Investing in the stock market can be a lucrative endeavor, but it also comes with its fair share of risks. One of the biggest mistakes that investors often make is falling for fool stock picks. These are stocks that may seem enticing at first glance, but ultimately turn out to be poor investments.

In this article, we will delve into the reasons why avoiding fool stock picks is crucial for any investor who wants to achieve long-term success.

Understanding Fool Stock Picks

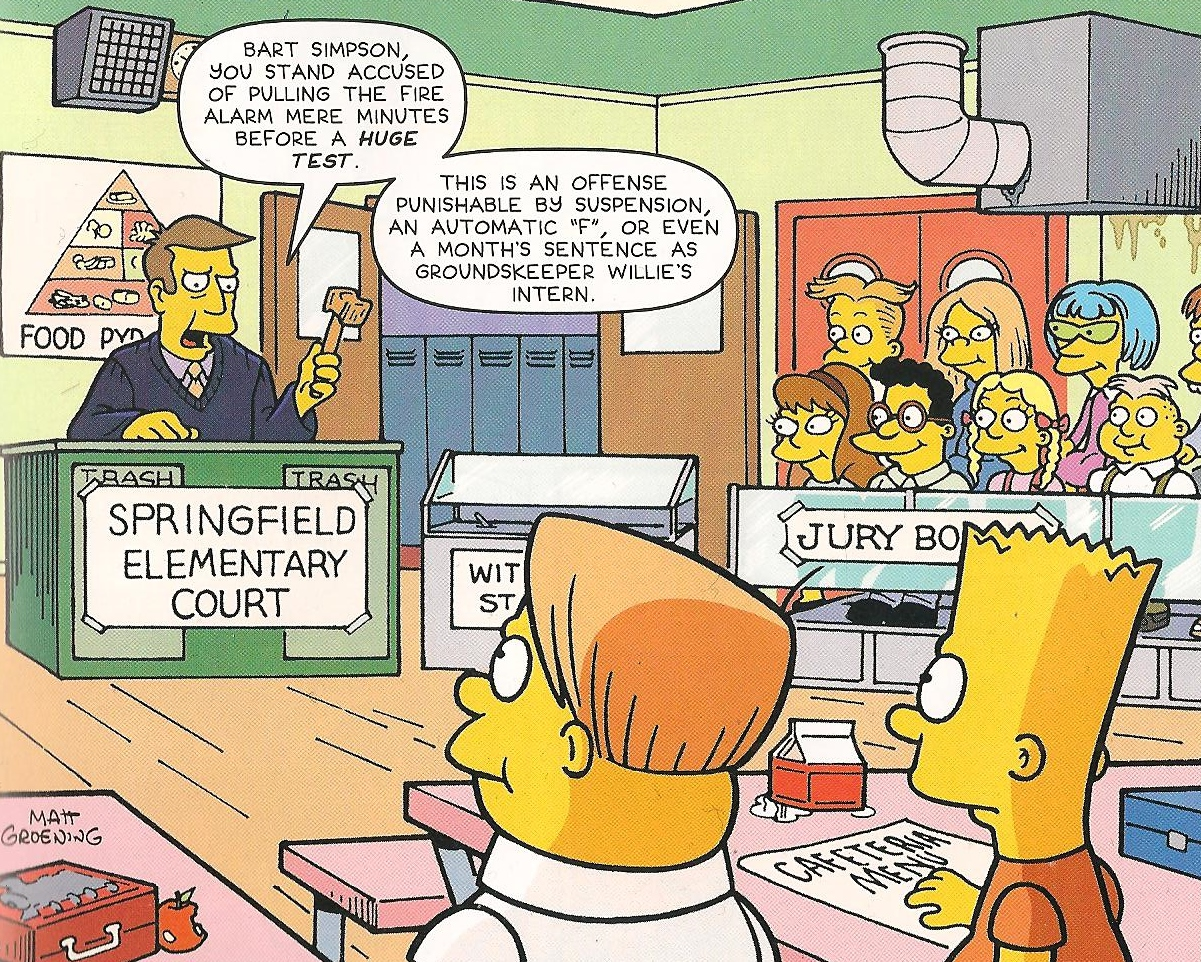

Fool stock picks, hyped by questionable individuals or organizations, promise quick gains but often fail to deliver. Investing in these stocks can lead to significant financial losses and erode investor confidence.

Approach with caution, conduct thorough research, and seek advice from trusted experts to mitigate risks associated with fool stock picks.

