Investing is a fascinating world that offers opportunities for individuals to grow their wealth and achieve financial goals. One popular investment option that has stood the test of time is silver. With its allure and historical significance, silver has attracted investors from various cultures throughout history.

But what about modern-day financial institutions like Bank of America?

Do they offer silver as an investment option? In this article, we will explore the topic of whether Bank of America sells silver and delve into the exciting world of silver investing.

The History of Silver Investing

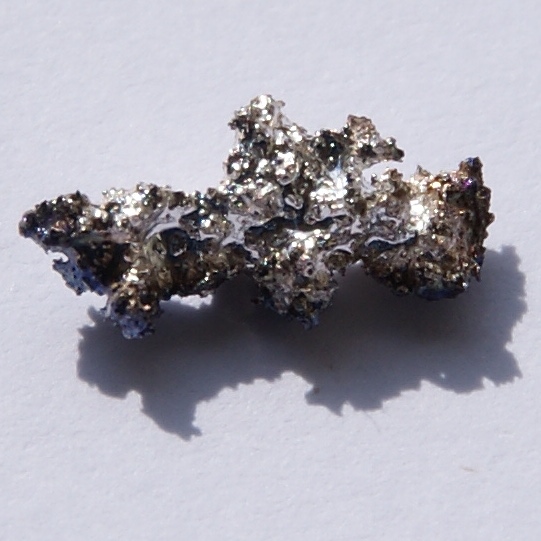

Silver has a long and fascinating history as an investment asset. Its beauty, rarity, and versatility have made it highly sought after by generations of investors. From ancient civilizations to modern times, silver has held cultural significance and served as a store of value cherished by many.

Investing involves allocating money into assets with the expectation of generating profits or income over time. Silver’s stability and potential for growth have made it an attractive choice for those looking to grow their wealth and secure their financial future.

The scarcity of silver adds to its value; compared to other precious metals, it is relatively rare. This limited supply creates exclusivity that drives demand among investors. Additionally, silver’s versatility in various industries ensures a constant need for this precious metal, contributing to its value over time.

Despite market fluctuations, silver has shown resilience and maintained its value over the long run. As we navigate the ever-changing financial landscape, the history of silver investing highlights its enduring allure as a stable and potentially lucrative investment asset.

Bank of America: A Trusted Financial Institution

Bank of America is a trusted and respected financial institution known for its commitment to customer satisfaction and financial stability. With a wide range of banking services and investment offerings, it provides individuals with the tools necessary for successful money management.

By choosing a reputable institution like Bank of America, investors can have confidence that their investments will be handled professionally and responsibly.

Understanding Silver as an Investment Option

Investing in silver offers individuals the opportunity to diversify their portfolios and protect against inflation. When considering silver as an investment, it’s essential to understand the options available and the factors that impact its value.

There are two main types of silver investments: physical silver (coins or bars) and paper silver (ETFs or derivatives). Physical silver provides tangible assets for secure storage, while paper silver offers convenience and flexibility for trading without physical ownership.

The value of silver is influenced by various factors, including supply and demand dynamics, industrial use, geopolitical events, and economic conditions. Supply shortages can drive up prices, while oversupply can lead to declines. Changes in industries relying on silver, geopolitical events, and economic downturns also affect its value.

Analyzing historical trends and projections can provide insights into potential growth or stability. However, it’s important to remember that past performance doesn’t guarantee future results. Consider multiple factors before making investment decisions.

Understanding silver as an investment option involves differentiating between physical and paper investments, analyzing influencing factors like supply and demand dynamics, industrial use, geopolitics, and economic conditions. Studying historical trends helps inform decision-making.

By considering these aspects, investors can make informed choices when entering the silver market.

Bank of America’s Investment Offerings: Beyond Traditional Banking Services

Bank of America goes beyond basic banking services by offering a wide range of investment options. In addition to stocks, bonds, and mutual funds, they provide access to retirement accounts and ETFs.

They also have the Bank of America Merrill Lynch Global Research division, which offers comprehensive analysis on various investment opportunities, including precious metals like silver. By leveraging their insights, investors interested in silver can make informed decisions and maximize potential returns.

Bank of America is committed to providing diverse investment choices and valuable expertise to help clients grow their wealth effectively.

Does Bank of America Sell Silver?

