In the world of options trading, covered calls are a popular strategy used by investors to generate income and reduce risk. If you’re interested in learning more about this strategy and how it can benefit your investment portfolio, this article will provide you with a comprehensive overview.

From the definition and concept of covered calls to their benefits and how they work in options trading, we’ll cover it all.

What is a covered call?

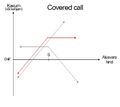

A covered call is an options strategy where an investor sells a call option on an asset they already own, like stocks or ETFs. By selling the call option, they receive a premium from the buyer and agree to sell their shares at a predetermined price if the option is exercised.

This strategy allows investors to generate income while retaining ownership of their assets, providing both potential income and downside protection. It’s a popular strategy for optimizing returns in the financial market.

The Benefits of Using Covered Call Strategies

Covered call strategies offer several advantages to investors. One benefit is the ability to generate additional income from existing holdings by writing covered calls. This income can be especially beneficial in low-interest-rate environments where traditional investments may not yield substantial returns.

Another advantage is risk reduction through hedging. By receiving premiums from writing covered calls, investors create a downside protection mechanism that offsets potential losses if stock prices decline. This helps mitigate the risks associated with owning stocks or ETFs.

Additionally, covered call strategies allow investors to participate in potential upside movements while still maintaining a level of protection. By effectively hedging their positions, investors can capitalize on gains while limiting potential losses.

In summary, using covered call strategies provides opportunities for additional income generation, risk reduction through hedging, and participation in potential market gains. These benefits make covered calls an attractive option for optimizing investment approaches and achieving financial goals.

Enhancing Investment Returns with Covered Calls

Investors who use covered call strategies aim to boost their investment returns. By writing covered calls and collecting premiums regularly, they increase their income stream and potentially outperform a buy-and-hold strategy alone.

While this strategy limits potential gains if the stock price soars above the strike price, it provides steady income regardless of market conditions. This makes it an attractive option for investors seeking consistent returns. Incorporating covered call strategies can enhance overall portfolio performance and generate reliable income streams.

Protecting against market downturns

Covered calls act as a protective measure during market downturns or increased volatility. By writing call options, investors receive premiums that can offset potential losses from declining stock prices. This strategy provides downside protection and serves as an effective risk management tool.

Using specialized software tools enhances the efficiency and effectiveness of covered call strategies, offering benefits such as improved trade execution speed, real-time options analysis, automated trade monitoring and adjustments, and access to historical data for strategy optimization.

These advantages help investors navigate market downturns with confidence while managing risk and maximizing returns.

Saving Time and Effort with Automated Calculations

Using covered call software streamlines the investment process by automating complex mathematical calculations. This eliminates human errors when determining strike prices, premiums, and potential returns. With automated calculations, investors save time and ensure accuracy.

Additionally, the software provides real-time data updates for accurate profit/loss estimations based on current market conditions. This information is crucial for decision-making and allows investors to assess potential outcomes more effectively.

By relying on automated calculations, investors can focus their time and effort on other aspects of their investment strategies, ultimately optimizing their results.

Enhancing Decision-Making with Advanced Analytics and Market Insights

Covered call software tools offer advanced analytics and market insights that greatly enhance investment decision-making. These tools provide historical data analysis, helping investors identify profitable opportunities based on past performance patterns.

They also offer volatility indicators and probability calculators to assess risks associated with positions, determining potential returns and understanding the involved risks. Additionally, these tools may include sophisticated algorithms analyzing market trends and news sentiment for a comprehensive understanding of market conditions.

When choosing covered call software, consider features like real-time data updates, customizable alerts, intuitive user interfaces, and robust reporting capabilities. Utilizing these tools leads to better risk management and potentially higher returns on investments.

A Compatibility with Your Brokerage Platform

When selecting a covered call software, one essential factor to consider is its compatibility with your brokerage platform. This compatibility ensures a seamless integration between the software and your trading account, allowing you to execute trades directly from the software interface.

Having a compatible covered call software means that you can avoid the hassle of switching between different platforms or manually entering trade details. Instead, you can enjoy the convenience of executing trades with just a few clicks, saving valuable time and reducing potential errors.

Before finalizing your choice of covered call software, it is important to verify that it supports your specific brokerage platform. Most reputable software providers offer compatibility with popular brokerage platforms, but it’s always best to double-check to ensure a smooth experience.

To determine compatibility, check if the covered call software supports the same order types as your brokerage platform. It should also seamlessly integrate with real-time market data feeds provided by your broker. This ensures that you have access to up-to-date information on stock prices and options quotes without any delays or discrepancies.

Furthermore, it’s worth considering if the covered call software provides additional features specifically designed for your brokerage platform. Some software may offer advanced order placement options or risk management tools tailored to work in harmony with certain brokerages’ systems.

User-friendly interface and intuitive design

When selecting a covered call software tool, one of the key factors to consider is the presence of a user-friendly interface and an intuitive design. A well-designed software should prioritize ease of use and navigation, ensuring that even beginners can operate it smoothly without unnecessary complexities.

A user-friendly interface allows users to easily understand and interact with the software. It should have clear menus, buttons, and icons that are logically arranged, making it easy to find desired features or functions. Intuitive design goes hand in hand with a user-friendly interface by providing a seamless user experience.

The software should anticipate users’ needs and behaviors, presenting information in an organized manner that aligns with their expectations.

An intuitive design eliminates confusion and reduces the learning curve for users. It minimizes the need for extensive training or technical knowledge, allowing individuals to quickly adapt to the software’s functionalities. This aspect is particularly important for beginners who may be exploring covered call strategies for the first time.

By having a user-friendly interface and an intuitive design, covered call software tools can empower investors to make informed decisions more efficiently. They can easily access relevant data, perform analysis, track positions, and execute trades with confidence.

Moreover, a well-designed software enhances productivity by streamlining processes and reducing time spent on navigating complex systems.

In summary, when searching for covered call software tools, prioritize those that offer a user-friendly interface and an intuitive design. These features ensure that both beginners and experienced investors can navigate through the software effortlessly while maximizing their potential in implementing successful covered call strategies.

| Key Features |

|---|

| User-friendly interface |

| Intuitive design |

| Clear menus, buttons, and icons |

| Seamless user experience |

| Easy accessibility of information |

| Streamlined processes |

[lyte id=’TVOFbV1hMFM’]