Investing in fast food chains has long been a popular choice for investors looking for stable and high returns. The fast food industry, with its consistent growth and profitability, offers an enticing opportunity for those interested in investing.

In this article, we will explore why fast food chains are a lucrative investment option, how to understand the fast food market, assess financial performance and stability, choose the right chain to invest in, conduct due diligence on potential investments, understand associated risks, implement successful investment strategies, and analyze case studies of successful investments.

By the end of this article, you will have gained valuable insights into investing in fast food chains.

Fast Food Chains: A Lucrative Investment Opportunity

The fast food industry presents a lucrative investment opportunity due to its consistent growth and stability. Despite economic downturns, people’s love for convenient and affordable meals remains unwavering. Investing in successful fast food chains offers high returns, thanks to their proven ability to generate substantial profits year after year.

These established players benefit from economies of scale, efficient operations, and strong brand recognition. Additionally, their global presence provides diversification benefits for investors.

With the added advantage of supporting sustainability initiatives, investing in fast food chains is a compelling choice for long-term gains in today’s market.

Understanding the Fast Food Market

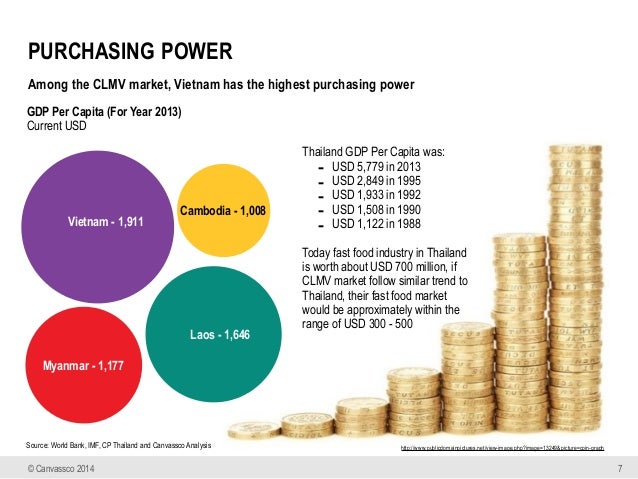

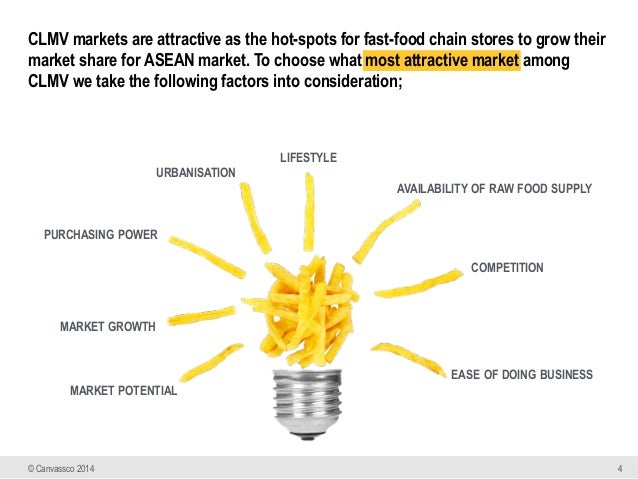

To make informed investment decisions in the fast food industry, it’s crucial to understand the market dynamics through researching popular chains, analyzing industry trends and consumer preferences, and identifying key competitors and their market share.

Research popular fast food chains to examine their financial performance, competitive advantages, customer loyalty programs, marketing strategies, and expansion plans.

Stay updated on industry trends and consumer preferences as they constantly evolve. For example, fast-casual dining concepts emerged to cater to health-conscious individuals seeking healthier options.

