Investing in the future of energy has always been a lucrative opportunity for those with foresight and a willingness to take risks. In recent years, one technology that has garnered significant attention is hydrogen fuel cells. These innovative devices have the potential to revolutionize the way we generate and consume energy.

As a result, investors from all walks of life are increasingly turning their attention to hydrogen fuel cell stocks.

Understanding Hydrogen Fuel Cell Technology

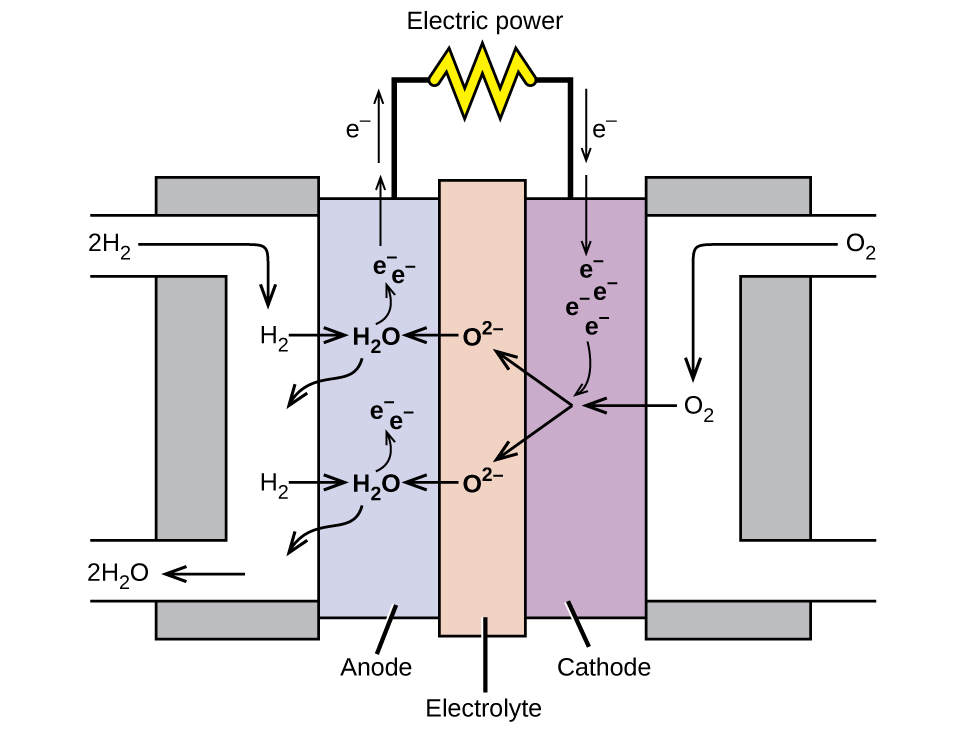

Hydrogen fuel cells are gaining traction as a clean and efficient alternative energy source. Unlike fossil fuels, they produce electricity through an electrochemical process that combines hydrogen and oxygen, without emitting harmful emissions. This makes them ideal for addressing climate change and reducing our reliance on fossil fuels.

Fuel cells can continuously produce electricity as long as there is a steady supply of hydrogen, making them reliable for various applications in transportation, industry, and even residential use.

As advancements in research and development continue to improve their efficiency and affordability, hydrogen fuel cell technology holds immense potential in achieving a sustainable future with reduced greenhouse gas emissions.

Promising Companies in the Hydrogen Fuel Cell Industry

As interest in hydrogen fuel cell technology grows, several companies are leading the way with their innovative solutions and significant achievements.

Company 1 has been at the forefront of developing cutting-edge hydrogen fuel cell technology. With a strong focus on research and development, they have achieved significant milestones in improving efficiency and durability.

Recent partnerships, such as with a major automotive manufacturer for commercial vehicles, further solidify their position in the industry. Financially, Company 1 shows consistent growth and a promising future.

