Investing in the stock market can be a thrilling endeavor, but it requires careful consideration and strategic decision-making. One sector that often catches the attention of investors is the discretionary sector.

With its allure and potential for growth, discretionary sector stocks have become an intriguing option for those seeking to maximize their returns.

The Allure of Discretionary Sector Stocks

Investing in discretionary sector stocks is incredibly enticing due to their potential for high returns. These companies offer non-essential goods and services, like luxury brands, entertainment companies, and travel agencies. When consumer confidence is strong and disposable income rises, these companies flourish.

Increased demand for non-essential items leads to substantial profits for investors who capitalize on these trends. Furthermore, investing in discretionary stocks allows diversification within an investment portfolio while tapping into evolving consumer preferences and societal trends.

By making informed decisions and staying attuned to market dynamics, individuals can enjoy the allure of discretionary sector stocks and potentially achieve significant financial gains.

What are discretionary sector stocks?

Discretionary sector stocks encompass a diverse range of industries within the consumer discretionary sector. These stocks represent companies that operate in highly competitive markets, where brand reputation plays a crucial role in attracting customers.

Examples include retail giants like Amazon and Walmart, entertainment companies such as Disney and Netflix, and luxury brands like Louis Vuitton and Rolex.

As an investor in discretionary sector stocks, it’s essential to understand not only the financial fundamentals of these companies but also their ability to adapt to changing consumer preferences.

Why Investing in Discretionary Sector Stocks Can Be a Wise Choice

Investing in discretionary sector stocks can be a prudent decision for several reasons. Firstly, these stocks have shown resilience during economic downturns, as consumers continue to allocate funds towards non-essential purchases even in times of financial uncertainty.

Additionally, the advancement of technology has opened up new growth opportunities within this sector, particularly with the rise of e-commerce and its convenience and accessibility. By investing in forward-thinking discretionary sector stocks that embrace digital trends, investors position themselves for long-term success.

Furthermore, the diversity of industries within the discretionary sector allows for portfolio diversification and risk mitigation. Lastly, changing consumer preferences and evolving societal trends present ample potential for growth within this sector.

Overall, investing in discretionary sector stocks offers stability, growth potential, and the opportunity to capitalize on market shifts.

Exploring the Potential of Discretionary Sector Stocks: Past Performance and Future Opportunities

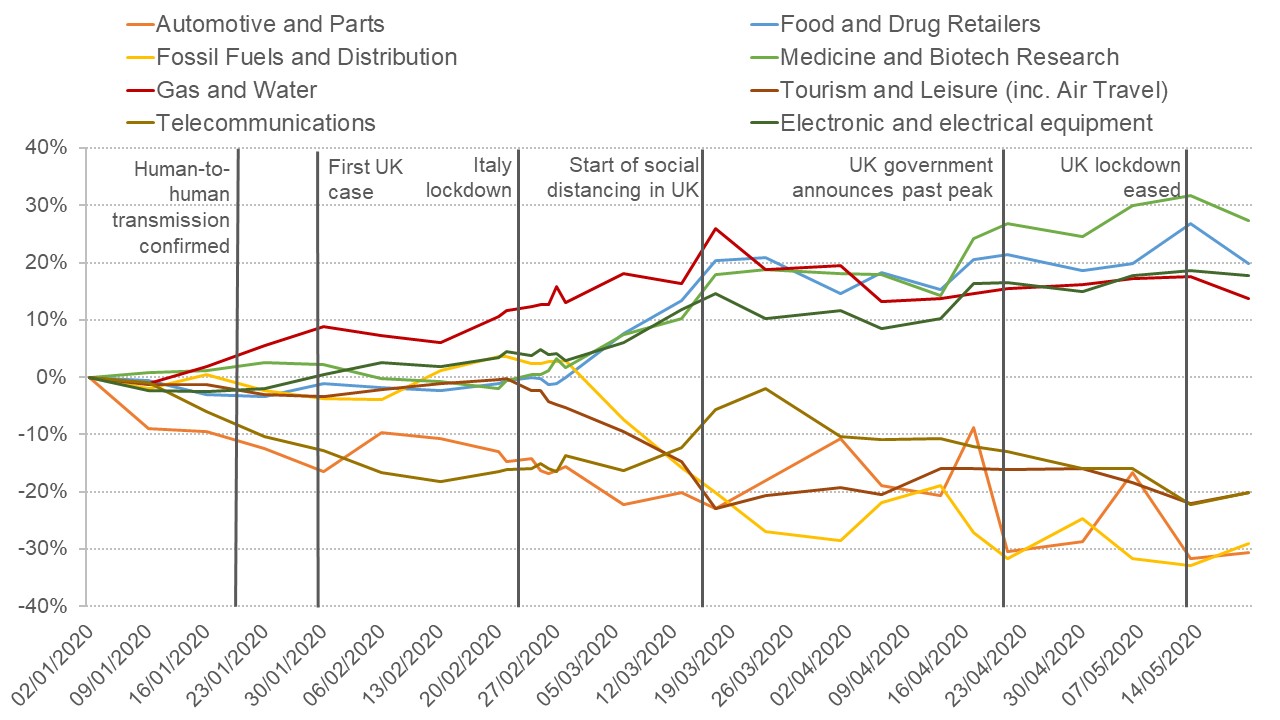

Discretionary sector stocks have shown strong growth historically, particularly during economic expansions when consumer spending rises. However, they can be more vulnerable during downturns as essential purchases take precedence.

