Investing in the stock market can be a thrilling and lucrative endeavor, but it also comes with its fair share of risks. Market volatility is an ever-present reality that can leave investors vulnerable to significant losses. That’s where defensive funds come into play.

These investment vehicles are specifically designed to provide stability and protection during turbulent times, making them an essential component of any well-rounded portfolio.

Explaining the Concept of Defensive Funds

Defensive funds, also known as defensive equity or low-volatility funds, prioritize capital preservation and steady income generation. These investment vehicles focus on stable earnings and lower-risk companies, making them appealing to conservative investors.

Unlike aggressive growth funds that chase high returns through volatile stocks, defensive funds take a cautious approach. They select securities from industries less susceptible to market fluctuations, protecting investors during periods of volatility.

Defensive funds emphasize companies with stable earnings, providing stability even in uncertain markets. They also focus on lower-risk profiles, reducing vulnerability to market downturns.

Investors seeking capital preservation and stability turn to defensive funds. These funds come in mutual fund or ETF form, offering diversification benefits.

In summary, defensive funds aim to preserve capital and generate steady income by investing in stable companies with lower risk profiles. They are an attractive option for conservative investors in uncertain markets.

Highlighting the Benefits of Defensive Funds in Volatile Markets

Defensive funds offer significant advantages in volatile markets. These funds are designed to weather market downturns effectively by focusing on stable companies with strong fundamentals. They provide resilience and help investors avoid substantial losses during turbulent times.

Additionally, defensive funds often offer attractive dividend yields, providing a consistent stream of income for investors seeking reliable cash flow or looking to supplement their retirement savings. By understanding risk and volatility, investors can appreciate the value that defensive funds bring to their portfolios.

These funds reduce exposure to market fluctuations and provide a better balance between risk and reward. Overall, defensive funds are an excellent option for protecting investments in unpredictable market conditions.

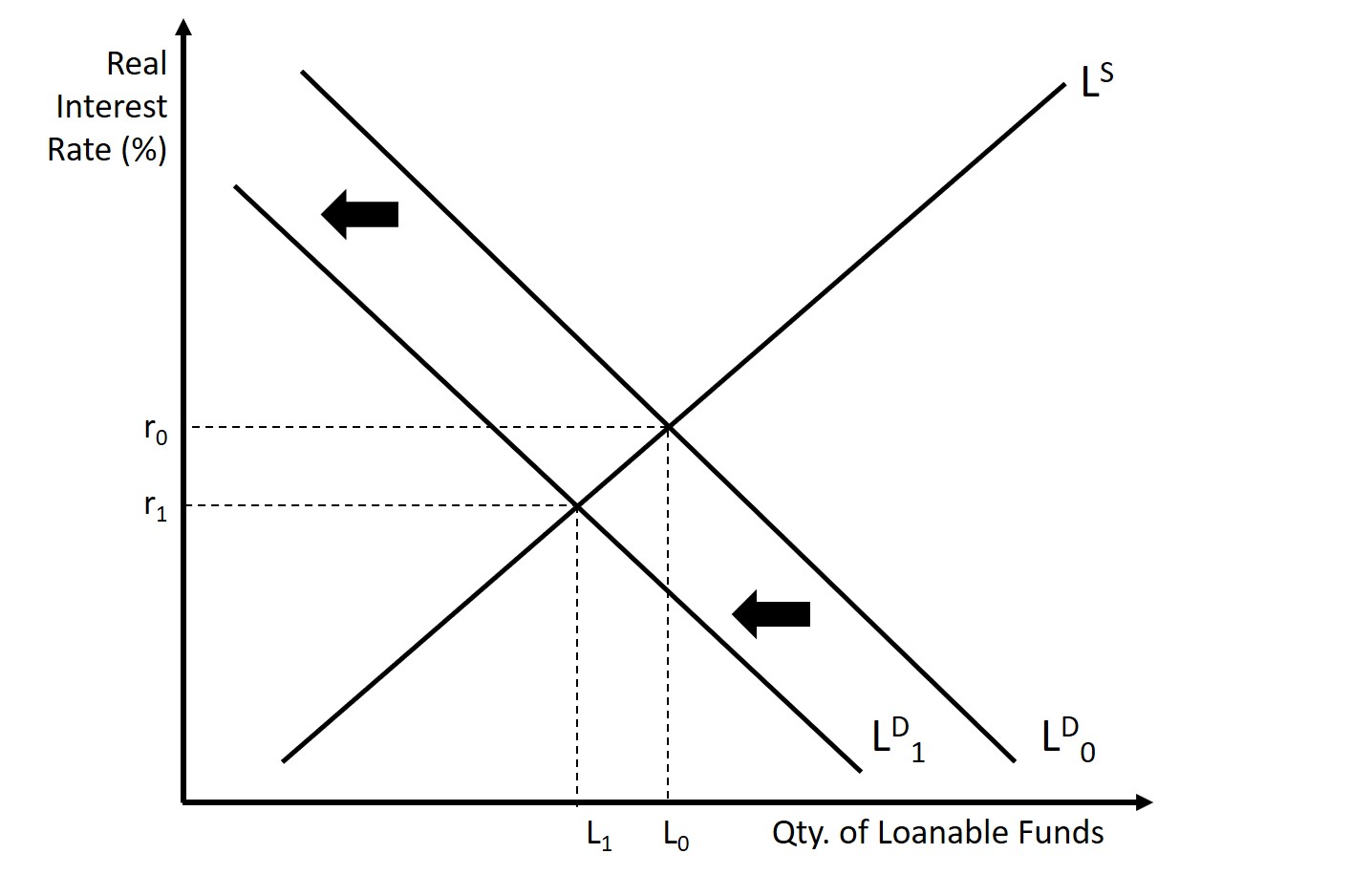

Defining Risk and Volatility in Investment Terms

Risk refers to the possibility of losing money on an investment, influenced by economic conditions, industry trends, company-specific issues, and market sentiment. Volatility measures price fluctuations over time. Highly volatile investments experience significant price swings, while low-volatility assets have more stable prices.

