Investing in commodities has always held a certain allure for investors. Whether it’s gold, oil, or agricultural products, these tangible assets have the potential to provide diversification and hedge against inflation. One commodity that stands out as an attractive investment option is copper.

Introducing Copper Exchange Traded Funds (ETFs)

Copper exchange-traded funds (ETFs) are a popular investment option for those interested in copper investing. These funds trade on stock exchanges and aim to mirror the price movements of copper. One advantage of ETFs is their liquidity, allowing investors to buy and sell throughout the trading day at market prices.

This accessibility makes it easier for individuals to participate in the copper market without dealing with physical assets or complex contracts. Conducting thorough research is essential before investing in copper ETFs to understand market dynamics and mitigate risks associated with this volatile commodity.

Overall, copper ETFs offer an accessible way for investors to diversify their portfolios and capitalize on the potential of copper markets.

Understanding the Copper Market

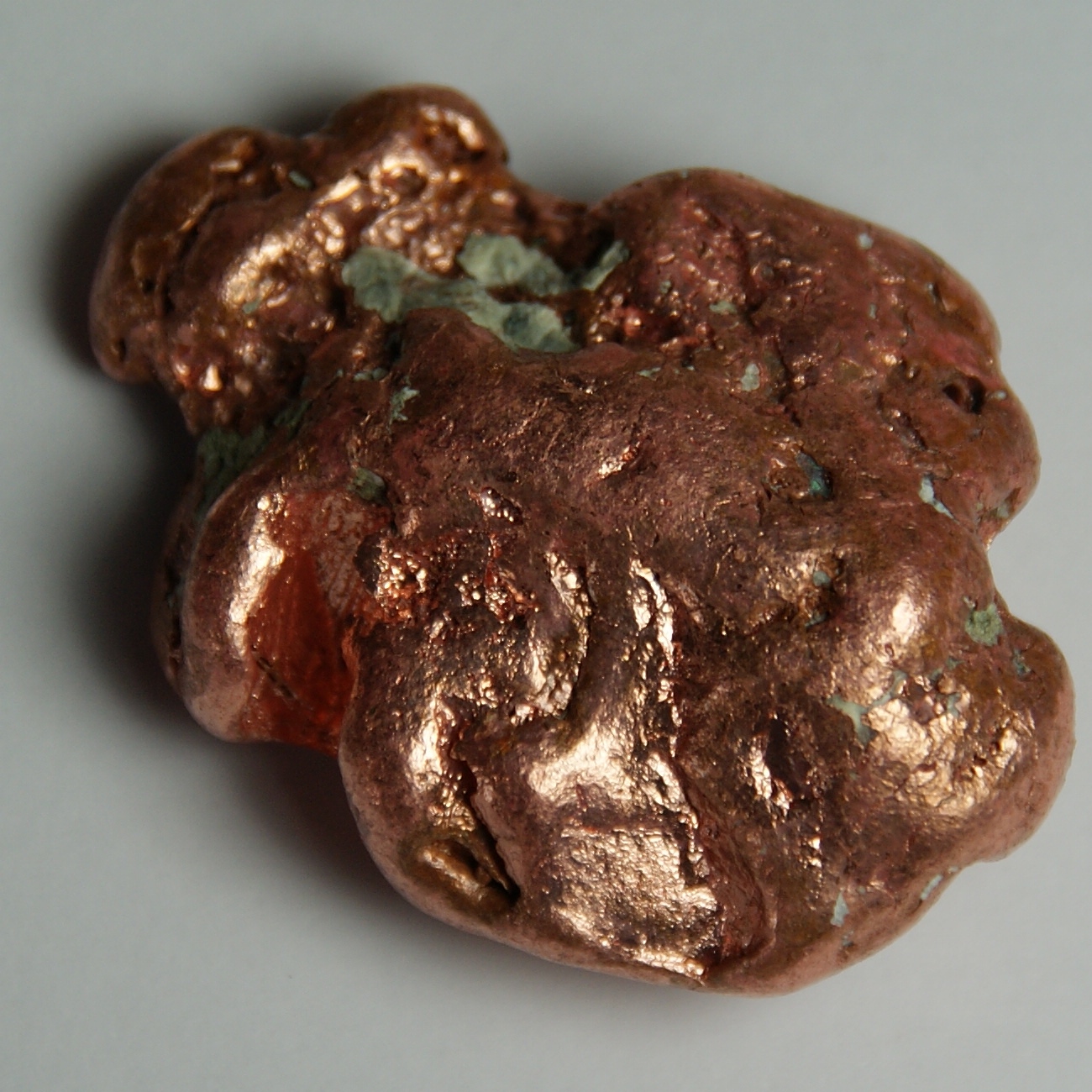

Copper, a versatile metal used in electrical wiring, plumbing systems, and construction materials, is crucial in our modern world.

