Exchange-Traded Funds (ETFs) have made investing in commodities more accessible and convenient. Unlike traditional methods, such as buying physical assets or futures contracts, ETFs allow individuals to participate in commodity markets without direct ownership.

These investment funds trade on stock exchanges and mirror the performance of a specific asset or index.

One key advantage of ETFs is their ease of access. They can be bought and sold through stock exchanges, providing flexibility and liquidity for investors. Additionally, ETFs offer diversification by including multiple commodities within a single fund, spreading risk across different assets.

Transparency is another benefit of ETFs. They disclose their holdings daily, allowing investors to evaluate the fund’s composition and performance. The prices of ETF shares are readily available for monitoring and analysis.

In summary, ETFs have revolutionized commodity investment by offering accessibility, diversification, and transparency. They provide individuals with the opportunity to participate in commodity markets without the complexities of direct ownership or trading futures contracts.

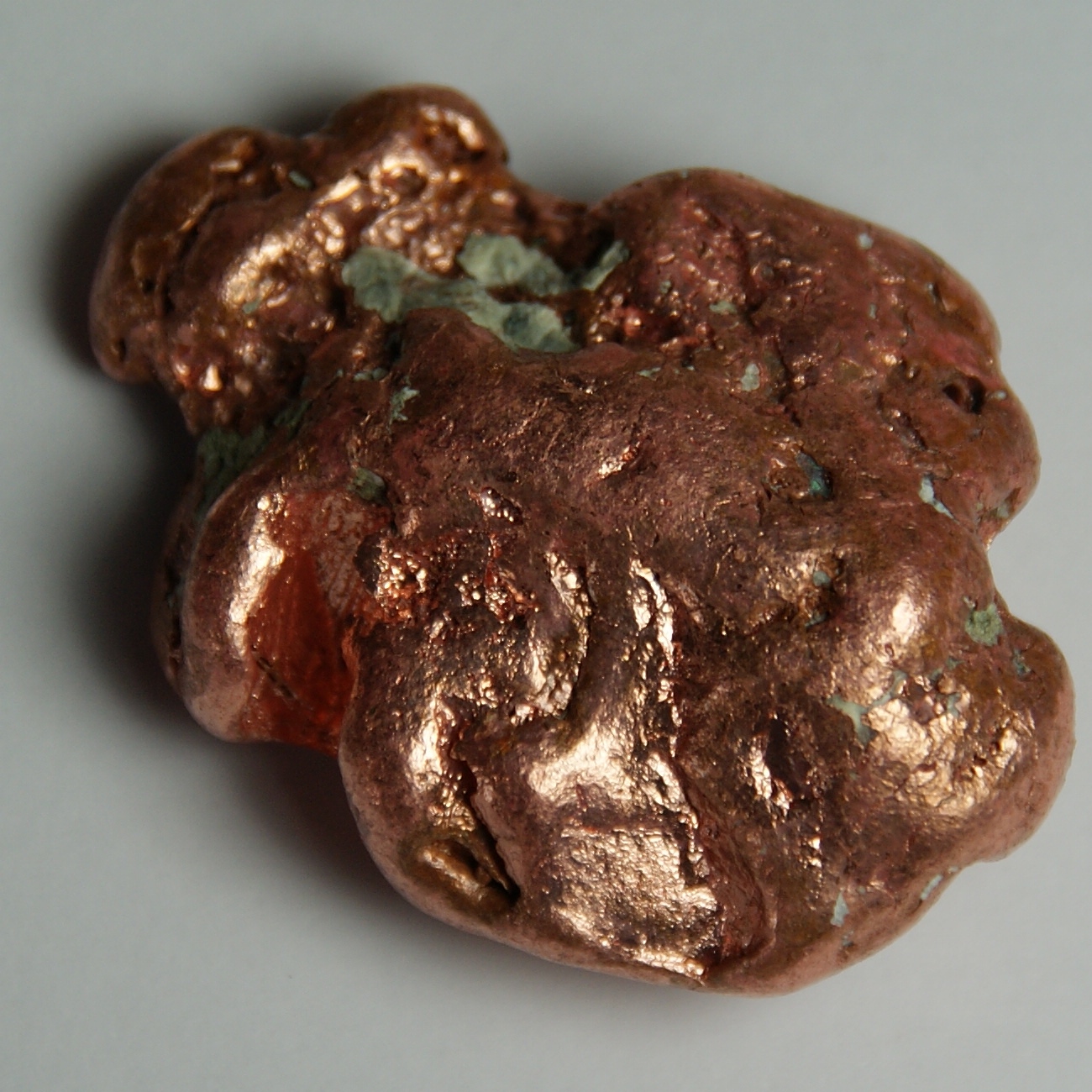

Introduction to Copper as a Commodity

Copper is a widely used metal in various industries due to its excellent electrical conductivity and malleability. It plays a crucial role in infrastructure development, construction, electronics, transportation, and renewable energy sectors. As an investment asset, copper is highly sought after due to its industrial demand and limited supply.

