Investing can often seem like a daunting task, especially when you only have a small amount of money to spare.

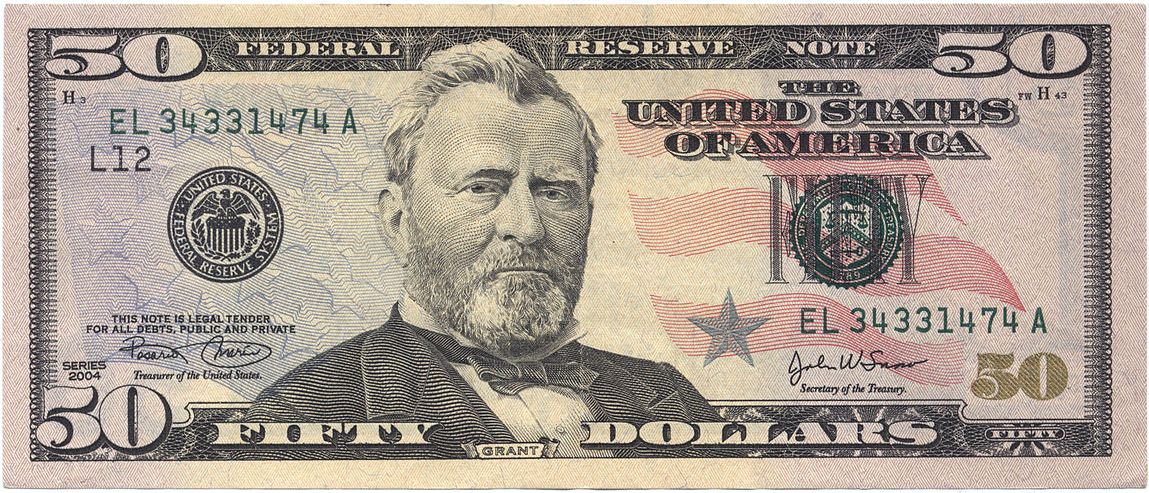

However, don’t let that discourage you! In this article, we will explore the world of investing with just $50 and discover how even such a modest sum can lead to significant financial growth.

The Tale of 50 Dollars: A Journey to Financial Growth

Contrary to popular belief, investing doesn’t require a large sum of money. With just $50, you can begin an exciting journey towards financial growth and gain valuable insights along the way.

Starting with a small investment may seem intimidating, but it offers unique opportunities. By setting aside $50, you can learn crucial financial concepts like diversification and risk management while minimizing your initial risk.

To illustrate the potential of starting with $50, let’s explore real-life stories of individuals who achieved significant gains from their small investments. These anecdotes serve as inspiration for anyone hesitant to invest due to limited funds.

Moreover, beginning with a modest amount cultivates disciplined saving habits and teaches budgeting skills. Regular contributions towards your investment portfolio lay the foundation for long-term financial security.

In summary, don’t underestimate the power of starting with $50. Through wise investments, learning from others’ experiences, and developing saving habits, you can witness your investment grow over time. Embrace the possibilities that lie ahead with just $50 in hand.

Understanding the Power of Compound Interest

Compound interest is a powerful concept in investing that can exponentially grow your money over time. By reinvesting your earnings, your wealth can snowball, benefiting from the growth of both your initial investment and any previously earned interest. Even small investments have the potential to grow significantly with compound interest.

For example, let’s say you invest $1,000 with a 5% annual interest rate. In the first year, you earn $50 in interest, bringing your total balance to $1,050. The following year, you earn 5% on this new balance, resulting in $52.50 in interest and a total balance of $1,102.50.

Starting early is crucial to maximizing compound interest. The longer your money has to compound and grow, the greater its potential for exponential growth becomes. So take action now and watch your wealth multiply as compounding works its magic.

Exploring Low-Risk Investment Options for $50

Managing risks effectively is crucial when venturing into investments with limited funds, especially for beginners. In this section, we will highlight low-risk investment options suitable for a $50 investment and discuss the importance of risk management.

Savings accounts and certificates of deposit (CDs) are popular low-risk options. Savings accounts offer easy access to funds with modest interest rates, while CDs provide higher interest rates in exchange for locking funds away for a fixed period.

We will outline the pros and cons of each option, helping readers make informed decisions based on their financial goals and risk tolerance.

To maximize returns while keeping investments safe, we will provide valuable tips on finding competitive interest rates for savings accounts or CDs. By exploring different banks and financial institutions, readers can compare rates and make the most out of their low-risk investments.

Diving into the World of Index Funds and ETFs

Index funds and ETFs are popular investment options due to their diversification benefits and low fees. Index funds aim to replicate the performance of a specific market index, while ETFs are traded on stock exchanges like individual stocks. Both offer instant diversification by holding a range of assets within a single fund or share.

