Investing in the energy sector can be a lucrative venture, but it requires a deep understanding of the industry and its nuances. One crucial aspect that every investor must grasp is energy stock symbols.

These unique combinations of letters and numbers serve as the gateway to unlocking investment opportunities and navigating the complex world of energy stocks.

In this article, we will delve into the basics of energy stock symbols, decode their meanings, explore different sub-sectors through these symbols, uncover hidden gems in small-cap energy stocks, analyze sector performance using symbols, and discuss effective strategies for investing using them.

So fasten your seatbelts as we embark on an exciting journey to discover the power behind energy stock symbols.

The Basics of Energy Stock Symbols

Energy stock symbols serve as unique identifiers for publicly traded companies within the energy sector. These symbols are comprised of a series of letters or numbers and play a crucial role in facilitating efficient trading and communication between investors and market participants.

Stock symbols, such as “XOM” for Exxon Mobil Corporation, allow investors to easily track the performance of specific companies’ shares on various exchanges.

They provide quick access to essential information, including current prices, historical data, financial reports, news articles, and analyst ratings associated with a particular company’s stocks.

While the concept of stock symbols remains consistent across all industries, there are specific differences when it comes to energy stocks. Unlike other sectors, energy companies often incorporate abbreviations or acronyms related to their industry or business focus within their stock symbols.

These distinctive characters offer valuable insights into the type of energy sub-sector a company operates in. For example, oil and gas companies may include abbreviations like “OIL” or “GAS” in their stock symbols, while renewable energy companies might use acronyms like “RENEW” or “SUST” to signify their commitment to sustainable practices.

By analyzing these unique characters within energy stock symbols, investors can gain a better understanding of the sector and identify opportunities that align with their investment strategies.

Whether it’s oil exploration and production (E&P), natural gas distribution (NGD), or alternative energy solutions (ALT), these symbols provide important clues about a company’s specialization within the vast energy landscape.

In summary, energy stock symbols act as powerful tools for investors seeking exposure to the dynamic world of energy markets. By leveraging these unique identifiers, investors can efficiently track performance and access critical information that contributes to informed decision-making.

Understanding the nuances of energy stock symbols allows investors to navigate this complex sector with greater ease and confidence.

Decoding Energy Stock Symbols

Understanding energy stock symbols is crucial for investors navigating the complex world of energy markets. These symbols, made up of letters and numbers, provide insights into a company’s identity and sector classification.

For example, Exxon Mobil Corporation’s symbol “XOM” represents its name or initials. Numbers like “22” may indicate share class or series.

Analyzing energy stock symbols reveals a company’s history, structure, and potential prospects. Common abbreviations used include:

- Oil and Gas: “OIL,” “GAS,” “PET,” or specific commodity names.

- Renewable Energy: “SOLAR,” “WIND,” “CLEAN,” or acronyms like “RENEW.”

- Utilities: “UTIL” or industry-specific phrases.

These indications are helpful but shouldn’t be the sole basis for investment decisions. Thorough research is essential to understand a company’s operations, financial health, and growth potential.

Decoding energy stock symbols helps investors make informed choices in this dynamic industry. Research beyond symbols is vital for successful investments.

Exploring Energy Sub-Sectors through Stock Symbols

In the world of energy investing, it’s important to understand the different sub-sectors and their corresponding stock symbols. Let’s take a closer look at two prominent sub-sectors: oil and gas, and renewable energy.

Major players in the oil and gas industry can be identified by their stock symbols such as Exxon Mobil Corporation (XOM), Chevron Corporation (CVX), Royal Dutch Shell PLC (RDS-A), and BP plc (BP).

Key indicators to watch for in this sector include crude oil prices, supply-demand dynamics, exploration and production activities, as well as refining margins and capacity utilization.

