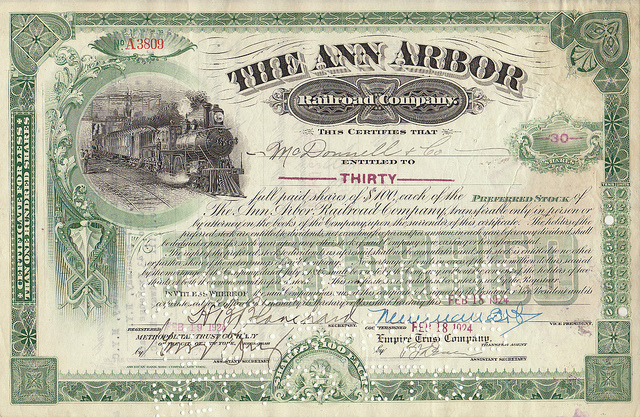

Investing in the stock market can be a thrilling and rewarding venture, especially when you stumble upon a hidden gem – a tiny company with massive growth potential. These small-cap stocks often fly under the radar of investors, presenting unique opportunities for those willing to do their homework.

In this article, we will take a deep dive into one such company – Tiny Ltd. By exploring its background, financial performance, growth prospects, and investment considerations, we aim to provide valuable insights for investors interested in the world of tiny company stocks.

Introduction to Tiny Ltd.

Tiny Ltd is a small-cap company with immense growth potential. Despite its size compared to industry giants, Tiny Ltd operates in niche markets and offers innovative products and services. Established [X years ago], this visionary company has shown resilience in navigating challenges while embracing emerging technologies and market trends.

Through its focused approach, commitment to innovation, and strong customer relationships, Tiny Ltd has positioned itself as a disruptor within the [industry]. Investors recognize the opportunities presented by small-cap companies like Tiny Ltd, making it an attractive option for high-growth potential within a specialized sector.

Financial Performance and Stock Market Position of Tiny Ltd.

Examining the financial performance and stock market position of Tiny Ltd is crucial for investors. By analyzing key financial indicators and historical trends, we can gain insights into its profitability, stability, and market perception.

Tiny Ltd has shown consistent revenue growth due to innovative offerings and effective cost management. Evaluating metrics like revenue growth rate, profit margin, and return on equity (ROE) helps assess profitability and efficiency.

Analyzing stock price movements and trading volume provides insights into market sentiment towards Tiny Ltd. Despite volatility in small-cap stocks, the company has generated considerable returns for early investors.

Understanding investor sentiment through factors like analyst recommendations and media coverage helps gauge overall perception. This analysis allows investors to evaluate growth potential and determine suitability for their portfolios.

Prospects and Growth Potential for Tiny Ltd.

Tiny Ltd holds promising prospects for growth and capital appreciation. By analyzing market opportunities, industry trends, and growth factors, we can gain valuable insights into its potential.

A. Market Opportunities and Industry Trends

Examining current industry trends, including the rising demand for [trend 1] and the emerging market of [trend 2], reveals how Tiny Ltd aligns with these developments. This positions the company to leverage these trends for future growth.

Understanding the competitive landscape and potential barriers to entry sheds light on Tiny Ltd’s ability to seize emerging opportunities. By assessing factors such as competitors, market saturation, customer preferences, and regulatory hurdles, we gauge their readiness to capitalize on these openings.

B. Assessment of Growth Potential

Tiny Ltd’s strategic initiatives, innovative products/services, and expansion plans make it an attractive prospect for investors seeking long-term capital appreciation. Factors like target market size, scalability, competitive advantage, and management expertise contribute to its growth potential.

Conclusion and Investment Considerations for Tiny Company Stocks

Investing in tiny company stocks like Tiny Ltd can offer promising opportunities for high potential returns.

With a solid financial performance history, favorable stock market positioning, exciting growth prospects aligned with industry trends, and a track record of innovation, Tiny Ltd stands out as a compelling choice within the small-cap stocks landscape.

When considering an investment in tiny company stocks, it is essential to weigh factors such as market volatility, liquidity risks, due diligence on the management team, and analysis of the competitive landscape. Diversification within one’s investment portfolio is crucial to mitigate risk associated with small-cap investments.

[lyte id=’b3YdvzYRz6s’]