Investing in the stock market has always been a way to capitalise on emerging trends and technologies. In recent years, one trend that has captured the attention of investors is autonomous technology.

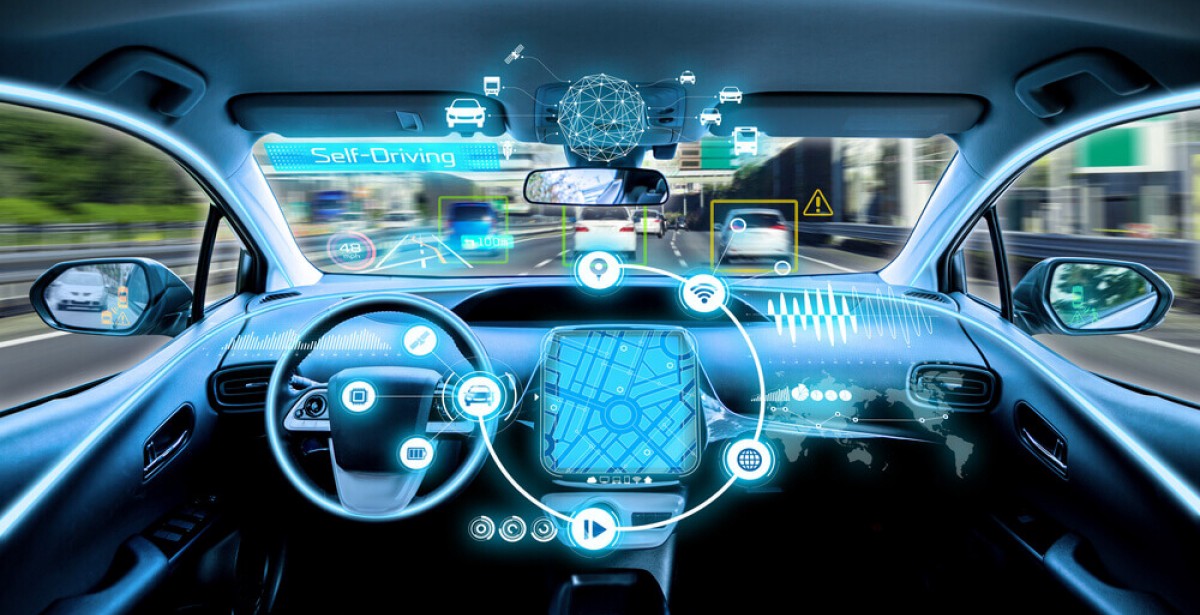

From self-driving cars to robotic surgical systems, autonomous technology is revolutionizing various industries and presenting exciting investment opportunities.

This article will delve into the world of autonomous technology stocks, exploring their definition, potential for growth, key factors to consider when investing, top companies to watch, and provide tips for successful investing in this dynamic sector.

The Rise of Autonomous Technology Stocks: Investing in the Future

Autonomous technology is revolutionizing industries like transportation, e-commerce, and healthcare. Self-driving cars are disrupting traditional commuting methods, while drone delivery services offer faster and more efficient logistics. Robotic surgical systems enhance precision in healthcare procedures.

Investors are recognizing the potential for significant growth and profitability in autonomous technology stocks, as companies at the forefront of this revolution leverage AI and ML to lead their sectors. This presents an exciting investment opportunity for individuals and institutions looking to capitalize on the future.

Understanding Autonomous Technology Stocks

Autonomous technology stocks involve companies developing or utilizing autonomous systems or devices. These stocks provide investors exposure to the rapidly growing autonomy sector. Notable companies like Tesla, Waymo, and Uber are driving advancements in self-driving cars, while Amazon and UPS explore drone delivery services.

The healthcare sector benefits from robotic surgical systems. Autonomy extends to various industries such as transportation, e-commerce, and healthcare, presenting investors with diverse opportunities for capital allocation.

| Sector | Benefits |

|---|---|

| Transportation | Reduced accidents Increased efficiency |

| E-commerce | Enhanced speed Improved convenience |

| Healthcare | Enhanced precision Shorter recovery times for patients |

Why Invest in Autonomous Technology Stocks?

