In the world of investing, there are countless strategies and tools available to help investors navigate the ever-changing market landscape. One such tool that has gained popularity in recent years is the Exchange-Traded Fund (ETF).

ETFs offer a unique way for investors to gain exposure to a diversified portfolio of assets, all within a single investment vehicle.

But what happens when the market takes a downturn? This is where inverse ETFs come into play.

Inverse ETFs are designed to provide investors with the ability to profit from declining markets. By taking short positions on various assets or sectors, these innovative investment vehicles allow investors to benefit when the market goes down.

In this article, we will explore the world of inverse ETFs and how they can be used as a strategic tool in an investor’s arsenal.

Understanding the Basics of ETFs

ETFs, or Exchange-Traded Funds, are investment funds that trade on exchanges like stocks. They aim to track the performance of a specific index or asset class by holding a diversified portfolio of underlying securities.

This diversification helps spread risk and provides investors with exposure to multiple stocks or bonds within a sector or asset class without having to buy each security individually. ETFs offer flexibility, liquidity, and transparency, making them popular among both individual and institutional investors seeking cost-effective investment options.

By understanding the basics of ETFs, investors can make informed decisions and potentially achieve more stable returns over time.

Exploring the Benefits and Drawbacks of ETF Investing

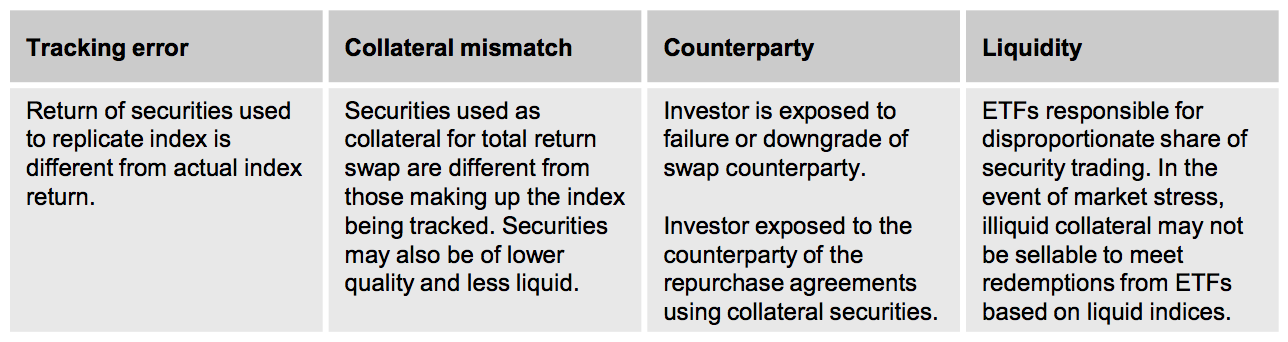

ETFs offer advantages over mutual funds and individual stocks, including lower expense ratios as they passively track an index. They also provide liquidity, allowing investors to buy or sell shares throughout the trading day. However, ETFs expose investors to market volatility and may have limited liquidity for niche markets or asset classes.

Careful consideration of these factors is crucial when incorporating ETFs into investment portfolios.

Defining Inverse ETFs and Their Purpose

Inverse ETFs, also known as exchange-traded funds, allow investors to profit from declining markets by delivering the opposite return of the index they track. These funds serve as a hedging mechanism, protecting portfolios from market downturns.

By taking short positions on assets or sectors, inverse ETFs generate positive returns when the underlying index or asset class performs poorly. They offer flexibility and accessibility, providing a risk management tool for investors during market volatility.

However, it’s important to be aware of potential risks such as tracking errors and imperfect mirroring of index movements. Overall, inverse ETFs provide a unique opportunity to capitalize on market declines while safeguarding investments.

How inverse ETFs differ from traditional ETFs

Inverse ETFs, also known as exchange-traded funds, differ from traditional ETFs in their approach to achieving investment outcomes. While traditional ETFs aim to replicate the performance of an index or asset class, inverse ETFs use derivatives like futures contracts and options to achieve their desired outcome.

Unlike traditional ETFs, which move in tandem with the underlying index, inverse ETFs move in the opposite direction. When the index goes down, the value of an inverse ETF goes up, and vice versa. This allows investors to profit from market declines or bet against specific sectors or indexes.

However, it’s important to note that inverse ETFs are designed for short-term trading strategies rather than long-term investments. They can deviate significantly from their intended inverse exposure over extended periods due to compounding effects and daily reset mechanisms employed by these funds.

To summarize, while both traditional and inverse ETFs have advantages for investors, they operate differently. Inverse ETFs use derivatives to achieve their desired outcomes and are suited for short-term trading strategies. Investors should carefully consider their goals and time horizons before incorporating inverse ETFs into their portfolios.

[lyte id=’-qXI4k2xI0o’]