Investing in the stock market can be a lucrative endeavor, but it requires careful analysis and strategy. One factor that plays a crucial role in stock trading is implied volatility. Understanding and identifying stocks with high implied volatility can provide valuable opportunities for investors and options traders alike.

In this article, we will explore the concept of implied volatility, its importance in stock trading, and how to find stocks with high implied volatility.

Understanding Implied Volatility

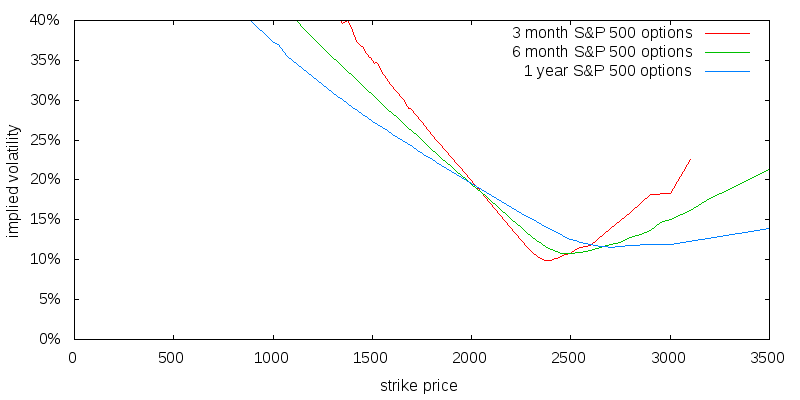

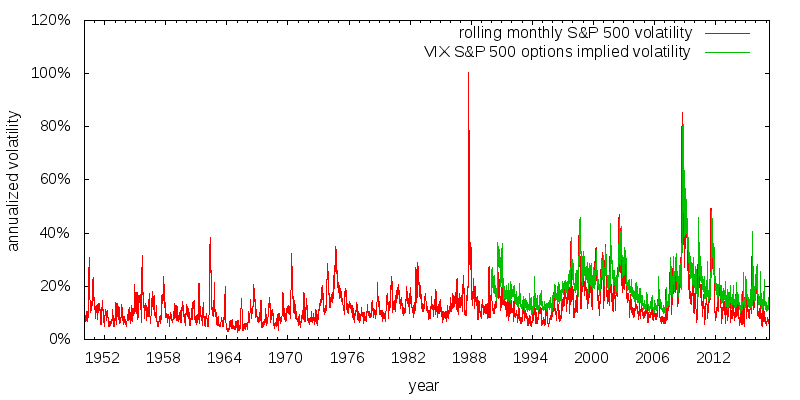

Implied volatility is a crucial concept in the world of stock trading, providing investors with valuable insights into market sentiment and expectations. By definition, implied volatility refers to the market’s expectation of how volatile a stock’s price will be in the future.

It is derived from the prices of options contracts and is expressed as a percentage.

The importance of implied volatility lies in its ability to inform investment decisions. Stocks with high implied volatility are generally seen as riskier investments due to their potential for significant price fluctuations. On the other hand, stocks with low implied volatility are considered less volatile and may offer more stable returns.

When it comes to options pricing, implied volatility plays a direct role in determining the premium paid for these contracts. Options give investors the right but not the obligation to buy or sell underlying assets at a predetermined price within a specific timeframe.

When implied volatility is high, options premiums increase because there is an increased likelihood of significant price movements in the underlying stock before expiration.

Conversely, when implied volatility is low, options premiums decrease as there is less expected price fluctuation. This relationship between implied volatility and options pricing highlights how market expectations can impact investment strategies.

Traders need to consider implied volatility when evaluating options contracts to ensure they are paying a fair premium based on anticipated future stock price movements.

In summary, understanding implied volatility provides investors with valuable information about market sentiment and helps them make informed decisions when trading stocks and options.

By considering the level of implied volatility, traders can assess potential risks and opportunities associated with different investments, ultimately enhancing their overall trading strategies.

Why High Implied Volatility is Attractive

High implied volatility in stocks offers several attractive aspects. Firstly, it presents the potential for higher returns as these stocks are more likely to experience significant price swings. This appeals to investors seeking greater profits despite increased risk.

However, it’s important to acknowledge that higher returns come with added uncertainty and the possibility of substantial losses.

Additionally, high implied volatility provides increased opportunities for options traders. They thrive on volatility as it allows them to profit from price movements.

Stocks with high implied volatility offer a wider range of strike prices and expiration dates, enabling options traders to structure trades based on their desired risk/reward profile.

Moreover, high implied volatility can serve as an indicator of market uncertainty or upcoming events that may impact a stock’s price. Anticipated significant news releases, earnings announcements, or regulatory decisions can affect a company’s value. As expectations rise, so does implied volatility.

In summary, the attractiveness of high implied volatility lies in the potential for higher returns, increased opportunities for options traders, and its indication of market uncertainty or upcoming events. However, it’s crucial for investors to conduct thorough research and careful analysis to mitigate the associated risks effectively.