Investing in autonomous technology stocks offers significant growth potential. As the sector rapidly advances, companies at the forefront stand to reap substantial rewards as early adopters and market leaders. The increasing adoption of autonomous systems across industries further drives this investment case.

With advancements in AI, ML, and sensor technologies, businesses recognize the benefits of autonomy and are incorporating these technologies into their operations, creating a growing demand for innovative solutions. Investing in autonomous technology stocks can be seen as a long-term strategy with considerable upside potential.

Companies that successfully navigate this evolving landscape have an opportunity to flourish over time. By tapping into industries such as transportation, healthcare, agriculture, and manufacturing, investors can access lucrative opportunities driven by increased efficiency and improved safety.

Embrace autonomy and seize the chance for significant returns with autonomous technology stocks.

Key Factors to Consider When Investing in Autonomous Technology Stocks

Investing in autonomous technology stocks requires careful evaluation of several crucial factors. Firstly, assessing a company’s fundamentals, including its financial health, revenue growth, profitability, and debt levels, is essential.

Additionally, analyzing competitive advantages such as proprietary technology or strategic partnerships can provide insights into a company’s potential edge over competitors. Understanding market positioning and considering regulatory landscape changes and potential risks are also crucial for making informed investment decisions in this sector.

By thoroughly evaluating these key factors, investors can maximize their chances of success while minimizing risks.

Top Autonomous Technology Stocks to Watch

In this section, we explore three top autonomous technology stocks that are revolutionizing transportation, e-commerce, and healthcare.

Company A is a key player in the self-driving car industry. Their innovative technology and strategic partnerships make them a promising investment opportunity.

Company B is leading the way in drone delivery services for e-commerce. Their solutions offer faster and cost-effective deliveries, making them a stock worth watching.

Company C’s cutting-edge robotic surgical systems are transforming healthcare. With their advancements and market opportunities, they present exciting prospects for investors.

These top autonomous technology stocks have the potential to reshape industries and create new investment opportunities.

Tips for Investing in Autonomous Technology Stocks

Investing in autonomous technology stocks comes with risks, so it’s crucial to employ effective risk management strategies. Diversify your portfolio across sectors to reduce the impact of stock market fluctuations. Additionally, take a long-term approach, as the development and adoption of autonomous technology may take time.

Stay informed about industry trends and developments to make well-informed investment decisions. Remember that uncertainties exist, so conduct thorough research and seek professional advice before investing. By following these tips, you can position yourself for potential success in the world of autonomous technology investments.

Success Stories in Autonomous Technology Stocks

In this section, we will explore two success stories in the autonomous technology sector. These companies have emerged as market leaders and offer valuable insights for investors looking to capitalize on the potential growth in this industry.

Company D started as a small startup but quickly became a dominant force in autonomous technology. Their commitment to innovation and research allowed them to develop groundbreaking technologies and stay ahead of competitors. Strategic partnerships with leading manufacturers expanded their customer base and provided access to new markets.

Lessons from Company D’s success include the importance of investing in R&D and building strong industry alliances.

Company E faced obstacles but successfully navigated through them. They anticipated challenges, developed strategies, and adapted to industry shifts. By diversifying product offerings and entering adjacent markets, they mitigated risks and capitalized on emerging opportunities.

Investors can learn from Company E’s resilience and adaptability, emphasizing the need to embrace change for long-term success in the autonomous technology sector.

These success stories demonstrate the strategies employed by companies that have thrived in autonomous technology, offering valuable insights for investors seeking opportunities in this dynamic industry.

Future Outlook for Autonomous Technology Stocks

The future of autonomous technology stocks is influenced by emerging trends, regulatory changes, and expert opinions. Technological advancements in self-driving vehicles, robotics, and artificial intelligence are driving the industry forward. However, regulatory changes can impact investment opportunities.

Stricter regulations may slow down growth, while supportive policies can create more opportunities. Expert opinions and forecasts provide valuable insights into market trends and potential risks. Understanding these factors is crucial for investors seeking to capitalize on the evolving sector.

Table: Potential Impact Factors on Investment Opportunities

| Factors | Potential Impact |

|---|---|

| Emerging trends | Drive technological advancements in sectors |

| Regulatory changes | Determine market dynamics and adoption rates |

| Expert opinions | Provide valuable analysis for informed decisions |

[lyte id=’Kj69Y67Y9-0′]