Investing in the stock market can be a thrilling yet daunting experience. As an investor, you’re constantly seeking opportunities to maximize returns while minimizing risks. One strategy that has gained popularity over the years is utilizing covered call exchange-traded funds (ETFs).

In this article, we will delve into the world of covered call ETFs, exploring their purpose, mechanics, potential for higher returns, downside protection, unique characteristics, and tips for investing. Whether you are new to investing or a seasoned pro, understanding covered call ETFs can enhance your investment journey.

What is a Covered Call ETF?

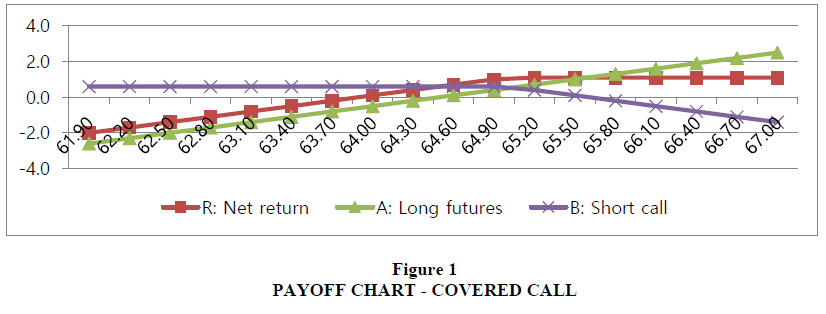

A Covered Call ETF combines the features of an ETF with the strategy of writing covered call options on underlying securities within its portfolio. These funds aim to generate income by collecting option premiums while maintaining exposure to a diversified basket of stocks.

In simple terms, a covered call ETF allows investors to participate in the stock market and earn additional income by selling call options. The fund manager writes call options on some of the stocks held in the portfolio, agreeing to sell them at a predetermined price within a specified time frame.

In return, the fund collects option premiums from buyers.

Covered call ETFs offer investors an opportunity to generate income while still benefiting from potential stock price appreciation. However, it’s important to understand that these funds come with risks, such as missing out on gains if stock prices rise significantly above the strike price.

Investors should carefully consider their investment objectives and risk tolerance before including covered call ETFs in their portfolios.

Potential for Higher Returns: Exploring the Income-Generating Nature of Covered Call ETFs

Covered call ETFs offer the potential for higher returns through their income-generating nature. These funds generate income by selling call options, allowing investors to benefit from option premiums.

While their returns may be lower during strong market rallies due to capped gains, covered call ETFs can outperform traditional equities in sideways or downward-trending markets thanks to the income generated from option premiums.

Factors such as market conditions and risk tolerance should be considered when incorporating these funds into an investment strategy. Thorough research is crucial to align individual investment goals with suitable investment vehicles like covered call ETFs.

Guarding Against Volatility: How Covered Call ETFs Provide Downside Protection

Covered call ETFs offer downside protection during market volatility. By selling call options, these funds generate income that acts as a buffer against potential losses in the underlying stocks. This income helps reduce portfolio volatility and provides a balanced approach to investing.

Incorporating covered call ETFs can lower risk exposure while still allowing for capital appreciation.

| Advantage | Description |

|---|---|

| Downside Protection | Income from selling call options cushions potential stock price declines. |

| Reduced Volatility | Option premiums offset stock price declines, reducing overall portfolio volatility. |

| Balanced Approach | Combining capital appreciation with risk mitigation strategies offers a balanced investment approach. |

| Income Generation | Selling call options generates additional income in the form of option premiums. |

Please note that the table provided above is just an example and can be customized or expanded upon as needed.

A Different Pattern of Returns: Understanding Covered Call ETFs

Covered call ETFs have a unique pattern of returns compared to traditional equity investments. During market rallies, these funds may underperform due to limited gains beyond the strike price of sold call options. However, this trade-off exists because covered call ETFs prioritize income generation and downside protection.

By relying on fund managers’ expertise, individual investors can simplify options trading and reduce stock-specific risks through diversification. Understanding the characteristics of covered call ETFs is crucial for those seeking alternative investment strategies aligned with their financial goals.

Choosing the Right Covered Call ETF for Your Portfolio

When selecting a covered call ETF for your portfolio, it’s crucial to evaluate underlying assets and strategy alignment. Consider factors like sector exposure, diversification, and risk profile. Additionally, assess expense ratios, fees, and historical performance to gauge long-term returns and fund stability.

Finally, ensure the fund’s risk-return profile aligns with your investment objectives and risk tolerance. By carefully considering these factors, you can make an informed decision that complements your overall financial strategy.

Popular Covered Call ETFs: Analyzing Strategies and Performance

Covered call ETFs have gained popularity among investors seeking income generation while maintaining potential for capital appreciation. These ETFs utilize a strategy known as covered calls, writing call options against underlying stocks in the portfolio.

Understanding the strategies and historical performance of these popular ETFs can help investors make informed decisions.

When selecting covered call ETFs, consider factors such as investment objective, holdings, and risk management approach. XYZ Fund is a popular ETF that focuses on large-cap stocks listed on major exchanges.

XYZ Fund writes covered call options on 75% of its large-cap stock holdings while retaining exposure to the remaining 25%. This strategy generates income through option premiums and allows participation in potential stock appreciation.

Analyzing historical performance during different market conditions provides insights into resilience and effectiveness. Understanding how XYZ Fund has performed during bullish and bearish cycles helps assess its ability to deliver consistent returns.

By analyzing strategies and performance of popular covered call ETFs like XYZ Fund, investors can align their goals with suitable options. Thorough examination of past data informs decision-making for income generation and effective risk management.

Tips for Investing in Covered Call ETFs

Setting realistic expectations is crucial when investing in covered call ETFs. While they offer advantages, such as potential income through call options, they may not deliver the same capital appreciation as pure equity investments during strong market rallies.

Diversification is key to a well-rounded portfolio. Consider incorporating covered call ETFs alongside other asset classes to mitigate risk and increase growth potential.

Regularly review and rebalance your portfolio to align with changing financial goals and risk tolerance levels. Monitoring your covered call ETF holdings allows informed decisions based on evolving market conditions.

When selecting a covered call ETF, consider expense ratios, historical performance, and underlying assets. Thorough research ensures a suitable choice aligned with investment objectives.

Stay updated on market trends and economic indicators to understand the impact on covered call ETFs. This knowledge informs decision-making regarding timing and allocation.

In summary, invest in covered call ETFs with realistic expectations, diversify your portfolio, regularly review and rebalance holdings, conduct thorough research when selecting a fund, and stay informed about market trends for successful investment strategy.

Common Misconceptions about Covered Call ETFs Debunked

Covered call ETFs offer unique benefits, but they may not be suitable for all investors. It’s crucial to assess your risk tolerance and investment objectives before allocating funds to these instruments. While covered call ETFs provide income-generation potential through option premiums, this income is not guaranteed.

Market fluctuations can impact the value of underlying securities and affect the income generated. Setting realistic expectations and understanding the risks involved is essential when considering covered call ETFs as an investment option.

[lyte id=’YMLVdY8y8vM’]