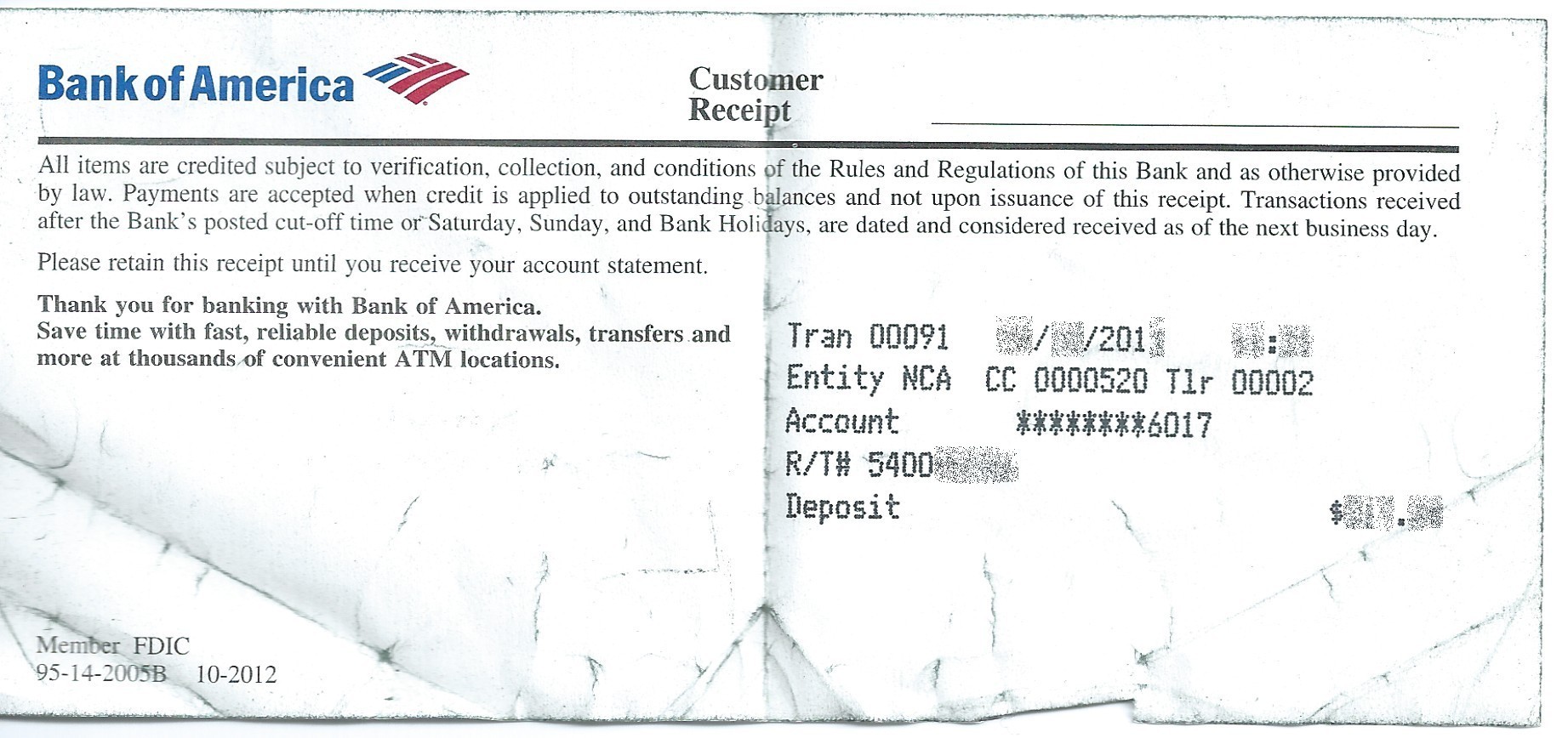

When it comes to the question of whether Bank of America offers silver as an investment option, the answer is a resounding yes. As one of the leading financial institutions in the world, Bank of America understands the importance of providing diverse investment opportunities for its clients.

While the availability and specific products may vary depending on individual client needs and circumstances, silver is indeed a viable option for those looking to diversify their investment portfolios.

It is worth noting that not all financial institutions offer silver as an investment option. However, reputable banks like Bank of America recognize its value and include it as part of their offerings. The availability of silver investments may be influenced by factors such as market conditions and client demand.

Nonetheless, investors can rest assured that Bank of America considers silver to be a relatively common choice among their range of investment options.

Bank of America provides multiple avenues for investors to access both physical and paper silver. Whether an investor prefers to hold tangible assets or opt for more flexible paper investments, Bank of America caters to both preferences.

By discussing their investment goals with a knowledgeable financial advisor at Bank of America, clients can explore the available options that best suit their needs. These options may include purchasing physical silver bullion or investing in exchange-traded funds (ETFs) backed by silver holdings.

Pros and Cons of Investing in Silver through Bank of America

Investing in silver through Bank of America has its advantages and disadvantages. One advantage is the convenience for existing customers, who can easily manage their silver investments alongside their banking activities. Bank of America’s reputation as a trusted institution ensures secure transactions.

Additionally, their partnership with Merrill Lynch Global Research provides expert analysis on precious metals like silver.

However, investing in silver through Bank of America may have limitations compared to specialized bullion dealers, who offer a wider range of products. It’s also important to be aware of potential fees and commissions associated with these investments. Carefully reviewing terms and conditions is crucial before making any decisions.

Overall, while Bank of America offers convenience and security for silver investments, investors should consider the limitations on investment options and potential costs involved. By weighing these pros and cons, informed decisions can be made about investing in silver through Bank of America.

Alternative Options for Investing in Silver

Investors seeking alternative ways to invest in silver can consider specialized bullion dealers. These dealers focus solely on precious metals like silver, offering a wider range of products and potential cost savings. Their industry-specific expertise can provide valuable guidance when making investment decisions.

However, thorough research is crucial before choosing any investment platform, whether it’s a specialized dealer or a traditional financial institution. Evaluating reputability, costs, available products, and customer service will help investors make informed choices and diversify their portfolios effectively.

How to Get Started with Silver Investments

To begin investing in silver, schedule a consultation with a financial advisor at your chosen bank, like Bank of America. They will provide personalized recommendations based on your goals and risk tolerance. Educate yourself about market trends and factors that impact silver prices while staying updated with relevant news.

Seek guidance from experienced professionals to navigate the complexities of investing in precious metals. Regularly monitor your investments to stay informed and make timely adjustments if needed. By following these steps, you can confidently enter the world of silver investments.

[lyte id=’LQ6chj4zuVY’]