In today’s digital era, gaming has evolved from a niche hobby to a multi-billion dollar industry. The rise of technology and the increasing popularity of video games have propelled gaming companies into the spotlight, making them an attractive investment opportunity.

If you’re looking to diversify your investment portfolio and capitalize on the booming gaming industry, investing in gaming companies might just be the right move for you.

In this article, we’ll delve into the world of gaming investments, exploring why they make sense, key considerations before investing, different types of gaming investments, strategies for successful investment management, and a glimpse into the future outlook of this dynamic industry.

The Rise of Gaming: An Industry Overview

The gaming industry has experienced unprecedented growth in the past decade. Advancements in technology and widespread accessibility have led to more people engaging in video games across various platforms. This surge in demand has resulted in significant revenue growth for gaming companies worldwide.

The industry consists of sectors such as game development, hardware manufacturing, eSports, streaming services, and more. Each sector plays a vital role in shaping the gaming landscape and presents unique investment opportunities.

Recent trends and innovations continue to shape the future of gaming. Virtual reality (VR) and augmented reality (AR) technologies are revolutionizing how people experience games. Cloud-based streaming services allow gamers to access a vast library without expensive hardware.

Understanding these trends can help investors identify lucrative opportunities within the market.

In summary, the rise of gaming is driven by technology advancements and accessibility. Different sectors contribute to its success, offering diverse investment prospects. Emerging trends like VR, AR, and cloud-based streaming are reshaping the industry and creating new opportunities for investors.

Why Investing in Gaming Companies Makes Sense

Investing in gaming companies is a smart move due to the industry’s consistent growth and increasing consumer demand. The market’s expansion provides ample opportunities for substantial returns on investment.

Factors like successful game releases, monetization strategies, strong intellectual property portfolios, and effective marketing and distribution channels drive profitability.

Case studies of established giants like Electronic Arts (EA) and indie studios like CD Projekt Red demonstrate the lucrative nature of this industry and inspire confidence in potential investors.

Key Considerations Before Investing in Gaming Companies

Before investing in gaming companies, thorough evaluation of market conditions, industry competition, financial performance, revenue streams, and associated risks is crucial.

Analyzing market trends, consumer behavior, and competitor strategies provides insights into a company’s positioning within the market. Understanding financial indicators such as revenue growth, profit margins, and cash flow helps assess stability and long-term prospects.

Risks include changing consumer preferences, technological advancements that may render platforms obsolete, regulatory challenges, and economic downturns. Conducting thorough risk assessments aids informed decision-making.

Investing in gaming companies requires careful consideration of these factors to maximize potential for success in this dynamic industry. Stay updated on industry trends and competitor strategies for a comprehensive understanding of the market dynamics at play.

Navigating Different Types of Gaming Investments

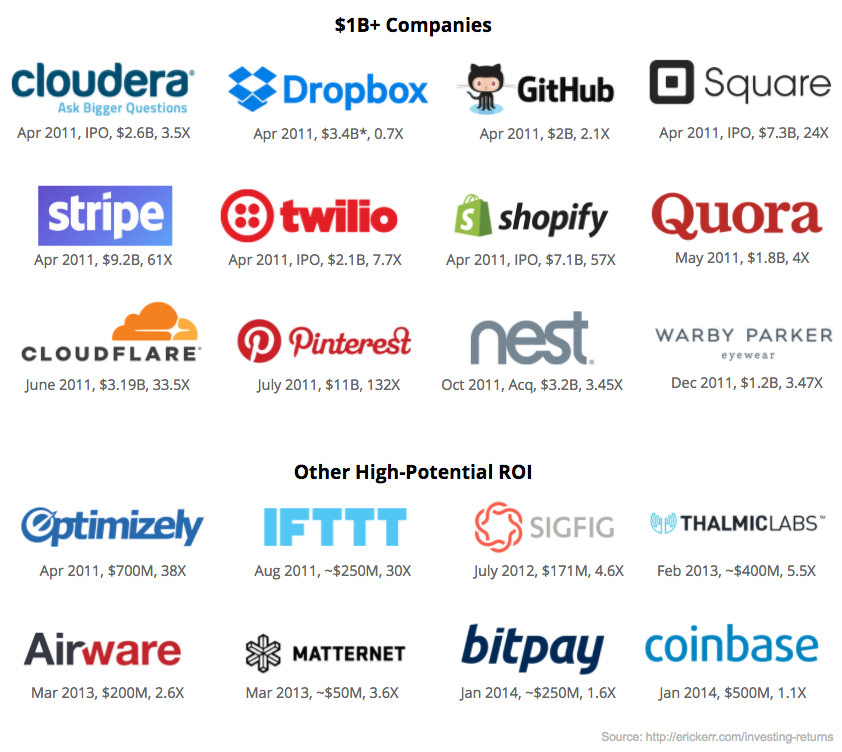

Investing in the gaming industry offers diverse opportunities for those looking to enter this thriving market. One option is investing directly in publicly traded game developers and publishers, such as Activision Blizzard, Take-Two Interactive, and Ubisoft.

Analyzing financial statements, stock performance, and growth prospects can help investors make informed decisions when selecting promising gaming stocks.

Another alternative is exploring investments in eSports organizations and tournaments. The rising popularity of eSports presents a unique opportunity to capitalize on increasing revenues generated by this rapidly expanding sector.

Factors like team performance track record, brand partnerships, and fan engagement strategies should be evaluated when considering such investments.

Funding independent game studios or start-ups is yet another avenue worth exploring within the gaming industry. Investors can identify promising studios through thorough market research, considering factors such as track record, team expertise, game concepts, potential market demand, and funding capabilities.

By understanding the opportunities presented by different types of gaming investments and conducting proper due diligence, investors can position themselves strategically within this exciting and lucrative industry.

Strategies for Successful Investment Management in Gaming Companies

Investing in the gaming industry requires strategic planning. Diversification is key, spreading investments across different sectors like game development, hardware manufacturing, eSports, and streaming services. Long-term investments offer compounding returns, while short-term approaches bring higher volatility but quick profits.

Staying informed on industry news and emerging technologies is crucial for making informed decisions. By following reputable gaming news outlets and attending conferences, investors can anticipate market shifts and identify lucrative opportunities ahead of time.

In summary, successful investment management in gaming companies involves diversification, weighing long-term versus short-term approaches, and staying informed about industry developments.

Future Outlook: Where is the Gaming Industry Headed?

The gaming industry is undergoing significant changes with the rise of emerging technologies like virtual reality (VR) and augmented reality (AR). These advancements have the potential to revolutionize gaming by offering enhanced immersion and interactivity.

Cloud gaming and streaming services are also reshaping the industry by providing on-demand access to games without expensive hardware. Investors must stay vigilant and adapt their strategies to capitalize on these game-changing innovations.

Constant innovation drives the gaming industry forward, making it crucial for investors to monitor potential disruptions and embrace new technologies to stay ahead in this dynamic market.

Conclusion

Investing in gaming companies provides a unique opportunity to capitalize on a rapidly growing industry driven by technology and changing consumer preferences.

By understanding the financial potential, evaluating market conditions, analyzing risks, exploring investment options, implementing effective strategies, and staying informed about industry trends, investors can position themselves for success in this dynamic market.

Thorough research, due diligence, and careful consideration are essential before making any financial commitments. With strategic decision-making and planning, investing in gaming companies can be a rewarding endeavor with immense growth potential.

[lyte id=’ciftzOqVpDg’]