Its price is influenced by factors such as global economic growth, technological advancements, geopolitical events, and government policies.

The Growing Popularity of Copper Commodity ETFs

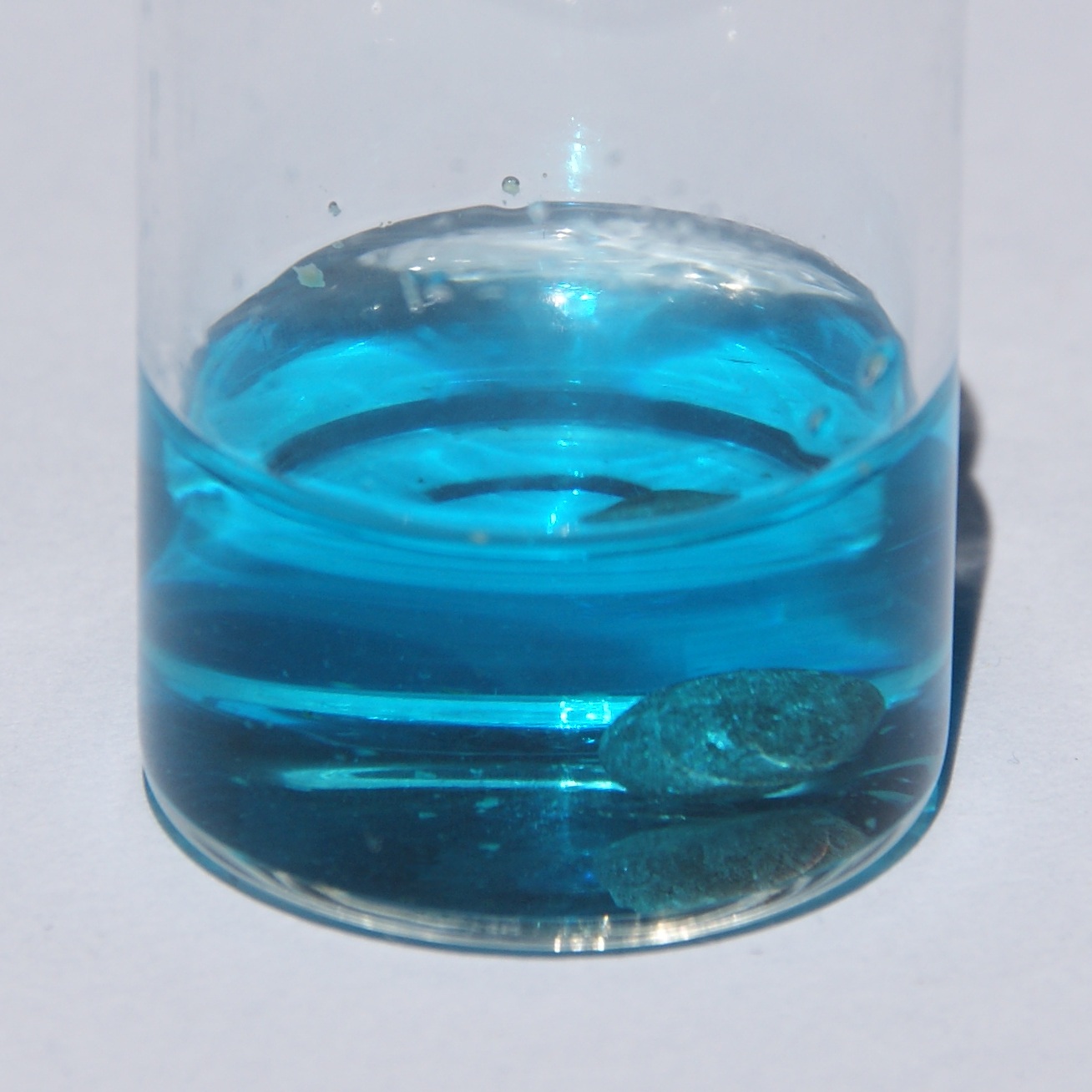

In recent years, copper commodity ETFs have gained significant popularity among investors looking to diversify their portfolios and benefit from the potential price appreciation of this valuable metal. These ETFs provide an efficient way to invest in copper without physically owning it or engaging in complex futures contracts trading.

Copper commodity ETFs offer investors exposure to the performance of copper prices, which have shown strong growth potential due to increasing demand and limited supply. They provide a convenient and liquid investment option as they are traded on major stock exchanges, allowing for easy buying and selling throughout the trading day.

Investing in copper commodity ETFs allows for diversification across various industries that rely on copper, such as construction, electronics, and renewable energy. This mitigates risks associated with investing solely in individual companies within the copper mining sector.

Furthermore, these ETFs offer a cost-effective alternative compared to traditional commodity investments, reducing transaction costs and storage expenses.