Evaluating risk and volatility helps investors make informed decisions that align with their goals and risk tolerance. Diversification is key to managing these factors and mitigating overall portfolio risk. Understanding these concepts is crucial for successful investment strategies.

Mitigating Risks with Defensive Funds

Defensive funds employ various strategies to mitigate risks associated with market volatility. They prioritize stability by investing in companies with steady earnings and lower risk profiles. This reduces portfolio volatility and minimizes losses during market downturns.

Diversification is another key strategy used by defensive funds. By spreading investments across different sectors and asset classes, they offset potential losses in one area with gains in another. This diversification further enhances portfolio stability.

Proactive risk management is crucial for defensive funds. They closely monitor market trends and make strategic adjustments to their portfolios as needed. This allows them to react quickly to changing conditions, minimizing losses and maximizing returns.

Capital preservation is a primary focus for defensive funds. While seeking higher returns may involve increased risk, these funds prioritize protecting investors’ capital over chasing excessive gains. This conservative approach ensures that losses are minimized, providing peace of mind for investors.

Overall, by focusing on stability, diversifying investments, practicing proactive risk management, and prioritizing capital preservation, defensive funds effectively mitigate risks associated with market volatility. These strategies not only limit potential losses but also safeguard investors’ capital during challenging market conditions.

Providing examples of recent market downturns and how defensive funds performed

During the Global Financial Crisis (2008), defensive funds outperformed aggressive growth funds, limiting losses for investors. Similarly, during the COVID-19 pandemic in 2020, defensive funds demonstrated stability compared to sectors that suffered significant declines.

These examples highlight the effectiveness of defensive funds in shielding against market turbulence and providing protection for investors. Understanding the different categories of defensive funds is important when considering which type aligns with your investment goals.

Consult with a financial advisor to gain insights into these options and incorporate defensive funds into your investment strategy for added stability and risk mitigation.

Exploring Different Categories of Defensive Funds

Defensive funds can be classified into three main categories: bond funds, dividend funds, and low volatility funds.

Bond funds invest in low-risk debt instruments like government bonds and corporate bonds. Their primary focus is on generating income and preserving capital.

Dividend funds primarily invest in stocks of financially stable companies that regularly pay dividends to shareholders. These funds aim to provide a steady stream of income while offering downside protection.

Low volatility funds target stocks with less price fluctuation compared to the broader market. They invest in companies with more stable earnings and tend to perform well during market downturns.

By understanding these different categories of defensive funds, investors can choose the strategy that aligns with their risk tolerance and investment objectives.

Discussing the Characteristics and Objectives of Each Type

When considering investment options, it is important to understand the characteristics and objectives of different types of funds. Bond funds, for instance, provide relatively stable returns and are well-suited for conservative investors who prioritize capital preservation and regular income.

These funds are deemed one of the safest investment choices due to the guaranteed interest payments offered by bonds.

On the other hand, dividend funds present an excellent choice for moderate-risk investors who seek a steady income stream while also aiming for potential capital appreciation. These funds typically invest in established companies with a proven track record of consistent dividend payments.

By doing so, they offer stability during market downturns while still providing opportunities for growth.

For those with a more aggressive investment approach, low volatility funds may be appealing. These funds target aggressive investors who are seeking growth but want to limit downside risk. By investing in stocks with lower price fluctuations, these funds strive to deliver relatively stable returns while participating in market upswings.

To summarize:

| Fund Type | Characteristics | Objectives |

|---|---|---|

| Bond Funds | Offer stable returns | Suitable for conservative investors looking for capital preservation and regular income |

| Dividend Funds | Provide steady income stream | Ideal for moderate-risk investors aiming for both regular income and potential capital appreciation |

| Low Volatility Funds | Deliver relatively stable returns with limited downside risk | Appealing to aggressive investors seeking growth while minimizing risk |

Understanding these differences can help investors align their goals and risk tolerance with the most suitable fund type. It is crucial to carefully evaluate each option before making any investment decisions as this will contribute to achieving long-term financial success.

Providing Real-Life Scenarios Where Each Type of Fund Might be Suitable

To better understand which type of defensive fund may be suitable, let’s explore real-life scenarios:

-

Sarah, nearing retirement, wants a stable income stream and capital preservation. A bond fund offers predictable interest payments and low risk.

-

John, a young investor with moderate risk tolerance, seeks stability in his portfolio. A dividend fund provides both income generation and potential capital appreciation.

-

Emily, an experienced investor cautious of market downturns, prefers low volatility. A low volatility fund offers exposure to equities with more stable price movements.

By analyzing these scenarios, investors can align their goals with the most suitable defensive fund option.

[lyte id=’dFuPGlKKZY4′]