Investing in gold has always held a certain allure. Throughout history, gold has been prized for its intrinsic value and enduring appeal. It has stood as a symbol of wealth and power, making it a coveted asset for investors.

If you’re looking to add gold to your investment portfolio, you may be wondering: what’s the best gold to buy? In this article, we will explore different types of gold and factors to consider when making your purchase.

The Allure of Gold

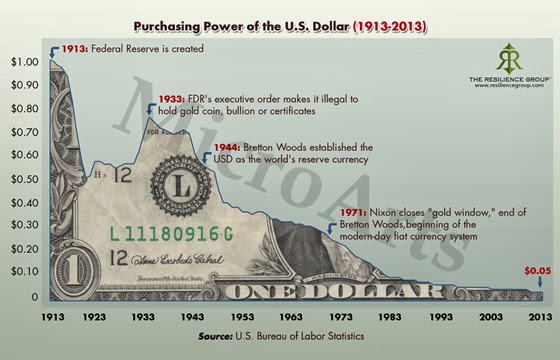

Gold holds both historical significance and value. From ancient civilizations to modern times, gold has played a prominent role in economies and cultures worldwide. Its rarity and beauty have made it a valuable commodity throughout the ages. Investors are drawn to gold for its ability to act as a hedge against inflation and economic instability.

Beyond its practical value, gold’s aesthetic appeal and universal recognition as a symbol of wealth contribute to its enduring allure.

Understanding Different Types of Gold

Investing in gold offers various options, each with its own characteristics and considerations. Physical gold refers to tangible assets like coins and bars, while paper gold includes investments through certificates or financial instruments. Gold mining stocks provide exposure to the industry.

Physical gold, such as American Eagle or Canadian Maple Leaf coins, can be held in hand and offers numismatic or investment value based on weight and purity. Factors like purity, weight, premiums, liquidity, and storage should be considered when purchasing physical gold.

Paper gold, like Exchange-Traded Funds (ETFs), tracks the price of physical gold without direct ownership. ETFs offer ease of trading and diversification but require assessment of management fees, tracking error, and counterparty risk.

Gold mining stocks allow participation in potential profits from mining operations. While they can provide higher returns than physical gold or ETFs, risks include operational challenges, geopolitical factors, and fluctuations in gold prices.

Understanding these different types of gold is crucial for informed decision-making aligned with investment goals and risk tolerance levels. Thorough research should be conducted before taking any investment actions.

Factors to Consider When Buying Gold

Investing in gold requires considering factors such as your investment goals and risk tolerance, as well as the current market conditions.

A. Investment Goals and Risk Tolerance

Decide whether you want short-term gains or long-term stability from your gold investment. Balancing risk and potential returns is crucial in selecting the right investment.

B. Market Conditions

Economic factors like geopolitical events, inflation rates, interest rates, and currency movements can significantly affect the price of gold. Different market conditions may lead to different types of gold investments based on expected price movements or perceived risk levels.

Consider these factors when buying gold to make informed investment decisions aligned with your goals and risk tolerance. Stay updated on market conditions to maximize the benefits of your gold investments.

The Best Gold to Buy for Different Investors

The best type of gold to buy depends on the investor’s preferences, risk tolerance, and investment goals. For conventional investors seeking stability, physical gold coins/bars or ETFs are recommended. Physical ownership offers security, while ETFs provide convenience without physical ownership.

Risk-tolerant investors can consider mining stocks for potential profits but with higher volatility. High-risk physical gold ventures include investing in exploration companies or small-scale mining projects with high growth potential but also higher failure rates.

It’s important to conduct thorough research and seek professional advice before making any investment decisions related to gold.

Table:

| Investor Type | Recommended Gold Investments |

|---|---|

| Conventional Investors | Physical Gold Coins/Bars or ETFs |

| Risk-tolerant Investors | Mining Stocks or High-risk Physical Gold Ventures |

Tips for Buying Gold Smartly

When buying gold, it’s essential to approach the process smartly and avoid scams or fraudulent practices. Research reputable dealers/sellers who have a long-standing reputation, transparent pricing policies, secure shipping methods, and proper certifications.

Understanding pricing structures can help you identify fair prices and avoid overpaying for gold. Be cautious of scams such as counterfeit coins or misleading marketing tactics promising unrealistically high returns on investment. By following these tips, you can make informed decisions and protect your investment in gold.

Storing Your Precious Metals Securely

To safeguard your investment in precious metals, it’s crucial to store them securely. Consider options like home safes or secure storage facilities. Home safes provide easy accessibility but rely on individual security measures, while secure storage facilities offer professional-grade security and insurance options for added peace of mind.

Taking necessary precautions such as obtaining insurance coverage, conducting regular audits, and maintaining proper documentation ensures the safety of your investment. By prioritizing security and following these steps, you can protect your precious metals and have peace of mind.

Conclusion

To make an informed decision about the best gold to buy, it’s important to understand the different types of gold available and key factors that influence investment decisions. Consider your investment goals, risk tolerance, market conditions, and storage options.

When determining your investment goals, consider what you hope to achieve with gold.

Are you seeking long-term value or a hedge against inflation?

Assess your risk tolerance to determine if physical gold or derivative products like ETFs are more suitable for you.

Stay informed about market conditions to identify potential buying opportunities and trends in supply and demand.

Choose a secure storage option that aligns with your preferences and level of comfort.

[lyte id=’M9cn__TcSdk’]