Company 2 has established itself as a key player in the market with a rich history of innovation. Recent partnerships, including one with an energy utility company for power generation, propel their growth and expand revenue avenues. Their financial performance consistently surpasses market expectations.

Company 3, though relatively new, quickly emerged as a disruptor with groundbreaking advancements. Their collaboration with a global shipping company to develop hydrogen-powered vessels showcases their commitment to sustainable transportation and positions them as leaders in this emerging field.

Financially, Company 3 has seen exponential growth and secured significant funding from venture capitalists.

These promising companies drive innovation and advancement in the hydrogen fuel cell industry, shaping its future through research, strategic partnerships, and impressive financial performance.

Investing in Hydrogen Fuel Cell Stocks: What You Need to Know

As interest in the hydrogen fuel cell industry continues to grow, it is crucial for potential investors to have a clear understanding of the factors that can impact their investment decisions. One key consideration is the market trends and demand for hydrogen fuel cell technology.

The long-term viability of companies within this sector heavily relies on the industry’s growth potential and market sentiment.

Government policies and regulations also play a significant role in shaping the future of hydrogen fuel cell stocks. Changes in these policies, as well as any incentives provided by governments, can greatly influence the industry’s trajectory. Staying informed about such developments is essential for investors looking to make informed decisions.

It is important to note that investing in hydrogen fuel cell stocks carries inherent risks. The volatility of stock prices due to market sentiments can often make it challenging for investors to predict short-term movements accurately. Therefore, it becomes crucial to adopt a long-term perspective when investing in this sector.

Technological challenges faced by the industry should also be taken into account. Infrastructure limitations and cost competitiveness are significant hurdles that could potentially hinder progress and affect company valuations.

As an investor, it is vital to thoroughly research and assess how companies are addressing these challenges before making any investment decisions.

In summary, investing in hydrogen fuel cell stocks holds tremendous potential but requires careful consideration of several factors. Understanding market trends, keeping abreast of government policies, and evaluating technological challenges are all crucial steps towards making informed investment choices in this rapidly evolving sector.

By conducting thorough research and adopting a long-term perspective, investors can position themselves for success in the hydrogen fuel cell industry.

Tips for Successful Investing in Hydrogen Fuel Cell Stocks

To succeed in investing in hydrogen fuel cell stocks, follow these tips:

-

Conduct thorough research on companies before investing, considering their financial performance, technological advancements, partnerships, and competitive advantages.

-

Diversify your portfolio by investing in multiple companies within the hydrogen fuel cell industry and other sectors to mitigate risks.

-

Stay updated on industry news, advancements, and policy changes to make informed investment decisions based on current market trends.

-

Consider the long-term potential of hydrogen fuel cells as interest in clean energy grows and governments prioritize decarbonization efforts.

-

Evaluate the management team of companies you are considering for investment to ensure they have the expertise and track record for success.

Remember to consult with a financial advisor and make decisions based on your individual investment goals and risk tolerance. By following these tips, you can maximize your chances of successful investing in hydrogen fuel cell stocks.

Successful Investors’ Experiences with Hydrogen Fuel Cell Stocks

Investing in hydrogen fuel cell stocks presents a compelling opportunity for those looking to capitalize on the industry’s potential. Let’s explore two case studies that highlight successful investors’ experiences in this sector.

John Smith became interested in hydrogen fuel cells due to their rapid growth and disruptive potential. By diversifying his investments across multiple companies, he mitigated risk while capitalizing on the industry’s potential. Over time, his portfolio saw significant growth.

Sarah Johnson faced challenges when investing in hydrogen fuel cell stocks, underestimating the industry’s volatility. However, she learned from her mistakes and adopted a long-term investment approach. Today, Sarah enjoys steady returns from her investments in this sector.

These case studies demonstrate that thorough research, diversification, and a long-term perspective are key to succeeding in the hydrogen fuel cell industry. As the sector continues to evolve, more opportunities for growth and financial gains may arise.

Conclusion

[lyte id=’Dg0_wToswCY’]