One advantage is their ability to provide diversified portfolios, reducing risk by spreading investments across multiple companies or sectors. They also have lower fees compared to actively managed mutual funds, making them cost-effective options for investors.

When choosing between index funds and ETFs, factors such as liquidity and expense ratios come into play. While both offer high liquidity, some ETFs may have slightly higher liquidity due to being traded throughout the day.

Expense ratios represent the annual cost of owning the investment; index funds generally have slightly higher expense ratios than ETFs.

To make this topic relatable, examples of popular index funds or ETFs that can be purchased with just $50 include Vanguard S&P 500 Index Fund (VOO) and iShares Core MSCI Emerging Markets ETF (IEMG). These affordable options provide individuals with a starting point for their investment journey.

In summary, index funds and ETFs offer investors simplicity, diversification, and cost-effectiveness. Understanding their differences in liquidity, expense ratios, and available options helps individuals choose the investment vehicle that aligns with their financial goals.

Whether you prefer index funds or ETFs, these options provide opportunities for both experienced investors and newcomers to the world of finance.

Navigating the Stock Market with Small Investments

Many people believe that investing in the stock market is only for the wealthy, but this couldn’t be further from the truth. Fractional shares have opened doors for investors with limited funds to participate in the stock market. These shares allow investors to own a portion of high-priced stocks without needing to buy a whole share.

To help readers get started, there are platforms that offer fractional shares for small investments. These platforms make it easy to diversify portfolios and invest in well-known companies even with limited funds.

Navigating the stock market with small investments is not only possible but also increasingly accessible thanks to fractional shares and dedicated platforms catering to investors with limited funds.

Strategies for Maximizing $50 Investments

Investing small amounts of money can be a great way to start building wealth, and there are strategies that can help maximize the potential of your $50 investments. One effective strategy is dollar-cost averaging, which involves investing a fixed amount at regular intervals to reduce the average cost per share over time.

Another strategy is dividend reinvestment plans (DRIPs), where dividends are automatically reinvested, compounding returns. Micro-investing apps like Acorns and Robinhood allow individuals to invest small amounts regularly, helping their $50 investments grow gradually.

By implementing these strategies, you can make the most out of your limited capital and work towards long-term financial success.

The Importance of Diversification

Diversification plays a crucial role in effectively managing investment portfolios. By spreading investments across different sectors or industries, individuals can mitigate risks and enhance the potential for long-term returns.

This strategy becomes particularly significant for those with limited funds, as it allows them to build a diverse portfolio without requiring substantial financial resources.

Investing in different sectors or industries is an effective way to achieve diversification. By allocating funds to various areas such as technology, healthcare, finance, and consumer goods, investors can reduce the impact of any single investment’s performance on their overall portfolio.

This approach helps protect against industry-specific downturns while capitalizing on potential growth opportunities in other sectors.

In addition to sector diversification, investing in diversified index funds or Exchange-Traded Funds (ETFs) further enhances portfolio diversification. These investment vehicles offer broad exposure to various asset classes such as stocks, bonds, commodities, and real estate.

By investing in diversified index funds or ETFs, investors gain access to a wide range of assets within a single investment option. This not only simplifies the investment process but also reduces the risk associated with holding individual securities.

When considering specific diversified index funds or ETFs, it is essential to choose options that align with one’s risk tolerance and investment goals. Conducting thorough research and consulting with a financial advisor can help identify suitable options that provide adequate diversification while still meeting individual needs.

In summary, diversification is critical for reducing risk and maximizing potential returns within an investment portfolio. By spreading investments across different sectors or industries and considering diversified index funds or ETFs, individuals can create well-rounded portfolios even with limited funds.

Embracing diversification allows investors to navigate market volatility more effectively while increasing the likelihood of achieving long-term financial success.

Empowering Readers to Take Action

Investing just $50 can have a significant impact on your financial future. Throughout this article, we have explored various strategies and concepts to empower our readers to take action and start investing today. By understanding the power of compound interest and exploring low-risk options, you can set yourself up for remarkable growth over time.

Our main goal is to motivate you to start investing with your $50 as soon as possible. Time is a valuable asset in investing, and by starting early, you can take advantage of compounding returns that can lead to substantial wealth accumulation.

To support you on your investment journey, we provide additional resources such as books, websites, and online courses where you can further expand your knowledge about investing. Continual learning is key to becoming a successful investor and making informed decisions that align with your financial goals.

Investing may seem daunting, but we believe in making it accessible for everyone. By breaking down complex concepts and offering practical advice, we aim to empower you with the knowledge and confidence needed to take control of your finances.

[lyte id=’h65R-XkAHjg’]