Investing in international emerging markets has long been seen as a lucrative opportunity for investors looking to diversify their portfolios and tap into the potential growth of developing economies. However, gaining exposure to these markets was not always easy or accessible.

That is until the rise of international emerging markets exchange-traded funds (ETFs). In this article, we will explore the concept of ETFs, delve into the growing popularity of international emerging markets ETFs, and discuss the benefits and risks associated with investing in these funds.

Understanding the Concept of ETFs

Exchange-traded funds (ETFs) are investment funds traded on stock exchanges, providing instant diversification and access to a range of assets. Unlike individual stocks, ETFs allow investors to spread their investments across multiple companies or sectors with just one trade, reducing risk.

They track specific indices or sectors, enabling investors to benefit from the overall performance of that group of stocks or assets. ETFs also offer liquidity, allowing investors to buy and sell shares throughout the trading day.

Moreover, investing in international-focused ETFs provides access to global markets without complex regulatory requirements or currency risks. Overall, ETFs are a convenient option for diversifying portfolios and gaining exposure to various assets.

Exploring the Growing Popularity of International Emerging Markets ETFs

International emerging markets have become increasingly popular among investors seeking higher returns and growth opportunities. This has led to a surge in demand for international emerging markets exchange-traded funds (ETFs).

These ETFs allow investors to participate in the economic growth of countries like China, India, Brazil, and more. They offer exposure to sectors such as technology, financial services, consumer goods, and others.

The appeal of international emerging markets ETFs lies in their potential for high returns. These economies often experience rapid growth rates and provide unique investment opportunities not found in developed markets. By investing in these ETFs, investors can potentially benefit from this growth while diversifying their portfolio.

While investing in international emerging markets carries risks such as political instability and currency fluctuations, carefully selecting diversified ETF options can help manage these challenges effectively.

Benefits and Risks of Investing in International Emerging Markets ETFs

Investing in international emerging markets ETFs offers both benefits and risks. These funds provide diversification by exposing investors to a variety of companies and sectors, reducing the risk associated with individual stocks. They also offer access to growth opportunities in rapidly developing economies that may outperform established markets.

With high liquidity and lower costs compared to actively managed funds, these ETFs are attractive to cost-conscious investors.

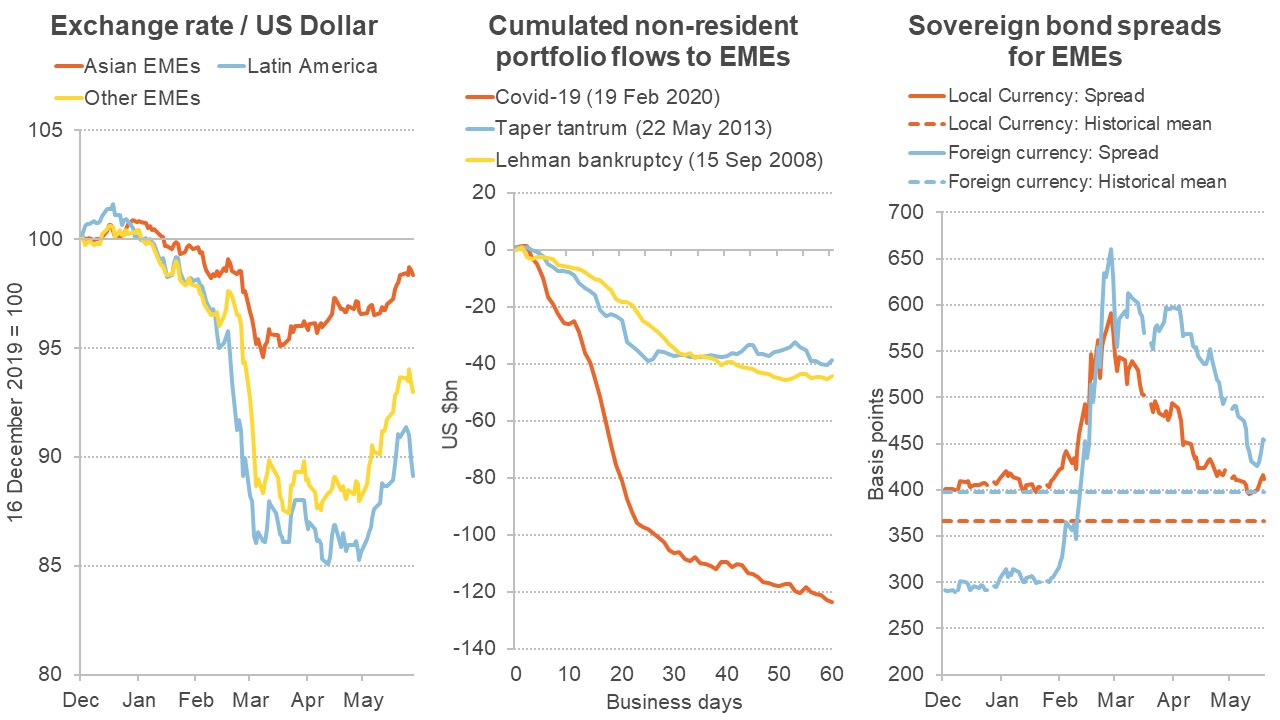

However, there are risks involved. Emerging markets can be volatile due to political instability, currency fluctuations, and regulatory changes. Currency risk is another consideration as exchange rate movements can impact returns. Political and economic challenges such as corruption or government intervention can affect investment performance.

Additionally, the lack of transparency in some emerging markets makes it harder for investors to accurately assess risks.

Despite these risks, many investors are drawn to the potential rewards offered by international emerging markets ETFs. It’s crucial for investors to carefully evaluate their risk tolerance and investment goals before allocating a portion of their portfolio to these funds.

By conducting thorough research and staying informed about market trends, investors can make informed decisions aligned with their needs and goals.

[lyte id=’Q1PMTMYhR_w’]