It’s important to note that past performance doesn’t guarantee future results, so analyzing current market conditions and macroeconomic factors is crucial for informed investment decisions.

Consumer sentiment and evolving preferences are key drivers of growth in the discretionary sector. When people feel optimistic about their finances and the economy, they’re more likely to spend on non-essential items.

Companies in this sector must stay attuned to changing trends and adapt their offerings accordingly, such as prioritizing sustainability to gain a competitive advantage.

By staying informed and conducting thorough research on individual companies within the discretionary sector, investors can identify promising opportunities for growth. Considering consumer sentiment, industry trends, and company-specific strategies provides a comprehensive evaluation of investment potential.

Unveiling the Key Players: Top Companies in the Discretionary Sector

When it comes to exploring investment opportunities within the discretionary sector, understanding the market position and growth potential of key players is crucial. This sector has witnessed the rise of several companies that have not only adapted to changing consumer preferences but also delivered substantial returns for investors.

One such notable player is Amazon, which has revolutionized the retail industry through its innovative e-commerce platform. By prioritizing customer experience, speedy delivery, and competitive pricing, Amazon has achieved unparalleled success.

As consumers increasingly shift towards online shopping, Amazon’s market position continues to strengthen, making it a formidable force within the discretionary sector.

Another success story worth mentioning is Netflix, a company that disrupted the entertainment industry with its pioneering streaming services. Recognizing the shift in consumer behavior towards digital content consumption, Netflix transformed how people watch movies and TV shows.

With a rapidly expanding subscriber base across the globe, investing in Netflix presents attractive opportunities due to its continued growth potential.

To make informed decisions when selecting discretionary sector stocks for their portfolios, investors need to conduct a comprehensive analysis of these success stories. Evaluating companies based on their market position, competitive advantages, financial performance, and future growth prospects is crucial.

By carefully assessing these factors, investors can identify promising investment avenues within the discretionary sector.

In summary, understanding the top companies within the discretionary sector is essential for investors looking to capitalize on potential growth opportunities. The success stories of Amazon and Netflix highlight how companies can navigate evolving consumer preferences and generate significant returns.

By conducting thorough analyses and considering factors such as market position and future growth prospects, investors can make informed decisions when selecting discretionary sector stocks for their portfolios.

Investing Strategies for Discretionary Sector Stocks: Tips to Maximize Returns

To maximize returns in the discretionary sector, investors should employ effective strategies aligned with their risk tolerance and goals. Two common approaches for stock evaluation are fundamental analysis, assessing a company’s financial health and prospects, and technical analysis, analyzing price patterns and market trends.

Combining both strategies can provide a comprehensive view for well-informed decisions.

Diversification within the discretionary sector is crucial to mitigate risk and capture profitable opportunities. By investing in various sub-sectors like entertainment or travel instead of focusing solely on luxury brands, investors ensure exposure to multiple growth sources while reducing reliance on any single company or industry.

In summary, maximizing returns in discretionary sector stocks requires employing effective investment strategies that incorporate fundamental and technical analysis methods. Diversification across sub-sectors further enhances the potential for success.

Assessing Risk Factors: Potential Challenges when Investing in Discretionary Sector Stocks

Investing in discretionary sector stocks comes with its share of potential challenges. Economic downturns can impact consumer spending, affecting companies within the sector. The highly competitive landscape requires careful analysis of a company’s competitive advantages.

Technological advancements and changing consumer preferences add complexity, requiring adaptability. Additionally, regulatory changes can affect operations and profitability. Thorough research and risk assessment are essential for maximizing returns while navigating these challenges.

Case Studies: Learning from Successful Investors in Discretionary Sector Stocks

In the world of investing, the discretionary sector offers promising opportunities for those who can navigate its complexities. By examining the strategies of successful investors, we can uncover valuable insights. Two case studies shed light on different approaches taken by seasoned investors.

Investor X achieved remarkable success by focusing on long-term trends within the discretionary sector. Through thorough research and analysis, they identified early opportunities in e-commerce and online shopping. Investing in companies that capitalized on this trend led to substantial returns as online retail gained traction.

Investor Y takes a contrarian approach, selecting companies facing temporary setbacks or unfavorable market sentiment. By acquiring undervalued shares with potential for a turnaround, Investor Y benefits from subsequent market recognition of the company’s value.

These case studies emphasize the importance of research, analysis, and strategic decision-making when investing in discretionary sector stocks. By learning from these successful investors and adapting their strategies, we can improve our chances of success in this dynamic market.

[lyte id=’Kq8gi5LM6AA’]