The Dangers of Fool Stock Picks

Fool stock picks may seem enticing, but they come with significant risks. These investments often lack solid fundamentals, relying on hype and speculation rather than actual business performance. Without a strong foundation, these companies are prone to failure.

Pump-and-dump schemes add to the danger. Manipulative individuals or groups spread false information to drive up stock prices artificially. Once the price peaks, they sell their shares, leaving other investors with worthless securities.

Investors attracted to fool stock picks often have short-term thinking. They’re looking for quick gains without considering long-term prospects. This impulsive approach prevents them from building a diverse portfolio that generates sustainable returns over time.

To protect yourself, be cautious of investments lacking solid fundamentals and avoid falling for schemes driven by false information. Instead, focus on long-term growth and consider building a well-diversified portfolio for stable returns.

Remember, fool stock picks may promise easy gains, but they can lead to financial disaster if you’re not careful.

The Case for Continuous Learning

In the complex world of investing, continuous learning is essential. Staying informed about market trends and updating our knowledge helps us identify lucrative opportunities and make informed investment decisions. By actively seeking new insights, we can avoid costly mistakes and evaluate different investment options objectively.

Continuous learning builds confidence, empowers us to navigate uncertainties, and keeps us proactive in an ever-changing landscape. Embracing a perpetual student mindset ensures we stay ahead of the curve and become more successful investors.

Diversify Your Investment Portfolio

Diversifying your investment portfolio is crucial to avoid making poor stock picks. By spreading your investments across different asset classes, sectors, and regions, you can mitigate risks and minimize the impact of any single stock’s poor performance.

This strategy helps balance potential losses with gains from other areas and protects against sector-specific downturns. Including a mix of stocks, bonds, real estate, commodities, and international markets allows you to capture growth opportunities while reducing dependence on one area or country.

Diversification is key to long-term success in investing.

The Significance of Patience and Long-Term Thinking

Investing requires patience and a long-term perspective. Rather than chasing after hot stocks or trying to time the market, focus on companies with strong fundamentals and sustainable advantages. By taking a patient approach, you can ride out fluctuations and increase your chances of consistent returns.

Diversifying investments and evaluating solid businesses further enhance this strategy. Embracing patience in investing leads to more successful outcomes in building long-term wealth.

Final Tips for Making Informed Investment Decisions

To make informed investment decisions, follow these final tips:

-

Do Your Due Diligence: Research potential investments thoroughly by analyzing a company’s financials, competitive position, and growth prospects.

-

Seek Professional Advice: Consult with a financial advisor who can provide expert guidance based on your investment goals and risk tolerance.

-

Stay Disciplined: Stick to your investment strategy even during market volatility and avoid emotional decision-making.

By following these tips, you can increase your chances of making successful investment decisions.

Resources for Further Education and Research

To enhance your investment knowledge, consider exploring these resources:

- Books: “The Intelligent Investor” by Benjamin Graham, “A Random Walk Down Wall Street” by Burton Malkiel.

- Podcasts: “InvestED” by Phil Town and Danielle Town, “The Motley Fool Money” by The Motley Fool.

- Courses: Online platforms like Coursera and Udemy offer various courses on investing and finance.

For staying updated with market news:

- Financial websites: Investopedia, Seeking Alpha.

- Blogs: The Motley Fool, CNBC’s Investing section.

These resources provide valuable insights, analysis, and education to help you make informed investment decisions and stay up-to-date with the latest market trends. Continuously expanding your knowledge is essential for successful investing.

Common Mistakes to Avoid as an Investor

Investing wisely requires avoiding common pitfalls that can hinder your success. Here are key mistakes to steer clear of:

1. Emotional Decision-Making: Letting emotions drive investment choices can lead to impulsive decisions. Manage your emotions and base decisions on research, not knee-jerk reactions.

2. Herd Mentality: Blindly following the crowd without conducting your own research is risky. Understand the rationale behind your investments rather than relying solely on others’ opinions.

3. Lack of Diversification: Failing to diversify exposes you to unnecessary risk. Spread investments across different asset classes, sectors, and regions for better long-term returns.

4. Ignoring Fundamental Analysis: Don’t overlook a company’s financial health and growth potential. Evaluate factors like earnings, debt levels, and industry trends for more informed decisions.

5. Neglecting Risk Management: Proactively manage risk by assessing tolerance, setting goals, and implementing strategies like stop-loss orders and portfolio reviews.

Avoid these mistakes to enhance your investment journey and increase your chances of long-term profitability. Stay informed, disciplined, and focused on your goals for successful investing.

[lyte id=’-ACh3jlcWrQ’]