Its value is influenced by factors such as supply and demand dynamics, economic indicators like global GDP growth and manufacturing activity, as well as geopolitical factors including trade tensions and supply disruptions.

By analyzing historical data and staying informed about market trends, investors and industry professionals can make informed decisions in the copper market.

Table: Factors Influencing Copper Prices

| Factor | Influence |

|---|---|

| Supply and Demand | Fluctuations directly impact copper’s value |

| Economic Indicators | Global GDP growth and manufacturing activity affect prices |

| Geopolitical Factors | Trade tensions and disruptions create volatility in the market |

In summary, understanding the copper market involves monitoring supply-demand dynamics, economic indicators, and geopolitical factors. This knowledge empowers individuals to navigate this dynamic marketplace more effectively.

Three Top Copper ETFs

When it comes to investing in copper, there are three top copper ETFs worth considering:

-

ABC Copper ETF: This fund tracks a specific index of copper-related assets, providing exposure to copper price movements without physically owning the metal. Consider expense ratios and management fees when comparing this ETF to others.

-

Global X Copper Miners ETF: Instead of tracking copper prices directly, this fund invests in companies involved in copper mining and exploration. It offers exposure to the performance of copper miners and their potential growth opportunities.

-

United States Copper Index ETF: This fund replicates the performance of an index composed of copper futures contracts. Investors can gain exposure to copper prices without buying or selling physical copper.

While leveraged or inverse ETFs offer amplified exposure, they come with higher risks and are more suitable for advanced investors who understand market dynamics and volatility.

In summary, these top copper ETFs provide different avenues for investors to gain exposure to the copper market and potentially benefit from its movements.

How to Use Copper ETFs for Investment Success

To effectively use copper ETFs for investment success, consider the following tips:

- Research and understand the copper market fundamentals.

- Monitor economic indicators and geopolitical events that impact copper prices.

- Diversify your portfolio by including multiple copper ETFs.

- Regularly review and adjust your investment strategy.

Strategies for maximizing returns include timing investments based on market trends, using dollar-cost averaging to mitigate volatility, and utilizing stop-loss orders for protection.

However, be aware of the risks associated with investing in copper ETFs such as price volatility, supply chain disruptions, and changes in global economic conditions. Stay informed and adapt your approach accordingly.

By following these guidelines, you can enhance your chances of achieving investment success with copper ETFs.

Evaluating the Performance and Returns of Copper ETFs

When analyzing copper ETFs, it’s important to consider risk-adjusted returns versus raw returns. Risk-adjusted returns measure the level of risk taken to achieve a certain return, providing a more accurate performance assessment.

Comparing ETF performance against other investments helps assess relative strength, while considering expense ratios is crucial to avoid high fees eating into profits over time. Historical performance data can provide valuable insights, but thorough research is necessary as past performance doesn’t guarantee future success.

By evaluating these factors, investors can make informed decisions about incorporating copper ETFs into their portfolios.

The Role of Copper ETFs in Portfolio Construction

Copper ETFs offer diversification advantages for traditional stock portfolios. By adding exposure to the commodity market, investors can potentially reduce portfolio volatility and increase returns. Including copper ETFs helps balance risk by mitigating industry-specific or regional risks tied to copper prices.

Strategic asset allocation considerations optimize risk-adjusted returns while tapping into global economic growth. With the widespread use of copper across industries, investing in copper ETFs positions investors to benefit from emerging market development and increased demand.

Incorporating copper ETFs enhances portfolios and improves long-term investment outcomes.

The iPath Series B Bloomberg Copper Subindex Total Return ETN

The iPath Series B Bloomberg Copper Subindex Total Return ETN is an exchange-traded note (ETN) that offers exposure to copper prices. Similar to ETFs, this ETN provides simplicity and ease of trading on stock exchanges throughout the day.

However, investors should be aware of its drawbacks, including credit risk since it is an unsecured debt obligation. Additionally, investing in this ETN does not grant ownership in physical copper assets but rather tracks the performance of a specific index.

Careful consideration of these factors is crucial before investing in this ETN or any other alternative options.

How to Incorporate Copper ETFs into a Diversified Portfolio

Diversifying your investment portfolio is crucial for managing risk and maximizing returns. Copper exchange-traded funds (ETFs) can play a valuable role in this strategy. Start by assessing your risk tolerance and investment goals. Allocate a portion of your portfolio to copper ETFs, balancing exposure to different sectors and asset classes.

Regularly rebalance your portfolio to maintain desired asset allocation. By including copper ETFs alongside other investments, you can seize opportunities in the commodity market while maintaining a balanced portfolio.

[lyte id=’R_2HSb9nA9Q’]