprehensive understanding of low-volatility ETFs and whether they are the right fit for your investment portfolio.

So let’s dive in!

The Best Low Volatility ETFs

Low volatility ETFs provide a stable investment option for investors looking to minimize risk while still seeking growth opportunities.

When selecting the best low volatility ETFs, it’s important to consider factors such as stock selection methodology, expense ratios, liquidity, historical performance, diversification, and underlying index methodology.

One key factor is how the ETF selects stocks with lower price fluctuations. Understanding this methodology can provide insights into its potential performance and risk mitigation capabilities. Expense ratios and liquidity should also be evaluated as they impact overall returns and trading flexibility.

Analyzing historical performance helps gauge an ETF’s track record during different market conditions. Diversification across sectors or regions reduces exposure to specific industries or geographic areas, reducing risk. Additionally, the underlying index methodology determines the portfolio composition and should align with investment objectives.

Considering these factors enables informed decisions that match risk tolerance and investment goals when choosing the best low volatility ETFs.

How to Invest in Low-Volatility ETFs

Investing in low-volatility ETFs can provide stability to your portfolio. These funds track specific indices that capture stocks with lower price fluctuations. To invest successfully, follow these steps:

-

Research: Thoroughly research the fund’s performance, expense ratios, and underlying index methodology. Consider sector exposure and geographic diversification.

-

Select: Choose the right low-volatility ETF based on your investment goals and risk tolerance. Evaluate historical returns, expense ratio, liquidity, and assets under management (AUM).

-

Execute: Place the trade through your brokerage account during market hours. Understand any fees or commission charges and consider using limit orders for better control over execution price.

By following these steps, you can effectively invest in low-volatility ETFs and benefit from their stability-focused approach. Remember to conduct research, make informed choices, and execute trades strategically for successful investing in these funds.

MSC World Minimum Volatility Performance

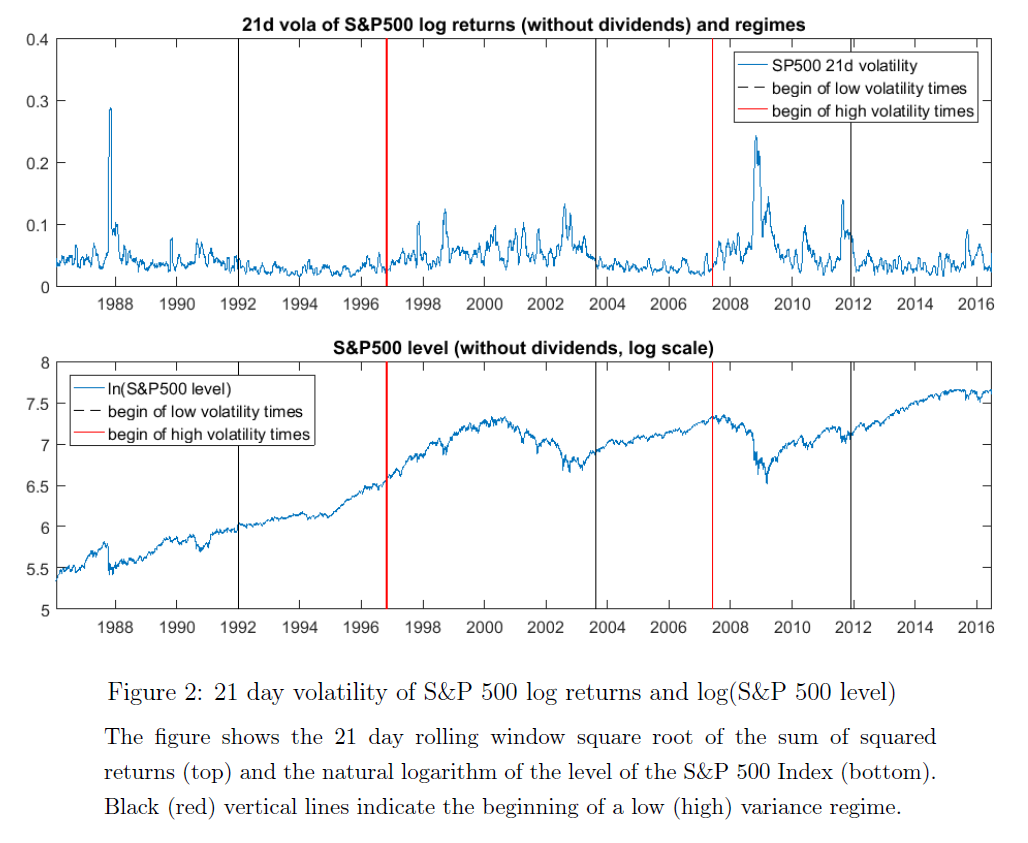

The MSC World Minimum Volatility index is a popular benchmark for low-volatility ETFs. Analyzing its performance provides insights into how these funds have historically performed compared to broader market indices.

