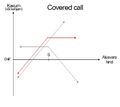

A covered call is an investment strategy where you sell call options on stocks you already own. This generates income from the premiums received for selling the options, providing potential profitability. The strategy offers downside protection by owning the underlying stock while generating additional income.

However, there are risks, as significant stock price increases may result in missed gains beyond the strike price of the sold options. It’s crucial to consider market conditions and risk tolerance before implementing this strategy.

How the strategy works

Covered calls are a popular strategy for generating income while maintaining ownership of stocks. Here’s an example to better understand how it works:

Let’s say you own 100 shares of XYZ Company, currently trading at $50 per share. You decide to sell one call option with a strike price of $55 and receive a premium of $2 per share.

If the stock price stays below $55 at expiration, the option expires worthless, and you keep both the premium and your shares. This means you earned $200 in premiums without selling your stock.

However, if the stock price exceeds $55 at expiration, your shares may be called away from you as someone exercises their right to buy them at the strike price. In this case, you would still keep the premium received but miss out on potential gains above $55.

Overall, covered calls allow investors to generate income while keeping their stocks. It’s a way to earn premiums without completely divesting from one’s stock portfolio.

Overview of the newsletter’s strategy

The Covered Call Newsletter focuses on enhancing investment returns through the use of covered calls. Subscribers receive trade recommendations targeting specific stocks and options, aiming for maximum effectiveness. By following these recommendations, investors can potentially achieve higher profits compared to traditional buy-and-hold strategies.

This precise approach allows subscribers to capitalize on specific market trends and opportunities, maximizing their chances of success.

How the Newsletter Selects Trades

Our newsletter employs a rigorous research process and analysis techniques to identify potential covered call trades. Experts analyze market trends, company fundamentals, and option pricing to determine stocks and options with the best income-generating opportunities.

Factors like volatility, time decay, and liquidity are carefully considered when recommending trades. By combining technical analysis with fundamental research, we aim to provide high-quality trade ideas with a higher probability of success.

Real-Time Portfolio Updates: Pete’s Covered Calls

Subscribers also benefit from real-time portfolio updates through Pete’s Covered Calls. These updates keep subscribers informed about our current positions and any adjustments made in our portfolio. They allow for monitoring trade performance and making informed investment decisions.

Our goal is to empower subscribers with the knowledge they need for successful covered call trading.

Introduction to Pete’s real-time portfolio

Pete’s real-time portfolio is a vital section of our newsletter, allowing subscribers to track actual trade results and performance. This transparency provides valuable insights into the covered call strategy by sharing gains, losses, and lessons learned from each trade.

Pete’s real-world scenarios demonstrate how the strategy performs and helps investors make informed decisions. The user-friendly layout includes interactive charts and comprehensive tables for easy understanding of key metrics. Pete’s real-time portfolio empowers investors with knowledge to navigate their investment journeys successfully.

Case Studies from Pete’s Portfolio

Pete’s real-time portfolio updates include case studies showcasing successful covered call trades. These examples demonstrate how implementing this strategy can generate significant income while effectively managing risk.

Pete also shares lessons learned from unsuccessful trades, providing valuable insights into potential pitfalls and mistakes to avoid when trading covered calls. By studying these case studies, traders can gain practical knowledge and improve their own trading performance.

Addressing common concerns or inquiries about Covered Calls

Covered calls are a popular options trading strategy, but before diving in, it’s important to address common concerns.

The capital needed for covered calls depends on factors like the stock price and number of shares owned. It’s recommended to have enough capital in your brokerage account to cover potential losses or margin requirements. Consult with your financial advisor for personalized guidance.

If the stock price rises above the strike price of the sold options, your shares may be called away. You miss out on potential gains beyond the strike price but keep the premium received for selling the options. Consider your risk tolerance and investment goals when using covered call strategies.

In summary, understanding the capital requirements and potential outcomes of covered calls can help investors make informed decisions and effectively incorporate this strategy into their portfolio.

Testimonials from subscribers who have found success with covered calls

Subscribers to the Covered Call Newsletter have experienced increased income through consistent use of the strategy. By following the trade recommendations provided by the newsletter, they have been able to generate additional profits while managing risk effectively.

Positive experiences with trade recommendations from the newsletter have highlighted the value of expert analysis and research in identifying profitable covered call trades. Subscribers have praised the clarity and effectiveness of the strategy, leading to improved investment outcomes.

How to Get Started with Covered Calls

[lyte id=’DeVsPFJCfAw’]