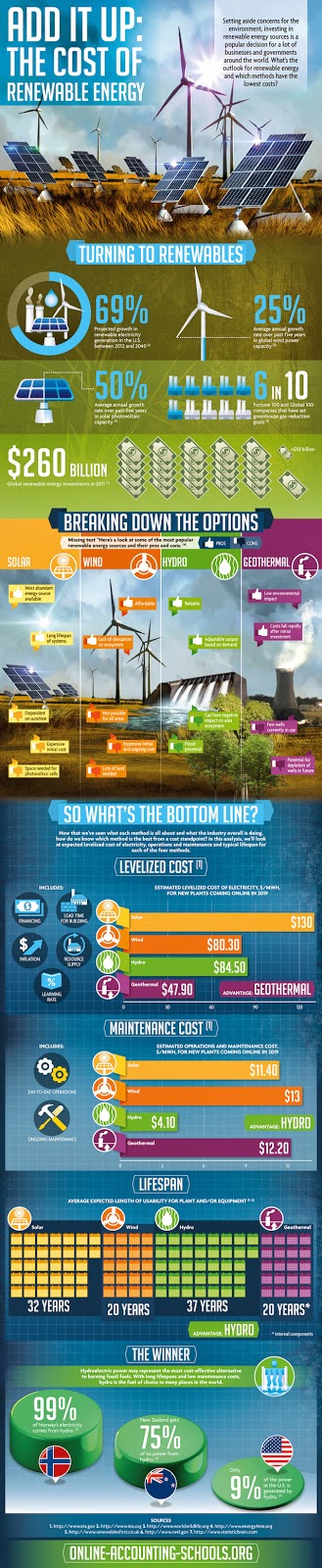

Renewable energy is gaining momentum as a sustainable investment option. Companies like First Solar, Inc. (FSLR), SunPower Corporation (SPWR), Canadian Solar Inc. (CSIQ), and NextEra Energy, Inc. (NEE) represent emerging players with growth potential.

Factors to consider when investing in renewable energy stocks include government policies supporting renewable energy, technological advancements in clean energy sources, and volatility due to changing regulations or subsidy programs.

Understanding the stock symbols and key indicators of these energy sub-sectors empowers investors to make informed decisions in an ever-evolving market. Whether focusing on traditional oil and gas or exploring the opportunities in renewable energy, staying informed is crucial for long-term success in energy investing.

Small-Cap Energy Stocks: Hidden Gems

Investing in small-cap energy stocks offers the potential for higher returns and undiscovered opportunities. These companies have the advantage of flexibility, adapting quickly to market conditions. By conducting thorough research on financials, management teams, and growth plans, investors can identify promising stocks.

Analyzing industry trends and competitive advantages is crucial for assessing their potential. While these investments come with risks due to volatility, diversification can help mitigate them. Small-cap energy stocks are hidden gems that offer attractive rewards for astute investors willing to navigate the market’s ups and downs.

Using Energy Stock Symbols for Sector Analysis and Comparison

Energy stock symbols are valuable tools for analyzing and comparing sectors within the energy industry. By tracking stock price movements, evaluating financial ratios, and assessing market capitalization, investors can gain insights into sector performance and identify investment opportunities.

Additionally, comparing revenue growth rates, profitability, and competitive factors among companies operating in the same sub-sector helps inform investment decisions. Understanding key risks and challenges specific to each company is also crucial for evaluating their long-term potential.

Overall, energy stock symbols provide a comprehensive view of sector dynamics and aid in making informed investment choices.

Effective Strategies for Investing in Energy Stocks Using Symbols

To invest successfully in energy stocks, implementing effective strategies is crucial. By utilizing stock symbols, you can make informed decisions in the market. Here are three key strategies:

-

Thorough research: Analyze financial statements, assess competitive advantage, and evaluate key performance indicators.

-

Stay updated: Monitor industry news, regulatory changes, technological advancements, and geopolitical events.

-

Risk management: Diversify investments across energy sub-sectors and geographically, while balancing capital allocation across different market capitalizations.

These strategies will help you navigate the energy stock market with confidence and increase your chances of success.

Symbol Changes, Mergers, and Acquisitions: What Investors Should Know

Symbol changes, mergers, and acquisitions can greatly impact investors and their holdings. Symbol changes occur due to rebranding or corporate restructuring, requiring investors to update their records to avoid missing out on important information or trading difficulties.

Mergers and acquisitions often lead to new names and ticker symbols, affecting how holdings are represented and traded. To manage investments during these events:

- Stay informed about upcoming changes through company communications.

- Seek guidance from financial advisors or brokers to adjust portfolios accordingly.

- Review terms and conditions of exchange offers or stock conversions.

By staying informed, seeking professional guidance, and reviewing details, investors can make well-informed decisions that align with their goals and minimize risks associated with symbol changes or mergers.

Conclusion

[lyte id=’uXMr4yvKZ3Q’]