Welcome to the exciting world of day trading, where fortunes can be made and lost in a single day. If you’re interested in investing and learning about the intricacies of the stock market, then day trading might just be your calling.

But before you dive headfirst into this fast-paced realm, it’s important to understand the risks, rewards, and strategies that come with it. In this article, we’ll explore the basics of day trading, the reality of its challenges, and how you can build a solid foundation for success.

The Basics of Day Trading

Day trading is a popular form of investing that involves buying and selling financial instruments within the same trading day. Unlike long-term investors who hold onto their positions for months or even years, day traders aim to take advantage of short-term price fluctuations to make quick profits.

One of the key differences between day trading and traditional investing lies in the time frame and approach. While long-term investors focus on analyzing fundamentals and trends over extended periods, day traders rely heavily on technical analysis and short-term market movements.

They closely monitor charts, patterns, and indicators to identify potential entry and exit points for their trades.

However, it’s important to note that day trading comes with both high potential rewards and significant risks. On one hand, successful day traders can earn substantial profits by capitalizing on volatile markets. They have the opportunity to make quick gains when prices rapidly fluctuate in their favor.

This ability to generate substantial profits in a short amount of time is what attracts many individuals to day trading.

On the other hand, inexperienced or poorly prepared traders can quickly lose money due to rapid price swings and emotional decision-making. Day trading requires discipline, knowledge, and skill.

It’s crucial for traders to have a solid understanding of technical analysis tools, risk management strategies, and market dynamics before diving into this fast-paced world.

To summarize, day trading is an investment strategy that involves buying and selling financial instruments within the same trading day. It differs from traditional investing in terms of time frame and approach since it focuses more on short-term market movements rather than long-term trends.

While it offers high potential rewards due to its ability to capitalize on volatile markets, it also carries significant risks that inexperienced traders should be aware of before getting involved.

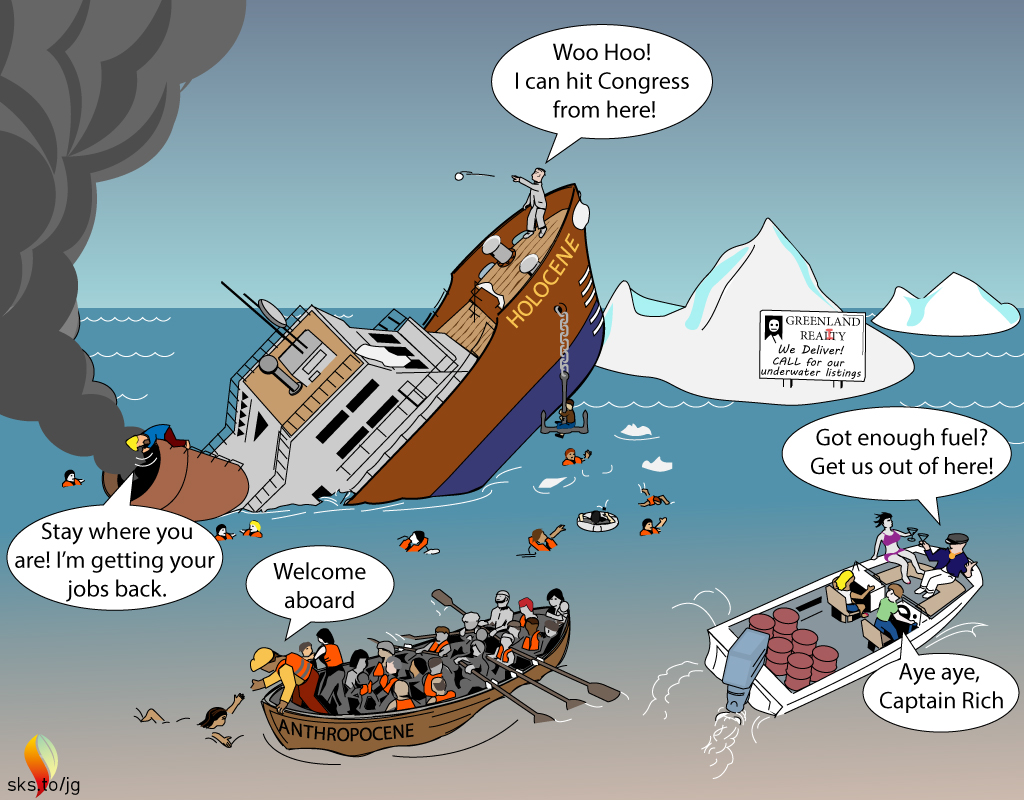

Sink or Swim: The Reality of Day Trading

Day trading is a high-stakes endeavor that requires constant vigilance and quick decision-making. Markets move swiftly, making split-second timing crucial for success. Traders experience a rollercoaster ride of emotions as they witness their trades go through ups and downs within minutes or even seconds.