Overall, the growing popularity of copper commodity ETFs reflects investor interest in alternative strategies that provide exposure to the potential price appreciation of this versatile metal.

Various Uses of Copper in Modern Society

Copper’s value as an investment asset lies not only in its scarcity but also in its numerous applications across different industries. It is essential for electrical wiring systems, plumbing infrastructure, telecommunications networks, and electronic devices like smartphones and computers.

Moreover, copper’s antimicrobial properties make it an integral part of healthcare equipment, helping prevent the spread of infections. As technological advancements continue to drive demand for copper, its value as an investment asset remains robust.

In construction, copper is used for corrosion-resistant piping systems. In the automotive industry, it powers electrical components that enable efficient fuel usage. Copper’s malleability and attractive color also make it a popular choice for artistic creations such as sculptures and jewelry.

Overall, the versatility of copper spans multiple sectors globally. From technology to healthcare to construction and art, its applications are vast and varied. As society continues to rely on technological advancements that require copper’s properties, the demand for this essential metal will persist in modern society.

The Role of Copper in Infrastructure Development and Renewable Energy

Copper is essential for both infrastructure development and renewable energy. In emerging economies, the demand for power grids, railway networks, and telecommunications systems is increasing due to urbanization and industrialization. Copper’s conductivity makes it indispensable in these infrastructures.

Additionally, copper components are crucial in renewable energy technologies like wind turbines, solar panels, and electric vehicle charging stations. As the world focuses on sustainable energy sources, the demand for copper is expected to rise, creating attractive investment opportunities in copper commodities.

| Key Points |

|---|

| – Copper plays a vital role in infrastructure development |

| – Emerging economies’ urbanization and industrialization drive increased demand for power grids and telecommunication systems |

| – Copper’s conductivity is essential in renewable energy technologies such as wind turbines, solar panels, and electric vehicle charging stations |

| – The global shift towards cleaner energy sources is expected to significantly increase the demand for copper |

| – Attractive investment opportunities are emerging in copper commodity ETFs |

Global Demand and Supply Dynamics Impacting Copper Prices

The price of copper is significantly influenced by global supply and demand dynamics. China, as the largest consumer of copper, plays a crucial role in shaping its prices due to its rapid industrialization and urbanization. Changes in Chinese economic policies or growth rates can have a substantial impact on the global copper market.

Apart from China’s influence, there are other factors that also affect copper prices. Geopolitical events, such as trade disputes or political instability in major copper-producing countries like Chile and Peru, can disrupt the supply chain and subsequently impact prices.

Additionally, macroeconomic indicators such as GDP growth rates, inflation levels, and interest rates have an indirect but significant effect on market sentiment towards commodities like copper.

Investors looking to engage with copper commodity ETFs need to understand these complex dynamics to make informed investment decisions. By analyzing supply-demand imbalances and potential price fluctuations resulting from various economic factors, investors can position themselves advantageously in the market.

To illustrate these dynamics more comprehensively, let’s consider a markdown table showcasing the main factors influencing copper prices:

| Factors | Impact on Copper Prices |

|---|---|

| Chinese Economic Policies | Significant influence due to high consumption |

| Geopolitical Events | Disruptions in supply chain |

| Macroeconomic Indicators | Affects market sentiment towards commodities |

By closely monitoring these factors, investors can gain insights into potential shifts in the global copper market. This knowledge empowers them to adapt their investment strategies accordingly and maximize their returns.

Understanding the intricate relationship between global demand and supply dynamics is essential for anyone seeking to navigate the ever-changing world of copper prices effectively.

By staying informed about both domestic and international influences on this vital commodity, investors can make better-informed decisions when engaging with related financial instruments like copper commodity ETFs.

Brief Explanation of ETF Structure

ETFs, including copper commodity ETFs, track the performance of an underlying index or asset. These funds aim to replicate the price movements of a specific benchmark related to copper. Investors can easily buy and sell shares of these ETFs through their brokerage accounts, just like stocks on exchanges.

Copper commodity ETFs offer diversification by providing exposure to various companies in the copper industry without buying individual stocks. They are transparent, with readily available information on fund composition and performance, and typically have lower expenses compared to traditional mutual funds.

Overall, copper commodity ETFs provide a convenient and cost-effective way for investors to participate in the copper market.

Introduction to Specific Copper Commodity ETFs

There are several copper commodity ETFs available in the market, each with its own investment strategy and objectives. Popular options include:

-

Global X Copper Miners ETF (COPX): Focuses on companies engaged in copper mining and exploration worldwide.

-

iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC): Seeks to track the Bloomberg Copper Subindex Total Return, reflecting changes in copper futures contracts’ price.

-

United States Copper Index Fund (CPER): Aims to track the performance of an index composed of copper futures contracts traded on major commodity exchanges.

Investors should research and compare these options based on their risk tolerance, investment goals, and desired exposure to the copper market.

[lyte id=’R_2HSb9nA9Q’]