Researching Stock Screeners and Tools

Stock screeners are essential tools for investors to filter through stocks based on specific criteria. By using these tools, investors can save time and effort by focusing on stocks that meet their desired volatility parameters. Here are three popular stock screener platforms:

-

Bloomberg Terminal: Widely used by professional traders, Bloomberg Terminal offers comprehensive financial data and analysis tools, including the ability to screen stocks based on implied volatility.

-

Finviz: A popular web-based platform, Finviz provides real-time quotes, charts, and customizable screening capabilities. Traders can easily identify stocks with high implied volatility using Finviz’s screener.

-

Yahoo Finance: While not as robust as other platforms, Yahoo Finance offers free stock quotes, news articles, and basic screening tools that can be useful for retail investors looking to identify stocks with high implied volatility.

In summary, stock screeners are valuable resources for investors to narrow down their search and find stocks that align with their volatility preferences. Platforms like Bloomberg Terminal, Finviz, and Yahoo Finance offer varying levels of features and accessibility to cater to different investor needs.

Using Technical Analysis to Identify High IV Stocks

Technical analysis is a powerful tool that traders use to identify stocks with high implied volatility. By studying past price and volume patterns, traders can make predictions about future price movements. There are several techniques and indicators that are commonly used in technical analysis to find stocks with significant price swings.

One such technique is the use of Bollinger Bands. Bollinger Bands consist of a simple moving average (SMA) with an upper band and a lower band that are two standard deviations away from the SMA. When the price moves outside of these bands, it suggests increased volatility and potential trading opportunities.

Another indicator for identifying high implied volatility is the Average True Range (ATR). The ATR measures the average range between daily highs and lows over a specific period. Stocks with higher ATR values indicate greater volatility, making them potential candidates for high implied volatility.

Moving Average Convergence Divergence (MACD) is another popular indicator used in technical analysis. It is a trend-following momentum indicator that helps identify potential buy or sell signals in a stock’s price movement. When the MACD line crosses above or below its signal line, it may suggest an increase in price volatility.

By utilizing these technical analysis tools, traders can effectively identify stocks with high implied volatility. This information can be valuable when making investment decisions and seeking out potential profit opportunities in the market.

Overall, technical analysis provides valuable insights into market dynamics and can help investors navigate through various market conditions. It is important to remember that technical analysis should be used in conjunction with other fundamental research methods to make well-informed investment decisions.

Analyzing Fundamental Factors for High IV Stocks

When investing in the stock market, analyzing fundamental factors is crucial for identifying high implied volatility (IV) stocks.

By examining industry-specific news and events, evaluating earnings reports and guidance updates, considering macroeconomic factors, analyzing the competitive landscape, and incorporating risk assessment, investors can gain valuable insights into potential volatility and price movements.

These factors help investors make informed decisions and navigate the stock market with a better understanding of high IV stocks.

VI Going Beyond the Numbers: Qualitative Analysis

To truly understand a company’s potential for price movements, investors must go beyond quantitative analysis and consider qualitative factors. Management changes, product launches, and legal issues can all impact a stock’s implied volatility.

By evaluating these non-financial aspects, investors can gain a more comprehensive understanding of a company’s risk profile and anticipate potential price swings. Incorporating qualitative analysis into investment strategies is essential for making informed decisions in the stock market.

Best Practices for Managing Risk when Trading High IV Stocks

When trading high implied volatility (IV) stocks, it’s crucial to implement effective risk management strategies. This involves setting position size limits, diversifying your portfolio, regularly monitoring trades, and using stop-loss orders.

To manage risk, set position size limits to allocate a specific percentage of your portfolio to each trade. This prevents overexposure and maintains balance. Diversify by investing in different industries, sectors, and asset classes to reduce the impact of any single stock’s performance on your portfolio.

Regularly monitor trades to stay informed about market conditions and news that could affect your stocks. This allows for timely decision-making and adjustments if necessary, minimizing potential losses. Use stop-loss orders to automatically sell if a stock’s price reaches a predetermined level, protecting against adverse price movements.

By following these best practices, you can effectively manage risk when trading high IV stocks and increase your chances of success in the stock market.

Examples of High IV Stocks in Recent Years

Tesla Inc., led by CEO Elon Musk, is a prime example of a high implied volatility (IV) stock. Musk’s Twitter activity has been known to create significant fluctuations in Tesla’s share price, resulting in both profitable and risky scenarios for investors.

Another notable case study is GameStop Corp., which experienced unprecedented volatility due to a short squeeze orchestrated by retail traders on Reddit’s WallStreetBets forum. These examples showcase how high IV stocks can provide extraordinary trading opportunities and reshape market dynamics.

By examining these case studies, investors can gain valuable insights into the factors driving IV stocks and develop strategies to navigate their uncertainties effectively.

[lyte id=’ypDl36M4rCg’]