Sarah, a young professional with a growing interest in investing, seeks to make smart decisions for her financial future. After extensive research, she discovers the advantages of Exchange-Traded Funds (ETFs) compared to other investment options. However, determining the optimal number of ETFs for her portfolio poses a challenge.

Factors such as investment goals, risk tolerance, asset allocation, costs, and market conditions need careful consideration. By evaluating these factors, Sarah can make informed decisions and maximize the benefits of her ETF investments.

This article aims to guide investors like Sarah in navigating the world of ETFs and achieving their financial goals.

Understanding ETFs: Benefits and Risks

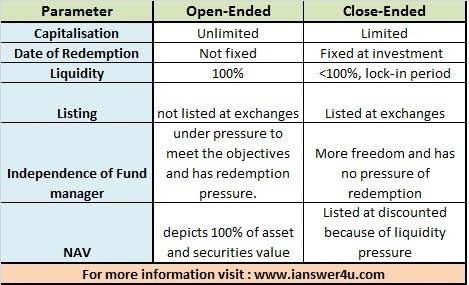

Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges, offering various advantages and risks. ETFs provide diversification by offering exposure to a portfolio of assets such as stocks, bonds, or commodities. They also have lower expenses compared to mutual funds due to passive management.

ETFs offer liquidity and ease of trading, similar to individual stocks. However, they are subject to market volatility and may have slight discrepancies in returns compared to their tracked index. Understanding these benefits and risks is crucial for informed investment decisions with ETFs.

Factors to Consider When Deciding on the Number of ETFs to Invest In

When determining the number of ETFs to include in your investment portfolio, it’s important to consider your risk tolerance, investment goals, and asset allocation strategy. Assessing your comfort level with risk and defining your short-term and long-term objectives will help guide your decision-making process.

Diversification across different asset classes can help manage risk, and understanding market conditions and trends is crucial for making informed decisions. By considering these factors, you can build a well-rounded ETF portfolio that aligns with your financial goals.

Keeping it Simple: The Case for a Core-Satellite Approach

Exchange-Traded Funds (ETFs) offer diversification but can be overwhelming. That’s where the core-satellite approach comes in. It involves focusing on a few core holdings while adding satellite investments to strike a balance between simplicity and diversification.

The advantages of this approach are threefold. First, it reduces complexity by concentrating research on key holdings, saving time and allowing for thoughtful decision-making. Second, satellite holdings provide an opportunity to capitalize on specific themes or sectors expected to outperform the market, potentially enhancing returns.

Lastly, combining core and satellite holdings achieves diversification without sacrificing control over investment decisions.

Moreover, the core-satellite approach helps minimize trading costs by reducing excessive buying and selling. Utilizing low-cost ETFs further keeps expenses manageable, ensuring more retained investment returns.

Deciding on the Optimal Number of Core Holdings

Determining the right number of core holdings in an ETF portfolio is crucial for investors. While there’s no one-size-fits-all answer, several considerations can guide this decision. Firstly, assess risk tolerance and investment goals.

Analyzing historical performance and risk profiles of potential holdings provides insights into their behavior under different market conditions. Diversify by selecting ETFs with low correlation to enhance portfolio diversification. Evaluate expense ratios and tracking error to optimize returns.

Allocating investments across sectors, geographies, or asset classes mitigates concentration risk and provides exposure to a broader range of opportunities. Striking the right balance ensures a well-diversified ETF portfolio tailored to individual needs and objectives.

Enhancing Returns with Satellite Holdings

Satellite holdings are additional ETF investments that complement the core portfolio by focusing on specific themes, sectors, or regions with growth potential. When selecting satellite ETFs, investors should consider factors such as theme-based or sector-specific investments, international exposure, and alternative asset classes.

Regular monitoring of these investments is essential to align them with investment goals and adapt to market changes. By incorporating satellite holdings into a well-diversified portfolio, investors can potentially enhance returns and achieve their financial objectives.

The Art of Rebalancing and Portfolio Review

Rebalancing and reviewing your investment portfolio is a crucial aspect of effective investment management. It involves adjusting asset weightings to maintain the desired allocation, aligning with your risk tolerance and long-term goals.

The frequency of rebalancing depends on market conditions and personal preferences. Some investors choose an annual approach, while others prefer more frequent adjustments. Striking a balance between staying informed and avoiding excessive trading costs is important.

Regular portfolio reviews offer benefits such as assessing changes in goals or risk tolerance. Adjustments can be made accordingly to ensure the portfolio reflects your current situation. Additionally, reviewing portfolios allows for adjusting asset allocation based on market conditions, optimizing returns, and managing risks proactively.

In summary, the art of rebalancing and portfolio review is essential for effective investment management. By periodically reassessing and adjusting asset allocations based on individual preferences and market conditions, you can align your portfolio with long-term financial goals while optimizing returns and managing risks effectively.

Final Thoughts: It’s All About You and Your Investment Journey

Investing is a personal journey with no one-size-fits-all solution. Each investor has unique circumstances, goals, and risk tolerances to consider when building their ETF portfolio. Staying informed about market trends and seeking professional advice are essential for making informed decisions.

Satellite holdings can enhance diversification, while regular portfolio review and rebalancing ensure alignment with long-term objectives. By combining education, guidance, and ongoing management, investors can navigate their investment journey with confidence.

[lyte id=’mlocPr6cF28′]