In recent years, the rise of stock trading apps has revolutionized the way people invest in the stock market. One such app that has gained significant popularity is Cash App. Known for its simplicity and user-friendly interface, Cash App offers an investing feature that allows users to buy and sell stocks with ease.

But is Cash App a good place to buy stocks?

In this article, we will explore the features of Cash App Investing, discuss its benefits and drawbacks, analyze the costs involved, provide tips for successful investing on the platform, share real-life user experiences, highlight safety measures and security features implemented by Cash App, and explore alternative options to consider.

By the end of this article, you will have a comprehensive understanding of whether Cash App is a suitable platform for buying stocks.

Understanding Cash App Investing

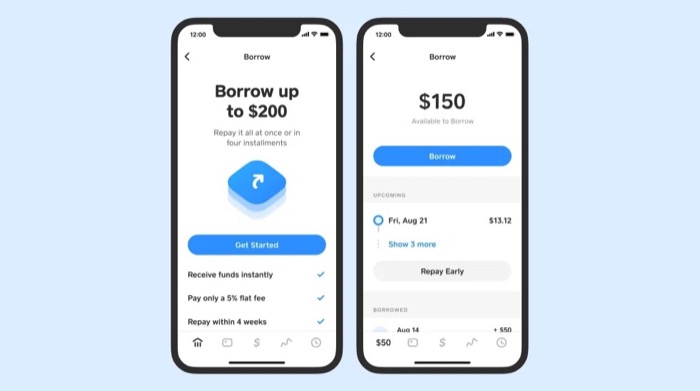

Cash App’s investing feature allows users to buy and sell individual stocks directly from their mobile devices. With a wide range of popular stocks from well-known companies, users can become shareholders in companies they believe in with just a few taps on their screens.

Setting up an investing account on Cash App is straightforward. Users need to download the app, sign up for an account, and navigate to the “Investing” tab. They can then follow prompts to provide personal information and fund their account with cash.

Cash App provides a diverse selection of stocks from various industries, giving users the freedom to choose companies that align with their investment goals. Real-time stock prices and performance metrics are readily available, empowering users to make informed decisions about buying or selling stocks.

In summary, Cash App’s investing feature offers convenience and accessibility for individuals looking to enter the stock market. Users can easily become shareholders in companies they believe in through an intuitive interface and access valuable information to guide their investment decisions.

Benefits and Drawbacks of Buying Stocks on Cash App

Cash App’s expansion into stock trading brings both advantages and disadvantages for investors.

One benefit is the app’s user-friendly interface and intuitive design, making it accessible even to beginners. Cash App also allows users to buy fractional shares, enabling investment in high-priced stocks without needing to purchase a whole share.

Additionally, the integration of features like peer-to-peer payments and direct deposit provides convenient financial management.

However, there are drawbacks to consider. Cash App has a limited selection of stocks compared to traditional brokers, which may restrict options for investors looking for niche or less well-known companies. The app also lacks advanced research tools and analysis capabilities that experienced investors might require.

Lastly, potential security concerns exist with any online platform handling financial transactions.

Understanding the Costs Involved in Stock Trading on Cash App

Investing in stocks through Cash App comes with certain costs that investors should be aware of. One important aspect to consider is the transaction fees and commission structure imposed by Cash App. When buying or selling stocks, Cash App charges transaction fees which vary depending on the size of the transaction.

However, these fees are typically minimal compared to those charged by traditional brokerage firms that often impose higher commissions.

To gain a better understanding of the costs associated with stock trading on Cash App, it is essential to compare them with other popular platforms such as Robinhood or E*TRADE.

While transaction fees are a key factor to consider, it’s equally important to take into account other expenses like account maintenance fees, inactivity fees, and margin rates. Each platform has its own fee structure, and investors should evaluate their individual needs to determine which option offers the most cost-effective solution for them.

By comparing the costs across different platforms, investors can make informed decisions about where to invest their money. It’s crucial to weigh not only the immediate transaction expenses but also any potential long-term costs they may incur while using a particular platform.

This analysis will help investors identify which platform aligns best with their financial goals and trading preferences.

In summary, understanding the costs involved in stock trading on Cash App requires careful consideration of various factors beyond just transaction fees. By evaluating all relevant expenses and comparing them across different platforms, investors can ensure they are making informed choices that align with their financial objectives.

Tips for Successful Investing on Cash App

Investing in stocks through Cash App requires careful consideration and a strategic approach. To maximize your chances of success, keep the following tips in mind:

-

Conduct thorough research: Before investing in any company, analyze their financial statements, understand industry trends, and stay updated with relevant news.

-

Diversify your portfolio: Spread your investments across different stocks and sectors to minimize risk. Cash App’s fractional shares feature makes diversification more accessible even with limited funds.

-

Set realistic expectations: Understand that the stock market can be volatile, so focus on long-term goals rather than short-term gains. Stay disciplined and patient throughout your investment journey.

By following these tips, you can make informed decisions, manage risk effectively, and work towards achieving your investment goals on Cash App.

Real-Life Experiences: User Testimonials

Users have reported positive experiences with investing through Cash App. They appreciate the app’s simplicity, especially for newcomers to investing. The ability to buy fractional shares is also praised as it allows investment in high-priced stocks without committing significant funds.

Users highlight the seamless integration with other Cash App features, making it a one-stop solution for their financial needs.

However, some users have faced challenges or negative experiences. These include limited stock options, technical glitches, and delays in executing trades. It’s important to consider both positive and negative feedback when evaluating Cash App for investment needs.

Safety Measures and Security Features Implemented by Cash App

Cash App takes user security seriously and employs various measures to protect sensitive information. These include:

- Two-factor authentication: Users are required to provide a unique verification code in addition to their login credentials, adding an extra layer of protection against unauthorized access.

- Encryption: User data is encrypted, transforming it into complex codes that are difficult for hackers to decipher, ensuring confidentiality.

- Account Monitoring: Cash App has a dedicated team that actively monitors for suspicious activity, providing additional protection against fraud or unauthorized access.

Users can also enhance their own security by enabling two-factor authentication, creating strong passwords, and regularly reviewing account activity. It is important to exercise caution when sharing sensitive information or clicking on links to avoid falling victim to phishing attempts.

By implementing these safety measures and following best practices, Cash App and its users work together to create a secure environment for financial transactions within the app.

Exploring Alternatives to Consider

When considering alternatives to Cash App for stock trading, it’s worth comparing popular apps like Robinhood and E*TRADE. Each app has its strengths and weaknesses, so investors should evaluate which aligns best with their goals. For advanced features and a wider range of options, traditional brokerage firms may be a better fit.

These firms offer comprehensive platforms for experienced investors who require more sophisticated tools. By exploring both stock trading apps and traditional brokerages, investors can find the right resources to enhance their investment strategies.

Factors to consider:

- Stock Trading Apps (e.g., Robinhood): User-friendly interface, low or no commission fees, limited investment options, basic educational resources.

- Traditional Brokerage Firms: Advanced research tools, potentially higher commission fees, extensive selection including mutual funds and bonds, dedicated advisors for personalized assistance.

With careful evaluation and research, investors can make an informed choice that aligns with their unique goals and preferences. By exploring beyond Cash App, opportunities arise to find the platform or firm that best suits individual needs.

IX: Conclusion

[lyte id=’AJhErO3Xp64′]