Managing emotions such as fear, greed, and impatience is essential for making rational trading decisions. Effective risk management is paramount in day trading to protect capital and minimize losses. Traders must set stop-loss orders, determine position sizes, and stick to their predetermined risk tolerance levels.

Overall, day trading demands resilience, discipline, and a keen understanding of risk management strategies.

Building a Solid Foundation for Day Trading Success

To succeed in day trading, it is crucial to build a strong foundation through education and learning from experienced traders. Expand your knowledge of the markets and trading strategies through books, online courses, and educational resources. Gain insights into technical analysis, chart patterns, and indicators.

Additionally, seek mentorship programs or join trading communities to learn from those who have already navigated the challenges of day trading. This accelerates your learning curve, allowing you to gain valuable insights, share experiences, and receive guidance from experienced traders.

| Heading | Content |

|---|---|

| A. Educating yourself about the markets and strategies | – Expand knowledge through books, courses, and resources – Learn technical analysis, chart patterns, and indicators |

| B. Learning from experienced traders through mentorship programs or trading communities | – Seek mentorship to accelerate learning – Join trading communities for valuable insights and guidance |

Developing a Day Trading Plan

To succeed in day trading, you need a solid plan. Start by setting realistic goals based on your risk tolerance and available capital. Understand that consistent profitability takes time and losses are part of the journey.

Create a detailed trading plan with specific entry and exit strategies, profit targets, stop-loss levels, and position sizing rules. This keeps you disciplined during fast-moving markets. Incorporate risk management techniques like setting predetermined stop-loss orders to control potential losses.

Diversify your portfolio across different asset classes to mitigate risks associated with individual trades. Continuously review and adapt your plan for long-term success in the ever-changing market environment.

Choosing the Right Brokerage Platform for Day Trading

Selecting the right brokerage platform is crucial for day trading success. Consider factors like cost structure, trade execution speed, research tools availability, user interface, and customer support. Evaluate commission charges, margin rates, and fees. Look for fast and reliable trade execution.

Access to real-time quotes, charts, news feeds, and technical analysis tools is essential. Ensure a user-friendly interface and customizable options. Prompt customer support is valuable. Choose a platform that aligns with your goals and trading strategies.

Practice Makes Perfect: Paper Trading and Simulators

Paper trading accounts and simulators are valuable tools for aspiring day traders to gain experience and refine their skills. With paper trading, traders can practice strategies in a simulated environment without risking real money, building confidence and testing new techniques.

Simulators replicate real-time market conditions, allowing traders to execute trades, monitor performance, and analyze outcomes as if using live funds. These tools provide a risk-free way to learn from mistakes, experiment with different approaches, and develop a systematic decision-making process.

By utilizing paper trading and simulators effectively, traders can increase their chances of success in the dynamic world of day trading.

Staying Calm Under Pressure: Managing Emotions in Day Trading

Day trading requires managing emotions effectively to navigate high-pressure situations. Greed, FOMO, impatience, and revenge trading can cloud judgment and impact decision-making. Recognizing these triggers is crucial for successful traders.

Greed tempts traders to take unnecessary risks for larger profits. FOMO leads to impulsive trades based on fear of missing out. Taking breaks and practicing deep breathing restores focus during stress.

Impatience causes hasty decisions without considering all information. Revenge trading, driven by frustration or anger, leads to greater losses. Avoiding these emotional traps is key.

To stay calm in volatile markets, set realistic expectations and maintain a long-term perspective. Understanding not every trade will be profitable reduces stress levels. Implement techniques like deep breathing and breaks from the screen.

Managing emotions is vital for day trading success. Recognize common triggers and implement strategies to mitigate their impact. Stay calm under pressure with rational decision-making in volatile market conditions.

Building Your Network: Joining Trading Communities

Joining trading communities offers numerous benefits for day traders. These communities provide a support system and knowledge-sharing platform where like-minded individuals can connect and gain fresh insights. Experienced traders within these communities offer guidance, mentorship, and potential collaboration on trades or investment ideas.

The environment fosters learning, with members freely sharing knowledge, strategies, and trade ideas. Additionally, access to valuable resources and staying updated on industry trends are added advantages. Overall, joining trading communities can greatly enhance your network and improve your trading skills for increased success in the market.

[lyte id=’xn_Nxa_0JBU’]