Investing in the stock market can be a thrilling and rewarding venture, but it also comes with its fair share of challenges. For those interested in investing in companies like Genesis AI, understanding the factors that influence stock prices is essential.

In this article, we will explore various aspects that impact the stock price of Genesis AI, providing you with valuable insights to make informed investment decisions.

The Impact of COVID-19 on Genesis AI Stock Price

The COVID-19 pandemic has significantly affected the artificial intelligence (AI) sector, including Genesis AI’s stock price. Global disruptions to supply chains and business operations have caused delays in product development and revenue generation for Genesis AI.

However, the increased demand for AI solutions in industries like healthcare and remote work has positively influenced their stock price. Despite challenges, Genesis AI’s ability to adapt to evolving needs has played a crucial role in shaping their stock price trajectory during these unprecedented times.

Investor Sentiment and Market Speculation: The Role of Social Media

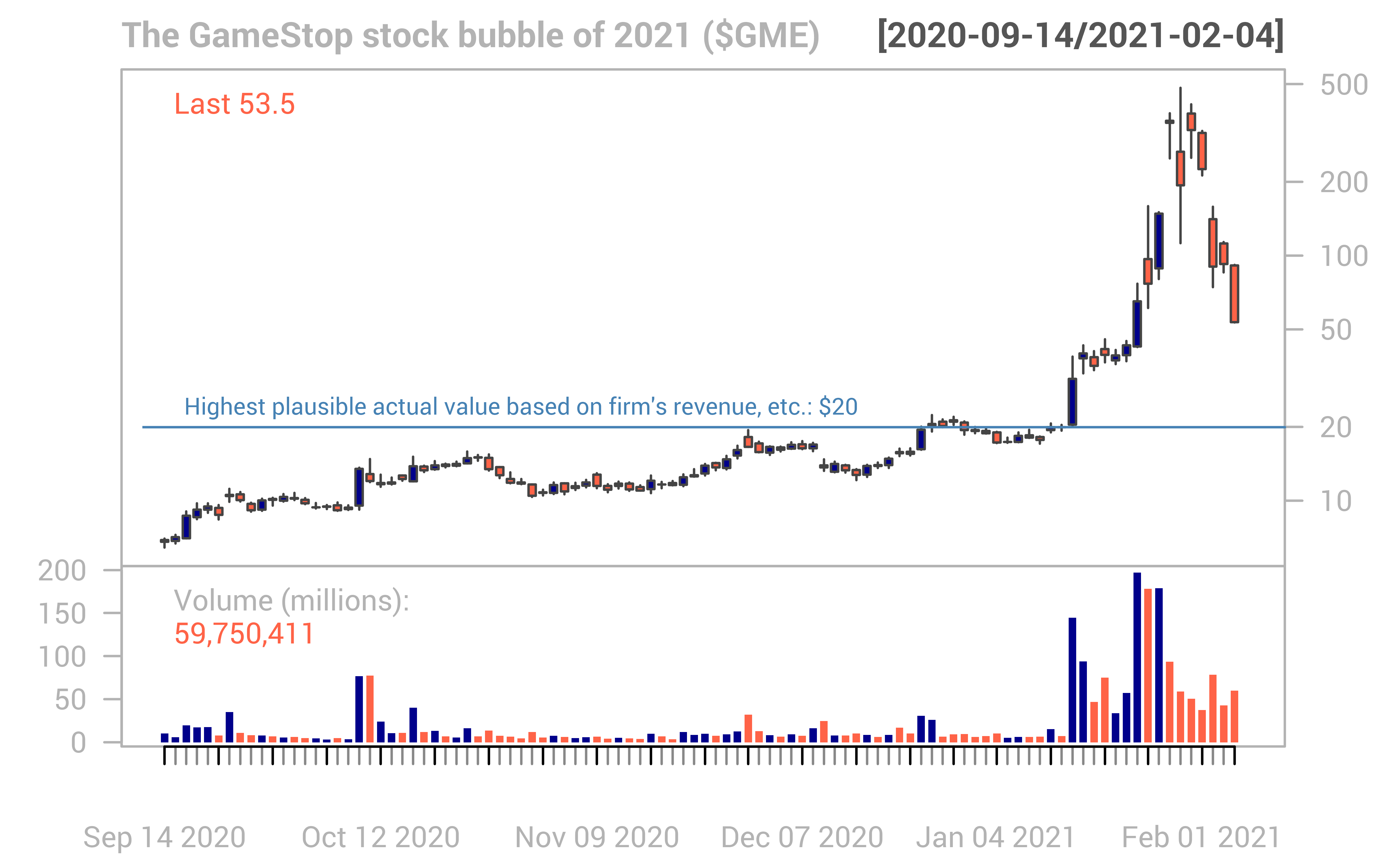

In today’s digital age, social media platforms hold immense power when it comes to influencing stock price movements. Online communities and forums, such as Reddit and Twitter, have become breeding grounds for discussions around specific stocks, including companies like Genesis AI.