Comparing the MSC World Minimum Volatility index with other indices like the S&P 500 or MSCI All Country World Index helps investors understand how low-volatility strategies fare against broader market trends.

By considering metrics such as annualized returns, standard deviation, beta coefficients, and risk-adjusted measures like Sharpe ratio or Sortino ratio, investors gain a holistic view of the index’s performance relative to other benchmarks.

This analysis equips investors to make informed decisions about incorporating low-volatility strategies into their portfolios.

| Metric | Description |

|---|---|

| Annualized Returns | Measures average rate of return per year over a specific time period |

| Standard Deviation | Indicates volatility or dispersion of returns from the mean |

| Beta Coefficients | Measures sensitivity of investment’s returns to those of a benchmark |

| Sharpe Ratio | Evaluates risk-adjusted performance by considering excess returns relative to volatility |

| Sortino Ratio | Focuses on downside risk rather than overall volatility |

Consideration of these metrics when analyzing the performance of low-volatility ETFs like the MSC World Minimum Volatility index enables more informed investment decisions based on historical data and comparisons with broader market indices.

Low-Volatility ETFs in Comparison

When evaluating low-volatility exchange-traded funds (ETFs), it is important to consider their returns and risk factors. Assessing both short-term and long-term performance helps investors identify funds that consistently deliver solid returns while minimizing volatility.

Additionally, analyzing how these funds handle market downturns and their suitability for different risk profiles provides valuable insights.

By considering returns and risk factors, investors can make informed decisions about allocating their assets effectively, striking a balance between steady returns and minimizing exposure to market volatility.

Return Comparison of All Low-Volatility ETFs

When evaluating low-volatility exchange-traded funds (ETFs), it is crucial for investors to consider the historical returns of these investment options. By examining the performance data of all low-volatility ETFs, a comprehensive comparison can be made to identify trends and patterns that may guide informed investment decisions.

The analysis of historical return data provides valuable insights into the consistency and relative performance of different low-volatility ETFs. This examination allows investors to determine which funds have consistently outperformed others over time.

By recognizing such patterns, investors gain a better understanding of the potential benefits and risks associated with specific ETFs.

Moreover, this comparison helps shed light on whether there are any common characteristics among the top-performing low-volatility ETFs. Identifying these shared traits can provide additional guidance for investors seeking to build a well-rounded portfolio that aligns with their risk tolerance and investment goals.

To facilitate a more accessible understanding of this return comparison, the use of a markdown table can be beneficial. The table could include headings such as ETF Name, Average Annual Return (%), Standard Deviation, and Expense Ratio.

By organizing this information in a clear and concise manner, investors can easily compare various low-volatility ETFs side by side.

Risks and Limitations of Investing in Low-Volatility ETFs

Investing in low-volatility ETFs offers stability, but it’s important to consider the potential drawbacks. These investments may result in lower overall returns compared to higher-risk assets, potentially causing investors to miss out on market upswings.

Other limitations include limited exposure to high-growth sectors or regions, overlap with existing holdings in a diversified portfolio, and the challenge of timing market entry and exit points. Careful evaluation is necessary when incorporating low-volatility ETFs into an investment strategy.

Incorporating Low-Volatility ETFs into Your Investment Strategy

Adding low-volatility ETFs to your investment strategy can provide several benefits. These investments help reduce overall portfolio volatility, enhance risk-adjusted returns, and offer stability during market downturns.

However, it’s crucial to consider diversification, correlation with other holdings, and investment objectives when making this decision. By carefully evaluating these factors and integrating low-volatility ETFs into your strategy, you can potentially improve the performance and resilience of your portfolio.

Is a Low-Volatility Index ETF Right for You?

Investing in low-volatility index ETFs can provide stability and minimize risk in your portfolio. These ETFs consist of stocks with historically lower price volatility, offering potential protection during market downturns.

Evaluating their performance against other indices, analyzing historical data for trends, and considering your investment goals and risk tolerance are crucial steps in determining if these investment vehicles are right for you.

By striking a balance between risk and reward, low-volatility index ETFs can be a valuable addition to your investment strategy.

[lyte id=’xUbJ21WcUWA’]