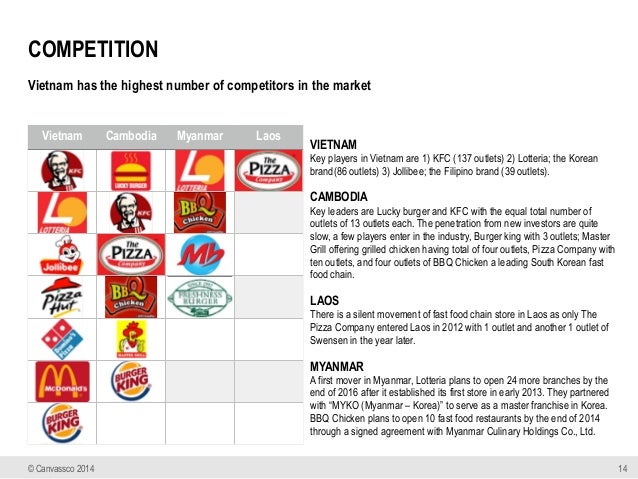

Identify key competitors and analyze their market share. This insight helps determine which chains dominate the market and have growth potential. Understanding the competitive landscape is essential for selecting the right chain to invest in.

By thoroughly understanding the fast food market through research, trend analysis, and competitor evaluation, investors can confidently assess investment opportunities within this dynamic industry.

Assessing Financial Performance and Stability

To make informed investment decisions in the fast food industry, it is crucial to assess a potential chain’s financial performance and stability. Reviewing key financial statements such as income statements, balance sheets, and cash flow statements provides insights into profitability, revenue growth, and debt levels.

Look for consistent revenue growth, strong profit margins, manageable debt levels, and positive cash flow. Additionally, consider how well the chain has adapted to external factors like inflation or economic downturns in the past.

By evaluating these factors, investors can gain a comprehensive understanding of a fast food chain’s financial health and make informed investment choices.

Choosing the Right Fast Food Chain to Invest In

Investing in the fast food industry requires careful consideration to maximize returns. Key factors to evaluate include brand presence, franchise opportunities, and geographical factors.

When selecting a fast food chain, opt for well-established brands like McDonald’s with a strong reputation and loyal customer base. These chains have proven their ability to withstand market fluctuations and deliver consistent value to shareholders.

Consider whether you want to invest in publicly traded chains or explore franchise opportunities. Publicly traded chains offer easy liquidity and diversification, while franchising provides potential higher returns but increased responsibilities as a business owner.

Geographical factors and target demographics also play a crucial role. Analyze which chains have a stronger presence in specific regions or cater to particular customer segments. Understanding these factors will help identify growth potential based on target markets.

Conducting Due Diligence on Potential Investments

To make informed investment decisions, conducting thorough due diligence is crucial. This involves reviewing historical performance and future growth projections of potential investments. Assessing management expertise and track record is essential to gauge their ability to drive success.

Additionally, evaluating the strength of the business model and marketing strategies provides insight into potential profitability and market share growth. By conducting due diligence, investors can mitigate risks and increase their chances of achieving positive returns.

Understanding the Risks Associated with Fast Food Investments

Investing in fast food chains comes with inherent risks that should not be overlooked. Regulatory challenges, such as health regulations and minimum wage laws, can impact operating costs and profitability.

Shifting consumer preferences towards healthier options and competition from fast-casual dining concepts also pose risks to traditional fast food chains. Staying informed about regulatory developments, investing in chains that adapt to consumer trends, and monitoring emerging industry trends are key strategies for mitigating these risks.

By understanding and addressing these challenges, investors can make more informed decisions in the fast food investment landscape.

Strategies for Successful Investing in Fast Food Chains

Successful investing in fast food chains requires a long-term approach, staying informed through regular monitoring of financial reports and industry news, adapting to market conditions, conducting thorough research and analysis, and implementing diversification strategies.

By adopting these strategies, investors can position themselves for success in this dynamic industry.

Case Studies of Successful Fast Food Investments

This section explores case studies that showcase successful investments in the fast food industry.

By analyzing the growth and success of McDonald’s, understanding the resilience of fast food chains during economic downturns, and highlighting examples of profitable investments, investors can gain valuable insights into strategies and approaches that lead to financial gains within this thriving sector.

These case studies offer a comprehensive look at how innovation, global expansion, adaptability, and informed decision-making contribute to successful investing in fast food chains.

[lyte id=’dqedNcw5Q00′]