These platforms can amplify both positive and negative sentiment about a company, subsequently affecting its stock price. Investors often rely on the opinions shared within these communities when making investment decisions.

The impact of social media on stock prices goes beyond mere sentiment. Viral trends and speculative trading can have a profound effect on stock performance as well.

For instance, in the case of Genesis AI, if there is a sudden surge in speculative trading or a viral trend that generates significant attention, it can cause drastic fluctuations in the stock price, regardless of the company’s underlying fundamentals.

It is important to note that while social media can greatly influence investor sentiment and market speculation, it is not always an accurate reflection of a company’s true value or future prospects.

The speed at which information spreads on social media platforms can lead to exaggerated reactions in the market, creating volatility that may not necessarily align with the long-term prospects of the company.

Regulatory Challenges: Navigating Legal and Ethical Concerns

Companies like Genesis AI face regulatory hurdles when it comes to legal and ethical considerations in the field of artificial intelligence (AI). Compliance with data privacy laws is crucial as breaches can result in legal consequences and harm investor trust, affecting their stock price.

Additionally, public perception regarding the ethical use of AI technology plays a significant role. Genesis AI must prioritize transparency and responsible practices to maintain investor confidence and avoid potential backlash that could impact their stock price.

Navigating these challenges requires robust governance structures and staying updated with evolving regulations and industry best practices. By addressing these concerns proactively, companies can protect their reputation and stock price in the competitive AI market.

The Importance of Leadership: Assessing Management’s Role in Stock Performance

Effective leadership is instrumental in shaping a company’s trajectory and influencing its stock performance. Investors closely analyze a company’s leadership track record, decision-making abilities, and strategic vision before investing. Confidence in management positively impacts stock prices, while a lack of confidence can lead to declines.

Factors such as transparency, adaptability, risk management, talent development, and corporate governance also play key roles in determining investor sentiment and ultimately impacting Genesis AI’s stock performance.

Investor Psychology: Behavioral Factors Affecting Genesis AI Stock Price

Investor psychology heavily influences the stock price of companies like Genesis AI. Factors such as herd mentality, fear, and greed can drive buying or selling patterns regardless of the company’s actual performance.

Educated investors who understand fundamental analysis are better equipped to make informed choices and mitigate emotional biases that could impact Genesis AI’s stock price. Sentiment analysis, analyzing social media trends and news sentiment, also plays a role in understanding investor behavior.

Being aware of cognitive biases is crucial for objective decision-making in the market. Overall, investor psychology has a significant impact on the fluctuations of Genesis AI’s stock price.

ESG Factors: Analyzing Environmental, Social, and Governance Considerations

ESG factors have gained prominence among investors evaluating companies like Genesis AI. Investors now prioritize companies with sustainable practices and positive social impact, which can attract more interest and potentially increase stock prices.

ESG ratings provide quantifiable measures of a company’s environmental, social, and governance performance. Higher ESG ratings can attract more investors and positively impact stock performance.

By focusing on improving its ESG rating through environmental management, ethical practices, transparent governance, and risk management, Genesis AI can strengthen its position as an attractive investment option for socially conscious investors.

The Role of Analyst Coverage: How Research Reports Impact Stock Price

Analyst coverage and research reports have a significant impact on stock prices. Positive ratings from analysts can attract new investors, driving up the stock price, while negative ratings may lead to a decline in investor confidence.

Investors heavily rely on expert analysis when making investment decisions, with the credibility and reputation of analysts playing a crucial role in shaping investor sentiment. Factors such as financial performance, industry trends, and management quality are considered in these reports.

Understanding how research reports influence stock prices is essential for both investors and companies seeking market favor.

International Expansion: Opportunities and Challenges for Genesis AI

Expanding globally presents opportunities and challenges for Genesis AI. It opens up new markets, leading to revenue growth and market diversification. However, cultural differences, regulatory complexities, and competition must be considered. Effective leadership is crucial to navigate these challenges and instill investor confidence.

Overall, international expansion can enhance profitability and long-term success for Genesis AI.

[lyte id=’_noA0yqHxAA’]