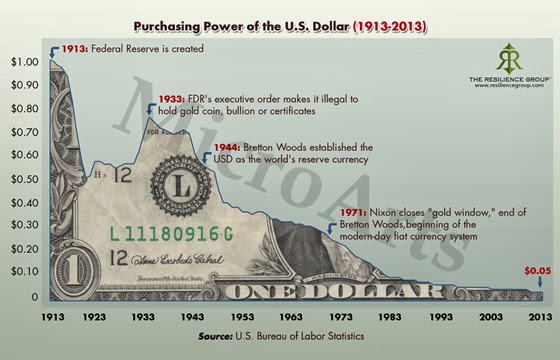

Investing in gold has long been a popular choice for those looking to diversify their portfolios and hedge against market volatility. While purchasing physical gold or investing in gold stocks are common strategies, there is another avenue that may pique the interest of savvy investors – buying gold royalties.

In this article, we will explore the concept of gold royalties, how to buy them, where to find reputable platforms, the associated fees, frequently asked questions, and the advantages and risks of investing in this unique asset class. By the end, you will have a comprehensive understanding of whether investing in gold royalties is right for you.

What is a Gold Royalty?

A gold royalty allows investors to share in the future production or revenue generated by a gold mining operation. It offers indirect participation in the potential upside of gold mining without owning or operating a mine directly.

Compared to physical bullion or mining stocks, gold royalties provide exposure to multiple mines and operators without operational risks. They offer diversification, passive income streams, and attractive investment opportunities for those seeking consistent returns.

How to Buy Gold Royalty Shares

Purchasing gold royalty shares is a straightforward process that can be done through online platforms and specialized brokers. Start by researching reputable platforms that align with your investment goals. Open an account, provide necessary identification, and deposit funds. Understand the terms, fees, and commissions before making any purchases.

Evaluate the company’s track record, financial stability, and potential for growth. Remember that owning gold royalty shares provides exposure to price fluctuations without physical ownership. By conducting thorough research and making informed decisions, investors can confidently navigate this opportunity.

Our Top Picks for Where to Buy Gold Royalty Shares

When it comes to buying gold royalty shares, popular platforms like Robinhood, TD Ameritrade, and E*TRADE offer convenience, transparency, and access to a wide range of options. Robinhood provides a user-friendly interface and commission-free trading, while TD Ameritrade offers a robust trading platform and comprehensive research tools.

ETRADE stands out with its powerful platform and extensive educational resources*. Consider factors like fees, ease of use, research tools, and customer support when choosing the best platform for your investment goals.

Fees for Buying 200x Gold Royalty Shares with Popular Platforms

Investing in gold royalty shares comes with its own set of costs and fees, which should be carefully considered, especially when purchasing a substantial quantity like 200x shares. The specific transaction size and brokerage commission structure can affect the fees on popular platforms such as Robinhood or TD Ameritrade.

To make informed investment decisions, it is crucial to review each platform’s fee schedule thoroughly.

In addition to transaction fees, some platforms may also charge account maintenance or custodial fees. These charges should be taken into account when calculating your overall returns. While fees are an important factor to consider, they shouldn’t be the sole determining factor when choosing a platform.

When evaluating different platforms, it is equally essential to assess other aspects beyond just fees. Consider the reputation of the platform, including factors such as reliability and security.

Look into the quality of customer service provided by the platform, as prompt assistance can be invaluable in navigating any issues that may arise during your investment journey.

Furthermore, research tools play a vital role in making well-informed investment decisions. Evaluate the availability and functionality of research tools offered by each platform to ensure you have access to the necessary information for analyzing market trends and making educated choices.

To summarize, while fees are a significant consideration when buying gold royalty shares with popular platforms, it is crucial to look beyond just these costs. Consider factors such as platform reputation, customer service quality, and available research tools before making your final decision.

By taking a comprehensive approach to evaluate various aspects of each platform, you can make confident investment choices that align with your financial goals.

Frequently Asked Questions about Gold Royalties

Investing in gold royalties may be unfamiliar territory for many investors. Here are answers to some frequently asked questions:

How do royalty payments work?

Gold royalty payments are calculated based on a percentage of the mine’s revenue or production volume, providing investors with a consistent income stream.

What factors can affect the value of gold royalties?

The value of gold royalties is influenced by factors such as gold prices, production levels, exploration success, geopolitical risks, and mining regulations. Stay informed about these factors to make informed investment decisions.

The Advantages and Risks of Investing in Gold Royalties

Investing in gold royalties offers diversification by spreading risk across multiple mines and operators. It provides a consistent income stream through royalty payments and potential upside when the value of the underlying mine’s production increases.

However, market volatility and fluctuations in gold prices can impact profitability and royalty payments. Geopolitical risks, such as changes in mining regulations or political instability in producing countries, can also affect investments. Consider these advantages and risks when investing in gold royalties for informed decision-making.

Is Investing in Gold Royalties Right for You?

Investing in gold royalties offers a unique opportunity to diversify portfolios and gain exposure to the benefits of gold mining without directly owning or operating a mine.

By understanding what gold royalties are, how to acquire them, and assessing associated risks and advantages, you can make an informed decision aligned with your financial goals. Remember that investing carries risks, so careful consideration is crucial. Thorough research on platforms, fee structures, and market trends is essential.

Ultimately, investing in gold royalties can be rewarding for those willing to do their due diligence and stay informed about market conditions.

| Heading 1 | Heading 2 |

|---|---|

| Benefit 1 | Explanation |

| Benefit 2 | Explanation |

| Benefit 3 | Explanation |

[lyte id=’6xHIQjFnHfA’]