Investing in the stock market can be an exciting and rewarding journey. As you dive deeper into the world of investing, you’ll come across various strategies and techniques to grow your wealth. One such strategy that has gained immense popularity is dividend investing.

In this article, we will explore the concept of dividend stocks and how they can help protect your portfolio while generating passive income.

So, let’s get started!

What is a Dividend?

A dividend is a payment made by a company to its shareholders as a distribution of profits. When you invest in dividend stocks, you become a partial owner of the company and are entitled to receive a share of its earnings. These payments are typically made on a regular basis, usually quarterly or annually.

Dividends play a crucial role in protecting your investment portfolio during volatile market conditions. While stock prices may fluctuate, dividends provide a steady stream of income even when the market is down. This income can act as a cushion against potential losses and help stabilize your overall returns.

In summary, dividends are payments made by companies to their shareholders as distributions of profits. They provide investors with reliable income and offer protection during market downturns.

Dividend Dominance

Dividend stocks dominate the market as reliable investments with numerous benefits. These stocks provide a predictable stream of income, allowing investors to supplement cash flow or reinvest for growth. They also offer potential capital appreciation and lower volatility compared to non-dividend-paying stocks.

Additionally, reinvesting dividends can accelerate investment growth through compounding. Overall, dividend stocks continue to maintain their position as a dominant force in today’s market landscape.

Exploring Dividend ETFs

Exchange-Traded Funds (ETFs) have revolutionized diversification for investors. These funds pool money from multiple investors to invest in a diversified portfolio of assets, including dividend-paying stocks. Investing in dividend-focused ETFs offers several advantages.

Firstly, these ETFs provide instant diversification by holding a basket of dividend-paying stocks across various sectors and industries. This helps spread the investment risk and reduces the impact of any single stock’s performance on the overall portfolio.

Additionally, dividend-focused ETFs typically have lower expense ratios compared to actively managed funds. This means more of your investment goes towards generating returns rather than being eaten up by management fees.

Furthermore, investing in these ETFs offers ease of management. With just one investment, you gain exposure to a wide range of dividend stocks without the need for constant monitoring and rebalancing.

In summary, exploring dividend ETFs allows investors to benefit from instant diversification, lower costs, and ease of management. These specialized ETFs are an attractive option for those seeking long-term growth and passive income opportunities in their investment portfolios.

Getting Started with Dividend Investing

Investing in dividend stocks can be a lucrative way to grow your wealth over time. Here’s how to get started:

- Research and Education: Learn about companies that pay dividends consistently, focusing on those with a track record of increasing payouts.

- Build a Portfolio Strategy: Allocate a portion of your investment portfolio to dividend stocks based on your goals and risk tolerance.

- Select Dividend Stocks: Choose stocks with attractive yield, payout ratios, and strong financial health.

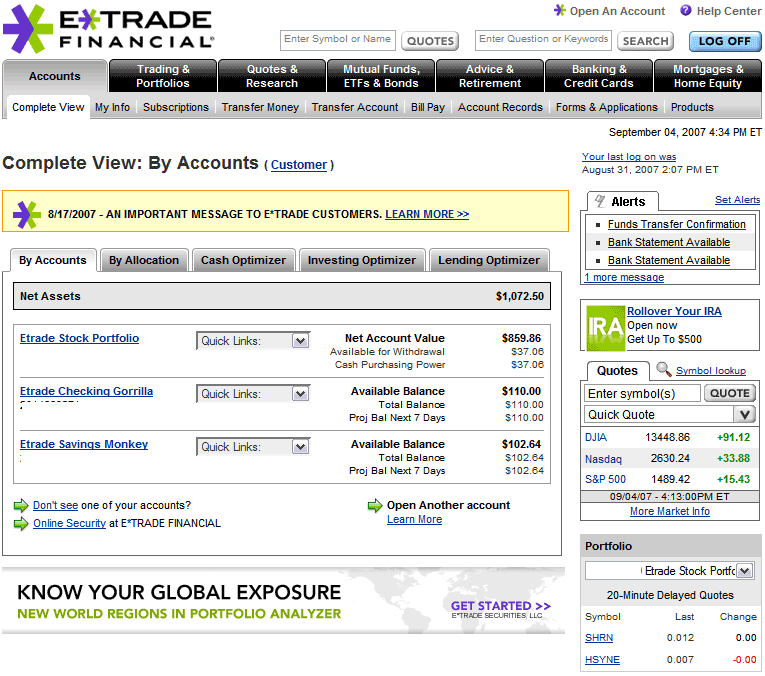

- Open an Account: Use reputable online brokerage platforms like E*TRADE to access a wide range of dividend stocks.

- Monitor and Review: Regularly review your portfolio’s performance and make adjustments based on market conditions and stock fundamentals.

Considerations for beginners:

– Understand your risk tolerance and choose investments accordingly.

– Diversify your portfolio across sectors for reduced risk.

– Approach dividend investing with a long-term perspective for compounding returns.

Follow these steps and considerations to confidently start your journey into dividend investing. Stay informed, adapt to changing markets, and think long-term for success in this rewarding strategy.

Maximizing Returns with Dividend Stocks

To maximize returns with dividend stocks, two key strategies come into play: dividend reinvestment and portfolio diversification. By reinvesting dividends back into the same stocks or other investments, investors can take advantage of compounding over time. This approach allows for significant growth in investment value and overall returns.

Additionally, diversifying the portfolio with different types of dividend-paying companies helps mitigate risk by spreading investments across various sectors, geographies, and market caps. By combining these strategies, investors can optimize their investment portfolios for steady income and long-term capital appreciation.

Start Investing Today!

Don’t wait any longer! Now is the perfect time to start investing in dividend stocks and unlock the power of passive income. With a solid strategy, patience, and the right knowledge, you can set yourself up for long-term financial success.

When selecting an online brokerage platform for dividend investing, consider factors such as trading fees, research tools, customer support, and the availability of dividend-focused ETFs. Platforms like E*TRADE offer a wide range of investment options and educational resources to help you make informed decisions.

[lyte id=’T6dSGJ0ewNU’]